23

PLANNING EXITS FOR INCOME

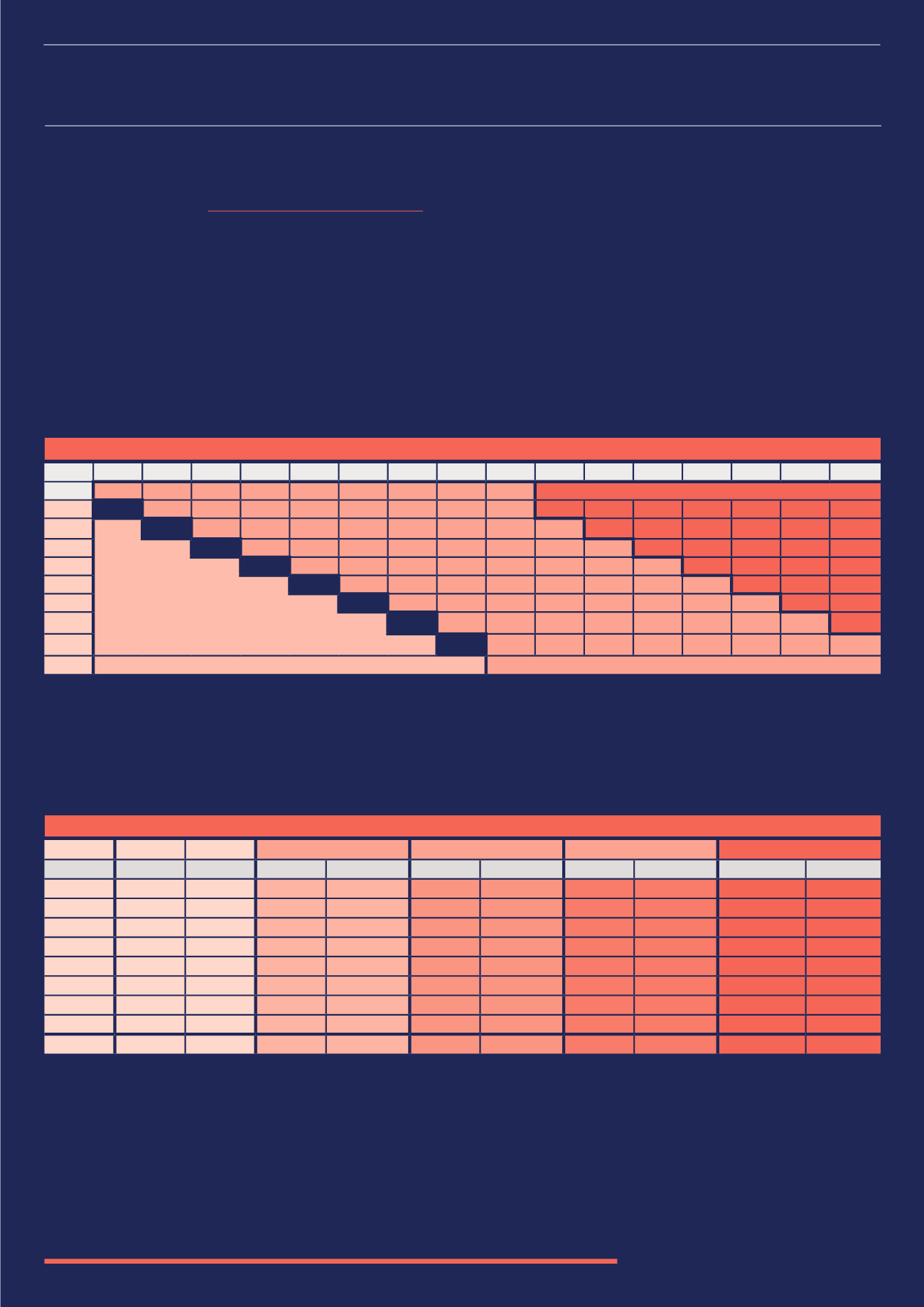

In this section we examine the possibility of reinvesting the gains from EIS investments in other EIS offers, and using ‘exit focused’ EIS

investments to try and build a tax-free source of annual income for the future. The spreadsheet we used to calculate the returns

is available on request from

METHODOLOGY

We looked at a hypothetical strategy where the investor has a surplus £10,000 annually and has used (or nearly used) their lifetime allowance

within their pension and their annual ISA allowance. Clearly we are thinking about wealthier investors here, perhaps nearing retirement age

and mortgage free home owners.

By investing the annual £10,000 surplus into EIS schemes with an exit focus, the capital can be recycled into another investment at exit.

In our simple example we have recycled the capital every three years and assumed each investment returns 1.3x capital

(equivalent to 10% simple annual growth).

We implemented this strategy with the surplus £10,000 a total of eight times (Pots A–H in the table below). This means that Pot A can be

crystallised in year 10 and the total return of £21,970 can be taken as a tax free gain – and the same can be done with all the subsequent

pots until year 17, providing a tax free annual income – potentially in the early years of retirement when spending is highest.

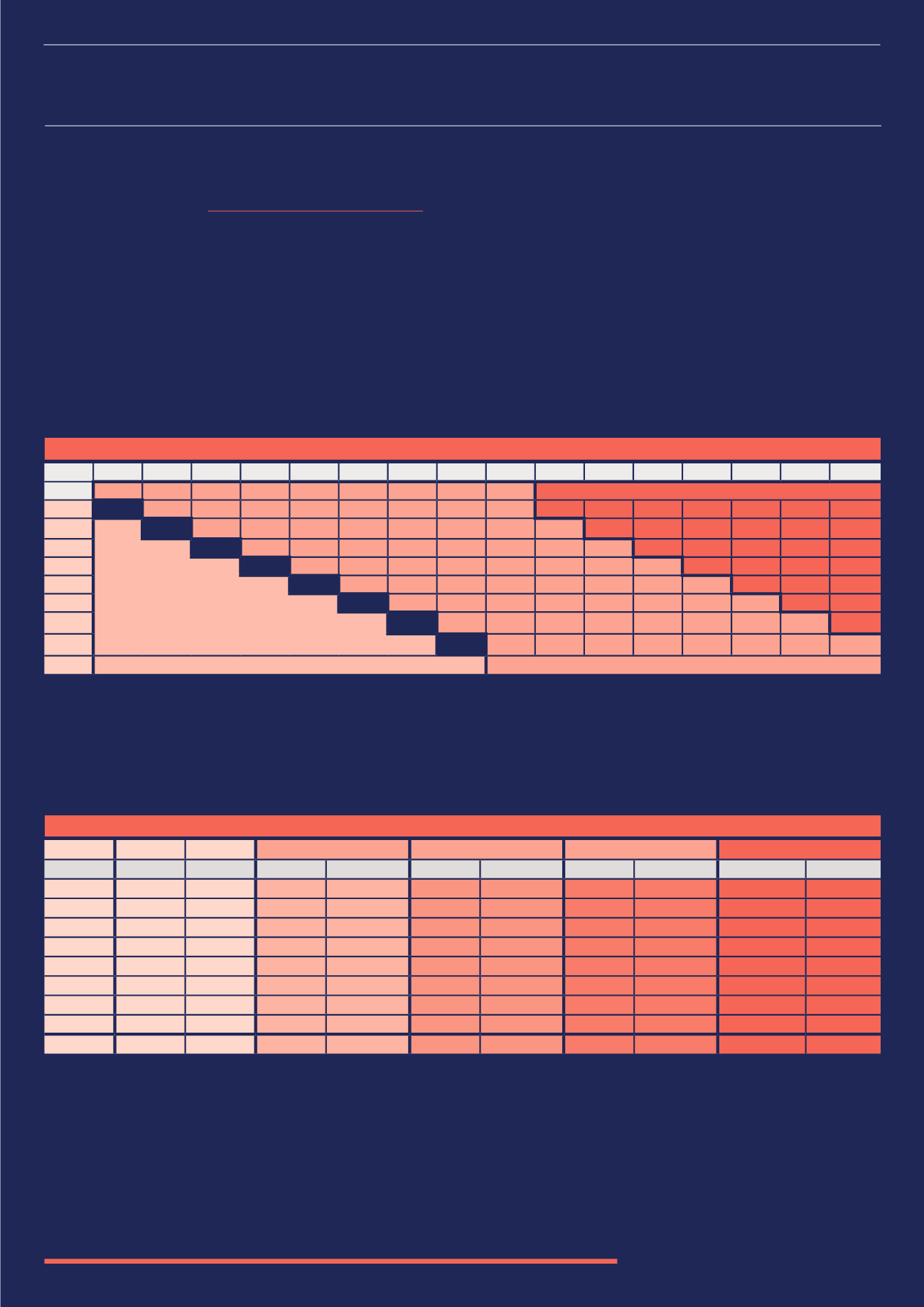

MORE COMPLEX SCENARIOS

Of course in reality the initial investment amounts are likely to fluctuate; as client circumstances change the level of returns will vary greatly, EIS

managers may take longer to achieve an exit than planned at the outset and advisers and investors may work over differing timeframes.

We carried out similar research with company returns set at levels based upon NESTA research (56% return less than cost, 35% return 1.5x cost

and 9% return >10x capital) and randomly distributed through our scenario. As you would expect, the ‘income’ taken as the investor starts to

exit was much more erratic, but still almost always positive each year, with some years providing significant returns in the tens of thousands.

MORE COMPLEX SCENARIOS

Investment 1

Investment 2

Investment 3

Final Exit

Pot

Initial

In Year

Return Timeframe Return Timeframe Return Timeframe Total Return In Year

A

£10k

1

0.5

3 years

1.5

3 years

0.5

3 years

£3.75k

10

B

£10k

2

10

3 years

0.5

3 years

0.5

3 years

£25k

11

C

£10k

3

0.5

3 years

1.3

3 years

0.5

3 years

£3.25k

12

D

£10k

4

1.5

3 years

0.5

3 years

1.5

3 years

£11.25k

13

E

£10k

5

0.5

3 years

1.5

3 years

0.5

3 years

£3.75

14

F

£10k

6

1.5

3 years

0.5

3 years

10

3 years

£75k

15

G

£10k

7

0.5

3 years

1.5

3 years

0.5

3 years

£3.75

16

H

£10k

8

1.5

3 years

0.5

3 years

1.5

3 years

£11.25

17

Totals

£80k

£137k

PLANNING EXITS FOR INCOME (£ ‘000s)

Year

1

2

3

4

5

6

7

8

9

10 11

12 13 14 15

16

Pot

Taking Profits As Income

A

10

13

16.9

21.97

B

10

13

16.9

21.97

C

10

13

16.9

21.97

D

10

13

16.9

21.97

E

10

13

16.9

21.97

F

10

13

16.9

21.97

G

10

13

16.9

21.97

H

10

13

16.9

Initial Investments

Re-Investing Gains

CONCLUSIONS

As the NESTA research indicates, small company investing can be risky and therefore a portfolio approach is necessary. If only one in 10

investments is going to be a stellar performer, this suggests that a portfolio of 28 investments would be optimal to give a 95% chance of

including the high performer. This level of diversification may be beyond many investors’ resources, which leaves advisers with a couple of

options: either using a fund or choosing to invest in lower risk, exit focused EIS opportunities. These are often based around established

businesses with predictable revenue streams and are very different to the growth focused investments EIS is traditionally associated with.

If the emphasis is on exit focused EIS, they can be combined in a portfolio approach similar to the one we’ve outlined here and advisers can

help clients build a satellite portfolio of tax efficient investments that will provide a regular stream of capital gains in the future.