10

WHAT IS IT

BPR is a statutory relief available on

investments in unquoted businesses

and their assets that gives 100% relief

on IHT (50% in some scenarios – but the

products that utilise BPR invest in assets

that achieve 100% relief).

More detail can be found here:

-

inheritance-tax/overview

WHY USE IT

With the IHT threshold (nil rate band)

frozen at £325,000 until at least 2018,

many more households are now facing

the prospect of paying this tax. Advisers

can use BPR to help these households

mitigate IHT

BPR investments qualify for IHT relief

after just two years, rather than the

seven years for more conventional

estate planning solutions

Investors in BPR can withdraw their

funds at any time (subject to liquidity)

so they do not have to sacrifice access

and control

Investors in BPR products can also

expect some meaningful growth in their

assets

Some AIM focused BPR products can

be placed within an ISA.

HOW DOES IT WORK

BPR products are usually invested in

low-risk opportunities with strong,

secure cash flows and low levels of

volatility

Some products are invested in a

portfolio of AIM listed companies, and

some are invested in unlisted

companies or income producing assets

Legal structures vary, but generally

they are discretionary managed

portfolios with investors having

beneficial ownership of the underlying

assets. In most cases they are not

collective investment schemes, which

face stricter rules around who they can

be promoted to

Provided the investor owns the

shares or assets for two years prior to

their death (and are still holding them

when they die), and that HMRC rule that

the assets qualify, then they will receive

100% relief from IHT

There is a three year window in

which to purchase replacement assets

whenever BPR qualifying assets are

disposed of, without having to requalify

for BPR relief.

WHAT ARE THE RISKS

Investors’ capital is at risk as the value

of the underlying investments may fall

HMRC assess the assets upon

application by the deceased’s estate

and refuse BPR - access to the relief is

assessed on a case-by-case basis, so

cannot be guaranteed upfront (it is a

retrospective relief)

Liquidity may be limited

The government may change the

rules on BPR qualifying assets, lower

the IHT threshold or introduce other

changes creating a new IHT liability

Changes in the investment

environment (such as interest rate rises

or asset growth) may create a higher

unplanned IHT liability or make other

risk averse assets comparatively more

attractive

The government could, in extreme

circumstances, deem that the use

of BPR “products” falls outside the

intended purpose of BPR and make

them illegal.

WHAT ARE THE MITIGANTS

Investment managers carefully run

their BPR portfolios to mitigate the first

three risks. Their track records can be

checked and verified

It is difficult to mitigate against

governments changing the rules, but

this risk applies to all long term

investment decisions.

“BPR is the quickest way

to protect assets from

Inheritance Tax. And

specialised BPR products

can often be simple to invest

in, maintain a relatively

stable value and will usually

return capital to the investor

or the beneficiaries within

a reasonable timescale. By

contrast, some other methods

of obtaining BPR have

significant drawbacks. EISs

can return capital to the

client at unpredictable times,

leaving them scrambling to

find a new BPR-qualifying

asset”

Andrew Sherlock, Oxford Capital

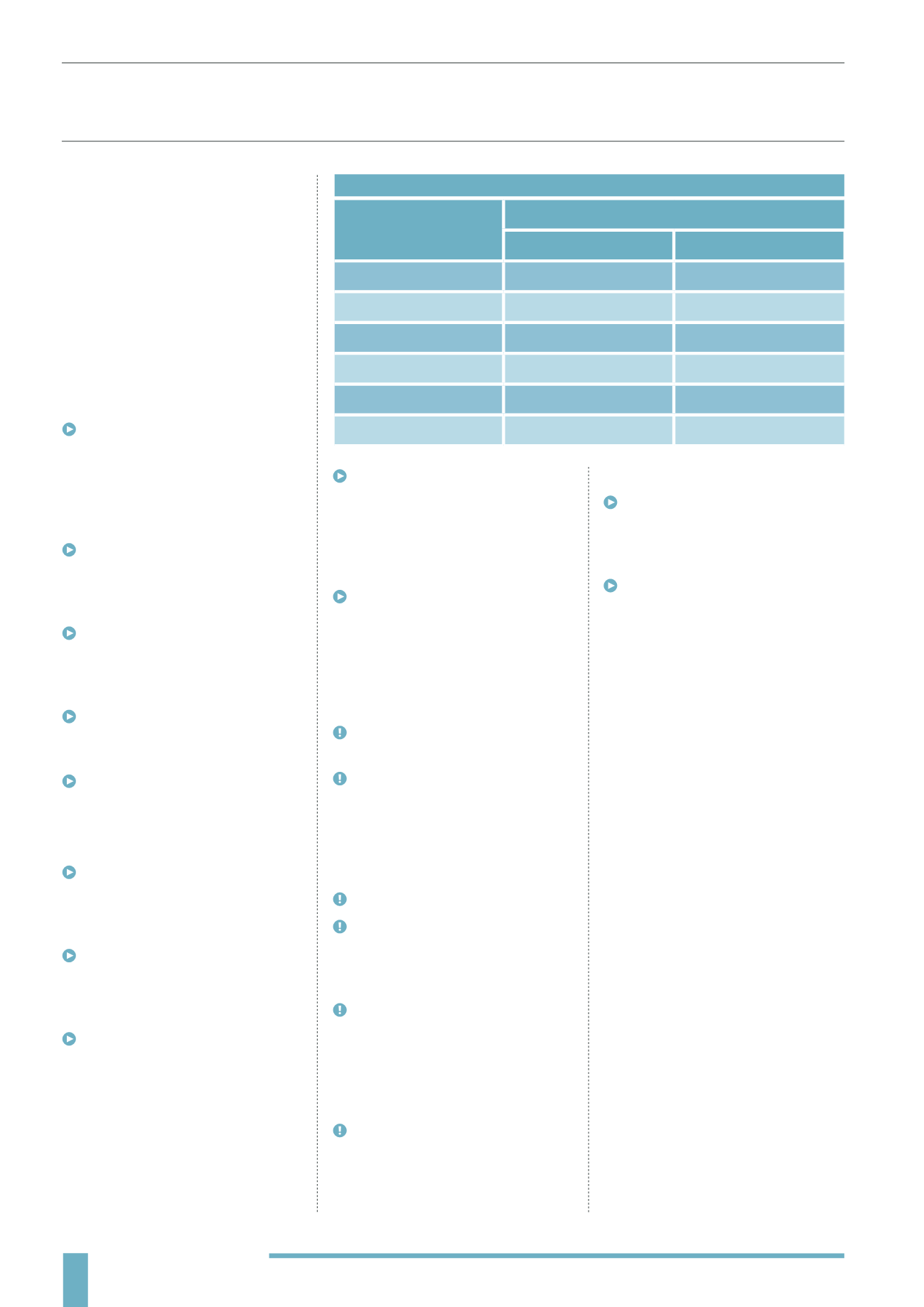

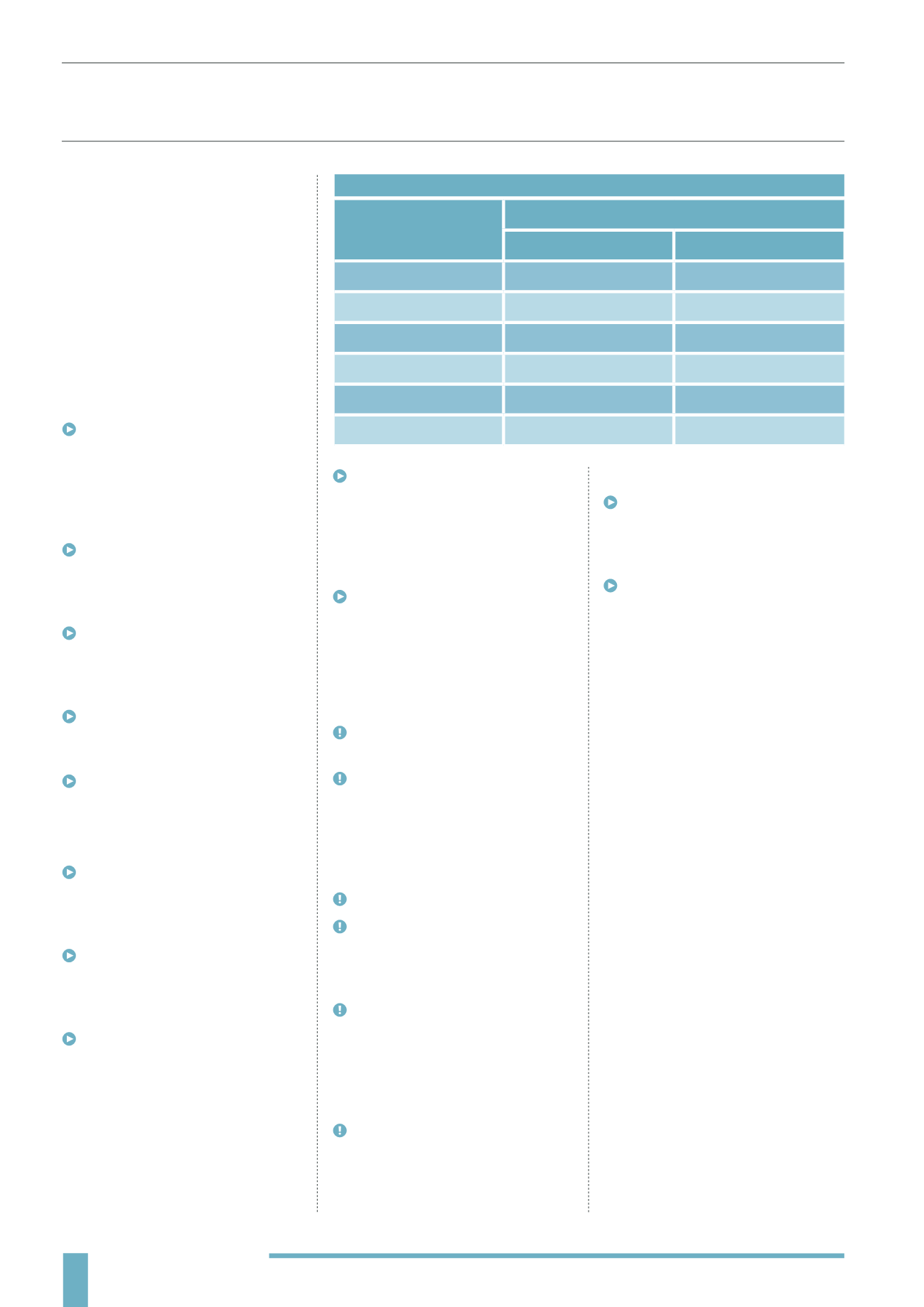

HOW MUCH INHERITANCE TAX MIGHT YOU PAY?

WHY BUSINESS PROPERTY RELIEF

Value of your estate

Inheritance Tax Liability

Single person

Married couple

£325,000

Nil

Nil

£500,000

£70,000

Nil

£650,000

£130,000

Nil

£1m

£270,000

£140,000

£1.5m

£470,000

£340,000

£2m

£670,000

£540,000