26

RISKS

Of course there are many risks

associated with investing in BPR

products, and these can be very

different from risks associated with

more traditional IHT solutions such as

gifts and trusts. The conversation on

risk and retirement between investors

and their advisers is probably a lot

different these days – with longer

retirements, in many cases there needs

to be some exposure to investment risk

within a portfolio in order to accumulate

enough wealth to meet future spending

needs.

The risks can be broken down

into investment risks (specific and

systematic risks), tax risks (risks to

qualifying status), what might be

thought of as legal / regulatory risk (a

change in the legislation on BPR or anti-

avoidance measures) and some other

risks (timing, withdrawals, FSCS status).

INVESTMENT RISKS

The usual risk warnings apply to BPR

products: capital is at risk and the value

of the investment can fall as well as

rise. Investors may not get back all (or

indeed any) of their capital and past

performance is not a guide to future

returns.

This is unavoidable of course - the

money has to be put into qualifying

business assets, which will be small,

unquoted companies or partnerships.

Statistically, smaller companies are

more likely to fail, so in following this

line of logic at first glance BPR could

be seen as a very risky investment. It

is an investment into a going concern

- losing money will always be a distinct

possibility.

However, in reality the BPR universe

is really all about sourcing the right

opportunities – asset allocation – and

either:

a)

Managing the underlying asset

to reduce risk to a minimum (without

manufacturing the trade) or

b)

Ensuring

sufficient diversification to reduce the

risk of a significant loss.

As we alluded to in the previous section,

free from the obligation to earn market

beating returns and report quarterly

performance, the managers of these

products can select established, steady

performers or seek out good value

opportunities in niches such as PFI,

lending or renewable energy generation.

But traditional techniques of

fundamental analysis and knowledge of

the investee companies and the sectors

they operate in is still vital. Smaller

companies ARE more vulnerable - for

example they might rely on fewer,

bigger customers, they may have more

key person risk than larger companies,

and they might not have the right

business mix to survive a change in

regulation - so the skills, knowledge

and experience that enable successful

stock picking are essential. Stellar

performance is not a requirement, but

capital preservation is - more so than

with any other investment product

perhaps, given the ultimate objective of

passing on wealth intact.

It’s also worth pointing out that with a

smaller investment universe and tighter

objectives, in many products the spread

of investments is not that great - risk is

not diversified away. This concentration

of assets has some advantages, such as

increased levels of control and influence

over the underlying investment,

but of course it also means that one

or two failures can have significant

negative impact on the entire portfolio

- increasing investment risk. This

potential concentration of assets is

more common in the non-AIM products.

LIQUIDITY

The other big investment risk is lack of

liquidity. Smaller unquoted companies

and BPR qualifying assets are not

generally liquid and certainly don’t

have the same levels of liquidity as

conventional main market investments.

This runs counter to one of the key

selling points of BPR products: investors

can retain control of their assets (unlike

using gifts and trust as IHT solutions). As

noted in the previous section, the BPR

product providers have addressed this

by building liquidity into their product

structures. Some products have been

structured to allow investors to make

regular withdrawals, and all of the

products allow lump sum withdrawals,

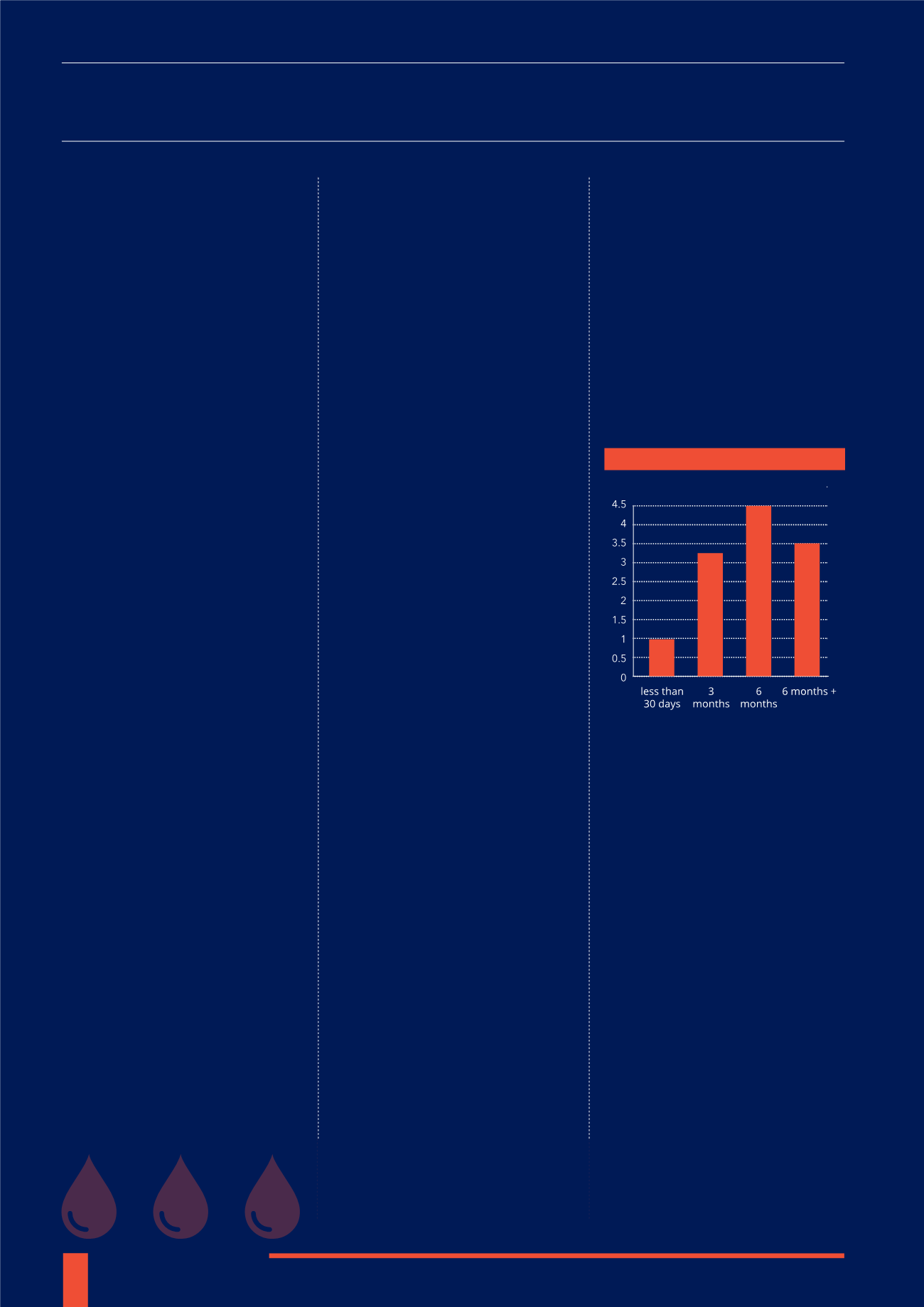

although the timeframe for fullfilling the

request for a withdrawal varies of one

to six months (We took a look, and our

research shows that there is usually a

correlation of higher levels of liquidity

to lower levels of return).

The other point with the promised

liquidity is while it has proven to be

workable for managers on a day to day

basis with low levels of redemptions; it

has not been tested in a situation where

everybody tries to withdraw their money

at once. One can speculate that in a

scenario like this it would turn out that

there was no liquidity after all, or exits

were only achieved at a significant loss

(much like the main market - however

much the regulators make a virtue of

liquidity, it doesn’t prevent losses).

GEARING

A risk that is not perhaps immediately

apparent to investors and their advisers

is gearing. Unlike more familiar unit

trusts and open ended investments,

BPR products are closed funds and

therefore they have the option of using

gearing to try and enhance returns.

WITHDRAWAL TIMING

Average target return (%)