24

DIFFERENT APPROACHES

Despite having the investable universe

narrowed by the BPR qualification

criteria and despite all of these products

having the same overarching objectives

(capital preservation and IHT mitigation)

there is a surprising amount of

differentiation in the marketplace.

The clearest distinction can be drawn

between managers who focus their

products on AIM listed shares and those

who invest exclusively in unquoted

assets.

UNLISTED ASSETS

The greatest portion of funds invested

in BPR products are invested in unlisted

assets (i.e. not in AIM portfolios). The

large wealth managers we spoke to

estimated that as much as 95% of their

BPR investments went into these kinds

of products.

Logically, this makes sense and fits in

with the primary objective of capital

preservation. As it is a traded market,

AIM share prices can be volatile and

investing on there can be risky. BPR

managers who are investing off AIM

can seek out lower risk underlying

trades that provide predictable return

streams. There’s a lot of scope here -

many of the products are only looking

to generate returns of 3-4% per annum,

so the investments do not have to be

aggressive and the investment horizons

are long - we’re a long way from the

short-termism much of the investment

industry is a slave to.

When you take these points and

consider them in the context of the

investment criteria we mentioned

earlier, it gives an indication of the kinds

of trades that will fit the bill: renewable

energy (underpinned by FiTs), secondary

PFI projects, infrastructure projects,

secured lending, property development

finance, agriculture finance, asset backed

trading enterprises and forestry are all

trades that are currently included in the

portfolios of BPR product providers.

The downside of the non-AIM products

is that they (or at least the underlying

trades) are less transparent. It is harder

to evidence and measure performance

and volatility, and to assess the risks.

The ability to invest in longer term,

lower risk trades with predictable

revenues is only a reality if that is what

the manager is doing!

Of course this downside can be

overcome with thorough due diligence

and careful product selection, focusing

in on key areas we’ve mentioned here

and elsewhere in the report, such as

levels of gearing, the risk return profile

and any conflicts of interest.

Finally, we can speculate that it is easier

for managers to have influence on

unlisted investee companies and ensure

investor’s interests are looked after (for

example, ensuring there is no surprise

secondary listing or sudden expansion

into non-BPR qualifying activity).

AIM

The advantages of investing on AIM are

ISA acceptance and the higher levels

of liquidity, scrutiny and corporate

governance that would normally be

associated with a listing. These are

genuine benefits, but they must not be

overstated - AIM is the junior market

and listing there is by no means as

onerous as listing on the main market,

and does not confer the same status.

Another issue is that AIM can be

infected when the mainstream markets

panic - increased levels of liquidity can

mean increased levels of volatility - and

AIM has not exactly been a brilliant

performer over the last few years.

From inception in 1995 until the end of

2013, the average stock on AIM has lost

investors nearly 1 percent a year, even

after the inclusion of dividends. In the

same period the FTSE 100 has a total

return of 118%.

This is not a reason to shy away from

AIM though; it just means it must

be approached sensibly. There are

some household names listed on

AIM, such as ASOS, Majestic Wine and

Mulberry. The underperformance at

the market level can be attributed to

the high number of IPOs on AIM and

the inevitable exposure to investment

fads. BPR managers will look behind the

headline performance and identify well

established firms that have no intention

of seeking a listing on the Main Market

(and thus lose BPR status) have

good valuations based on economic

fundamentals, and steady revenues.

In short, although at the top level AIM

can be volatile, the BPR managers want

to invest in the steady performers that

make up the backbone of the market.

Of about 1,000 companies listed on

AIM, it is estimated that just over 600

of those qualify for BPR (Fundamental

Asset Management).

AIM shares became ISA eligible in

August 2013, and being able to place

BPR qualifying investments within the

nations’ most popular and accessible

tax efficient wrapper is clearly very

attractive – the assets are essentially

income, capital gains and inheritance.

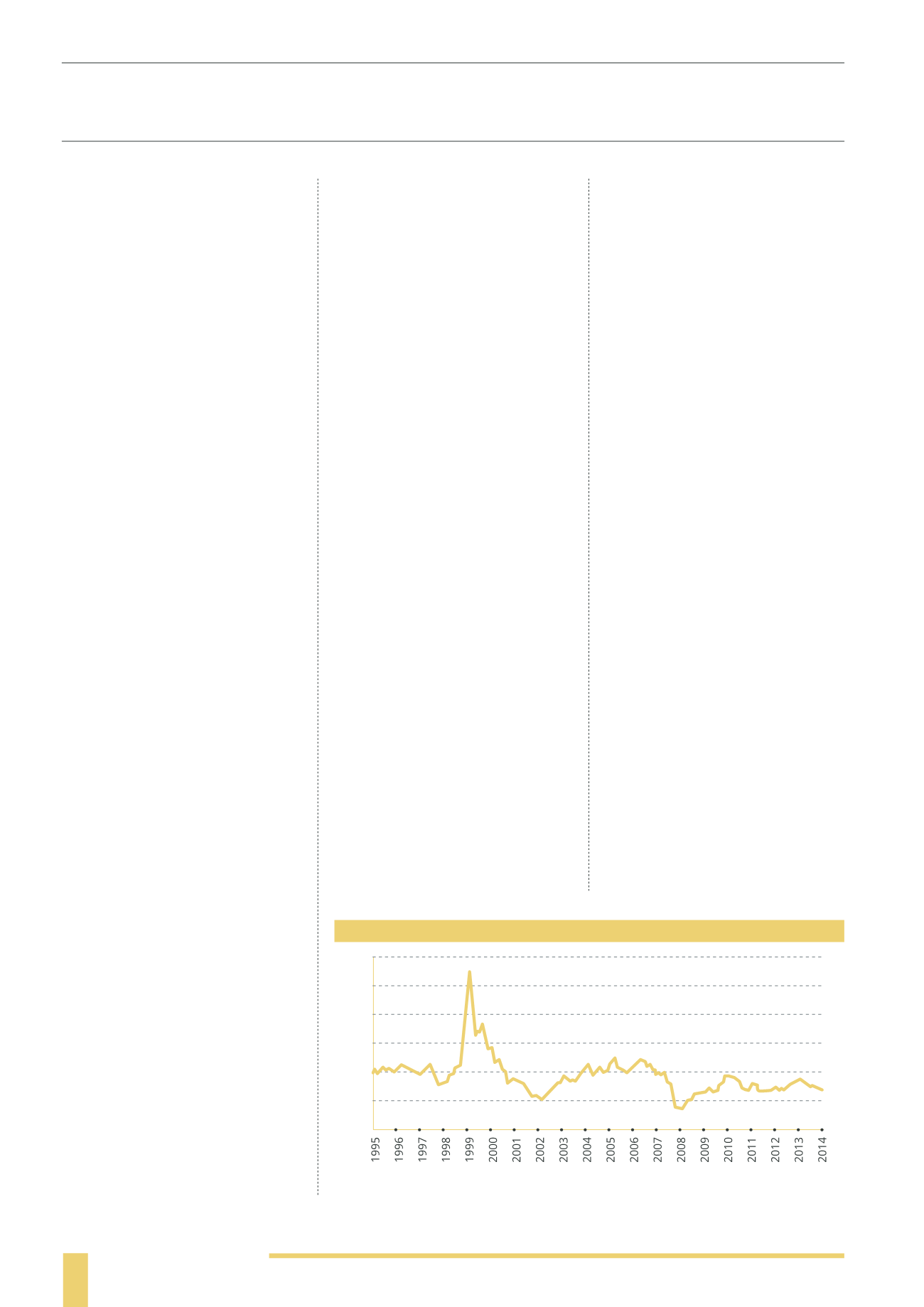

AIM INDEX

(1995-2014)

3000

2500

2000

1500

1000

500

0

Volatile overall market performance masks the fact that there are some steady performers listed on AIM.