25

Since this change, increased inflows

into AIM funds and BPR products have

been reported - but nobody should

be under any illusion that AIM shares

are comparable with the traditional

shares held in a stocks and shares ISA.

Great care needs to be taken to ensure

that clients understand the difference,

especially when investing as part of an

estate planning strategy.

GROWTH & RETURNS

/

ACCESS TO FUNDS

(REGULAR WITHDRAWAL)

There is a dilemma choosing between

the potential for higher levels of growth,

which necessitate a longer investment

time frame, and ease of access to the

investment funds, which is one of the

selling points of BPR as an IHT solution.

Several managers actually shape their

service to address this issue by offering

a range of portfolios for investors - so

investors can choose to sacrifice returns

in exchange for more liquidity by

investing in the appropriate portfolio.

Liquidity can be provided by holding

cash, selling assets or matching

redemptions with new investments.

SPECIALIST / GENERALIST

Another distinction is the sector that

BPR investment managers choose to

invest in. Some investment managers

are generalists (usually focused on

AIM shares) and some are specialists,

investing in an area of particular

expertise (usually focused in unlisted

assets). Some do a bit of both.

Of course, generalists will argue that

fundamental security analysis and stock

picking is the same whatever sector the

company operates in - and this is why

generalists focus on AIM. A generalist

ought to provide greater levels of

diversification within their portfolio

and has a bigger universe of potential

investment and more deal flow. There is

less chance of them struggling to place

the money in the right opportunity.

On the other hand, specialists can

leverage many years of relevant

experience to find good value

opportunities, they can use their

experience to help guide investee

companies and they can afford to manage

a smaller portfolio more closely to ensure

it remains within the BPR qualifying rules.

CARE

Some managers have recognised that

one of the big drivers for investors

choosing BPR over other IHT solutions

is they want the option to access the

funds at a later date in order to pay for

long term care. Products are structured

specifically to address this need, which

seems a sensible backstop for investors

who are concerned with this issue and

can afford it.

SUMMARY

Despite managers using a narrow

range of similar legal structures and

despite them all having the same broad

objectives of capital preservation,

IHT mitigation and low risk growth,

there is in fact a lot of differentiation

between the products. The two biggest

distinctions are between AIM portfolios

and investments in non-listed assets

and partnerships; and between

specialists and generalists. It is a little

surprising to see so much variety in this

small part of the investment universe,

but perhaps, freed from the tyranny

of quarterly and annual performance

figures, benchmarks, peer groups

and the pressure to generate market-

beating returns this is a space where

managers can be more creative with

their strategies.

10.2

%

14.6

%

12.9

%

3.6

%

3.5

%

2.2

%

1.6

%

0.4

%

1.4

%

1.4

%

1.6

%

0.1

%

13.8

%

4.9

%

0.4

%

7.3

%

2.2

%

15

%

20

%

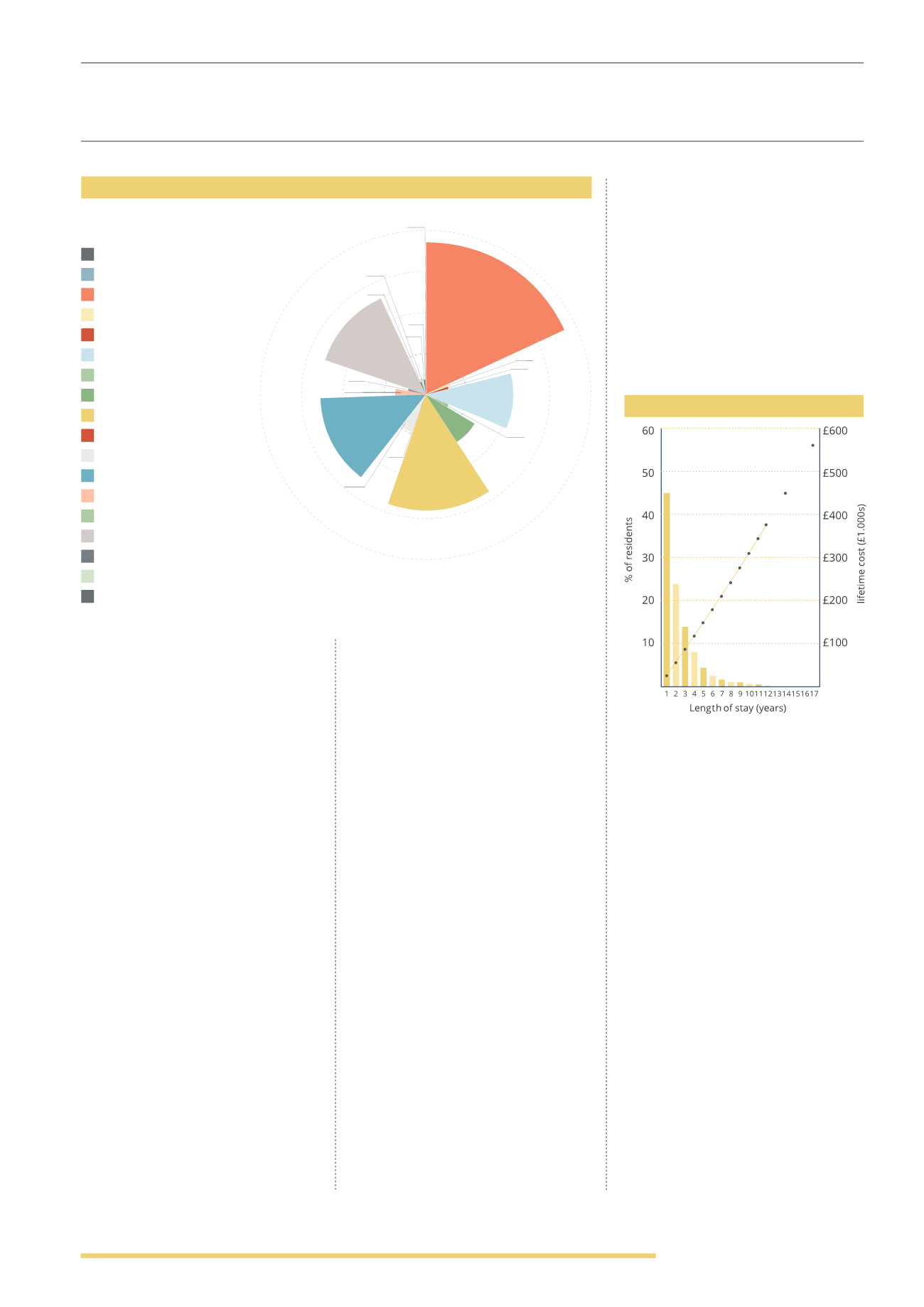

AIM MARKET COMPOSITION

(April 2015)

3000

2500

2000

1500

1000

500

0

“Whilst the demand for BPR solutions has increased, investors in this market remain understandably risk-

averse; therefore the ability for BPR solutions to be transparent and simple to understand has never been

more important”

Richard Cook, Blackfinch Investments

The AIM market is a stock-pickers market

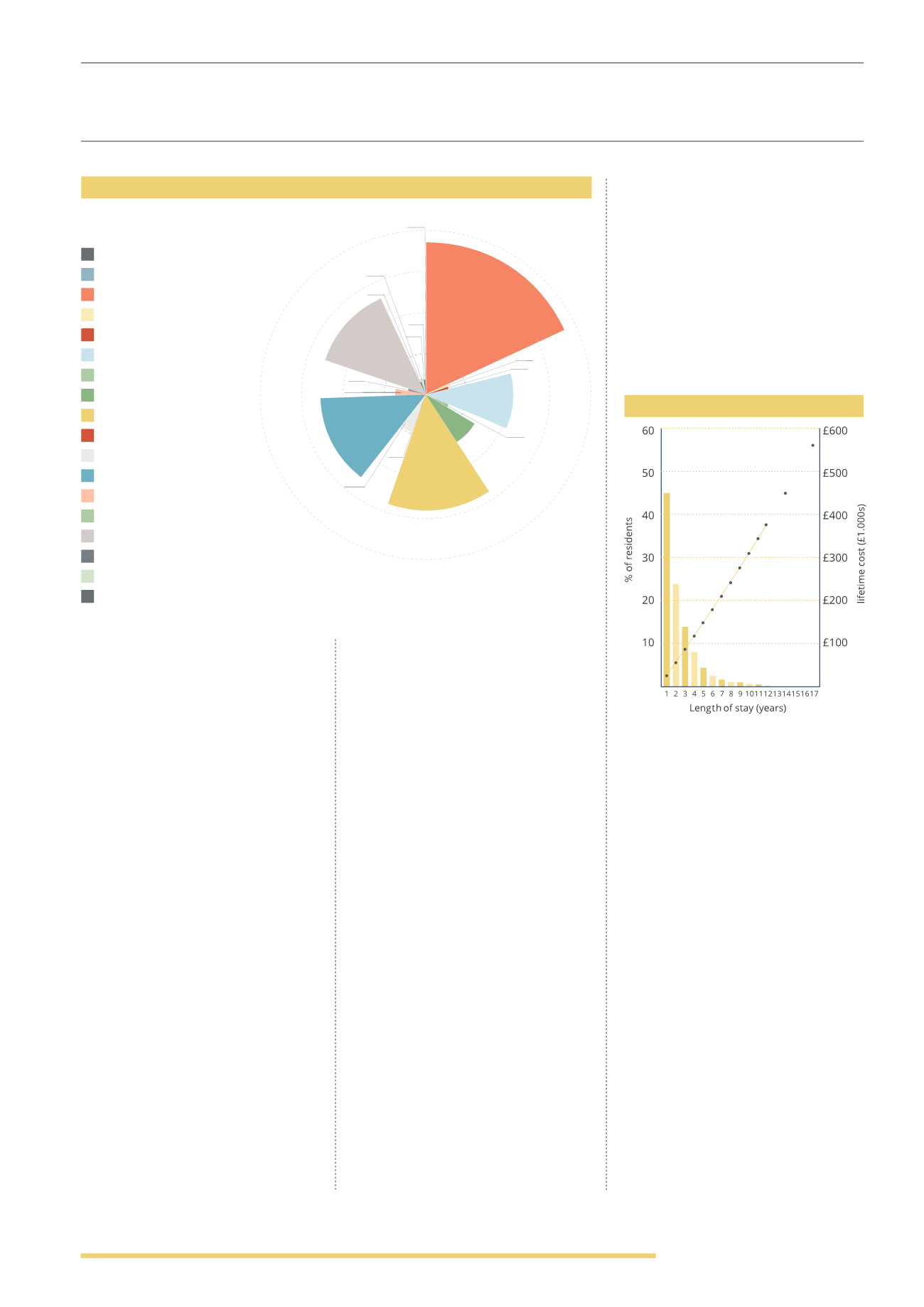

Source: Personal Social Services Research Unit

LENGTH OF STAY

Source: London Stock Exchange

Cost of long term care costs rise

considerably as the length of stay increases

Automobiles & pets (0.4%)

Banks (0.1%)

Basic Resources (18.2%)

Chemicals (1.6%)

Construction & Materials (1.4%)

Financial Services (10.2%)

Food & Beverage (2.2%)

Health care (7.3%)

Industrial Goods & Services (14.6%)

Insurance (0.4%)

Media (4.9%)

Oil & Gas (13.8%)

Personal & Household goods (3.6%)

Retail (2.2%)

Technology (12.9%)

Telecommunications (1.4%)

Travel & Leisure (3.5%)

Utilities (1.6%)

18.2

%