15

CONCLUSIONS TO THE

MARKET OVERVIEW

For over 30 years now there has been a

government policy to use tax incentives

to encourage private investment into

smaller company shares, and EIS has

been the preferred scheme for most

of that time. Smaller companies play

a vital role in the economy but the

investment deals available are too small

for institutional investors. Therefore,

private investment plays an essential role.

And whilst the government will always be

keen to ensure that capital is genuinely

being put at risk to encourage economic

growth, the parameters for EIS qualifying

companies are perhaps more generous

than many people realise. EIS investment

does not have to be about investing in

small start-ups (although it can be). Very

well established companies with large

workforces and significant assets can

qualify and can be lower risk investments.

Despite all the rules and regulations that

are wrapped around EIS qualification and

claiming the tax benefits, the underlying

investments themselves are actually very

simple – it’s investing into the share capital

of businesses to help them expand.

This kind of smaller company investing

holds out the prospects of occasional

stellar returns, frequent steady returns

and, possibly, some total losses. It can

be a much more engaging part of an

investment portfolio when compared to

plain vanilla, mainstream fund investing.

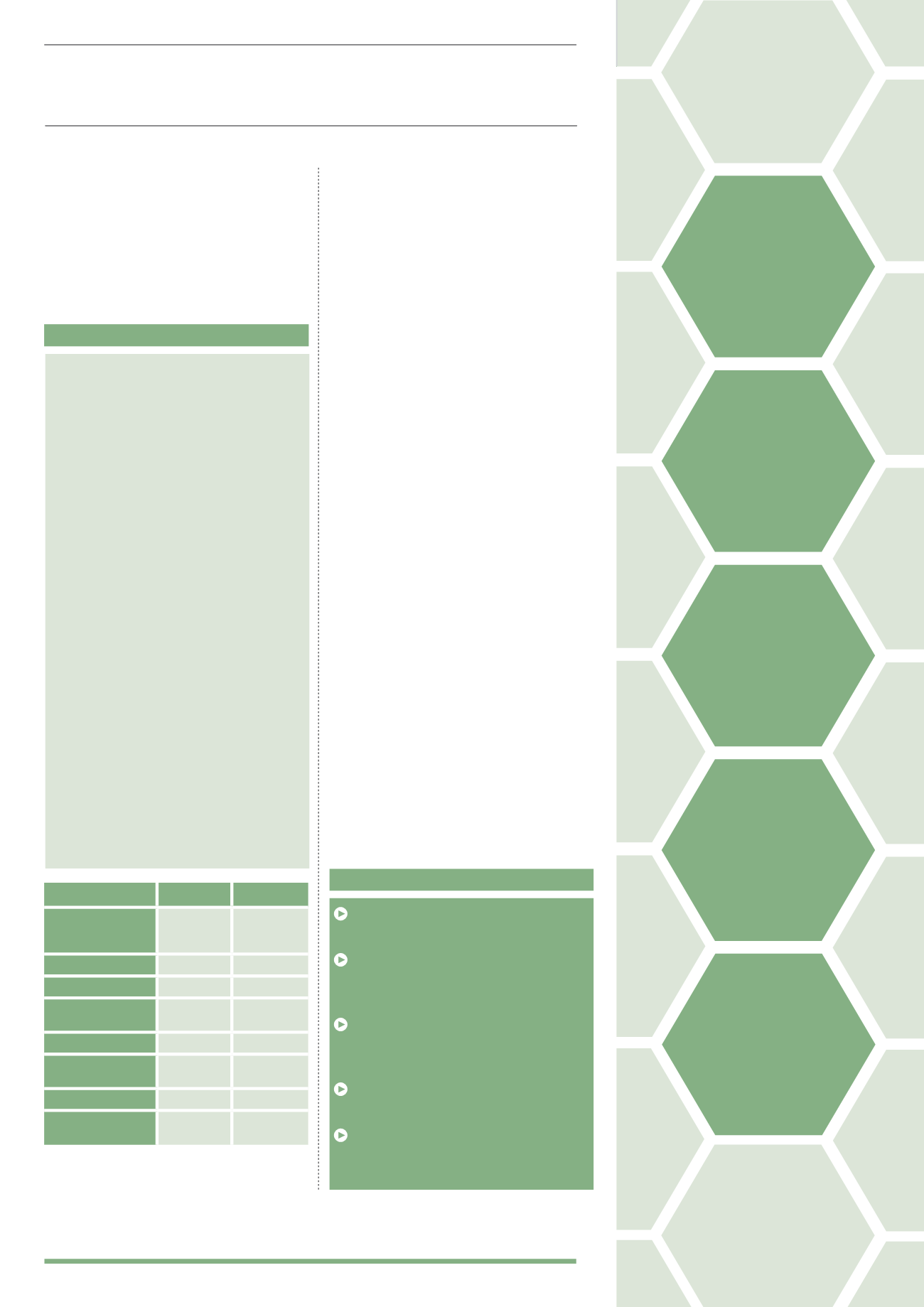

EIS vs VCT

EIS and VCTs are often positioned as

competing sectors – after all, they are

both focused on small company investing,

offer generous tax breaks and managers

often operate funds in both the EIS and

VCT segments of the market. However,

there are significant differences as

well, and there is no reason why they

can’t both be included in a portfolio.

VCTs are sometimes focused on larger

companies and as a listed vehicle give

investors easier access, liquidity (though

this can be illusory) and more clarity on

overall investment performance. VCTs

can also pay tax-free dividends, perhaps

making them a more suitable long-term

investment vehicle (and perhaps more

suitable for pension substitution).

However, the tax breaks on offer are

not as generous as those attached to

EIS investments. Both sectors have

recently come under the microscope for

exploiting the tax breaks and not putting

capital genuinely at risk – something

the government indicated they are

concerned about in the 2014 budget.

EIS qualifying companies can have up

to 250 staff and assets of up to £15m

Investing in smaller companies has the

potential for high returns, but also

increased risk

Companies with less than 10

employees account for 95% of all UK

businesses

Smaller company shares are more

often illiquid

Investors in unquoted equity can find

they lack influence with the underlying

companies

FEATURES EIS

VCT

Maximum

Annual

Investment

£1,000,000 £200,000

Tax Relief

30% 30%

Holding Period

3 years

5 years

One Year Carry

Back

Yes

No

Dividends

Taxable Exempt

Capital Gains

Tax

After 3

years

Exempt

Deferral Relief

Yes

No

Inheritance Tax

Relief

After 2

years

No

“EIS investment is vital for

early stage companies that have

no assets or income stream to

support bank lending”

SarahWadham, EISA

POTENTIAL

FOR

SUBSTANTIAL

CAPITAL

GAINS

DIVERSIFICATION

IT’S A BUYERS’

MARKET

IT’S

INTERESTING

AND EXCITING

IT SUPPORTS

THE UK

ECONOMY

IS VS VCT

KEY POINTS