22

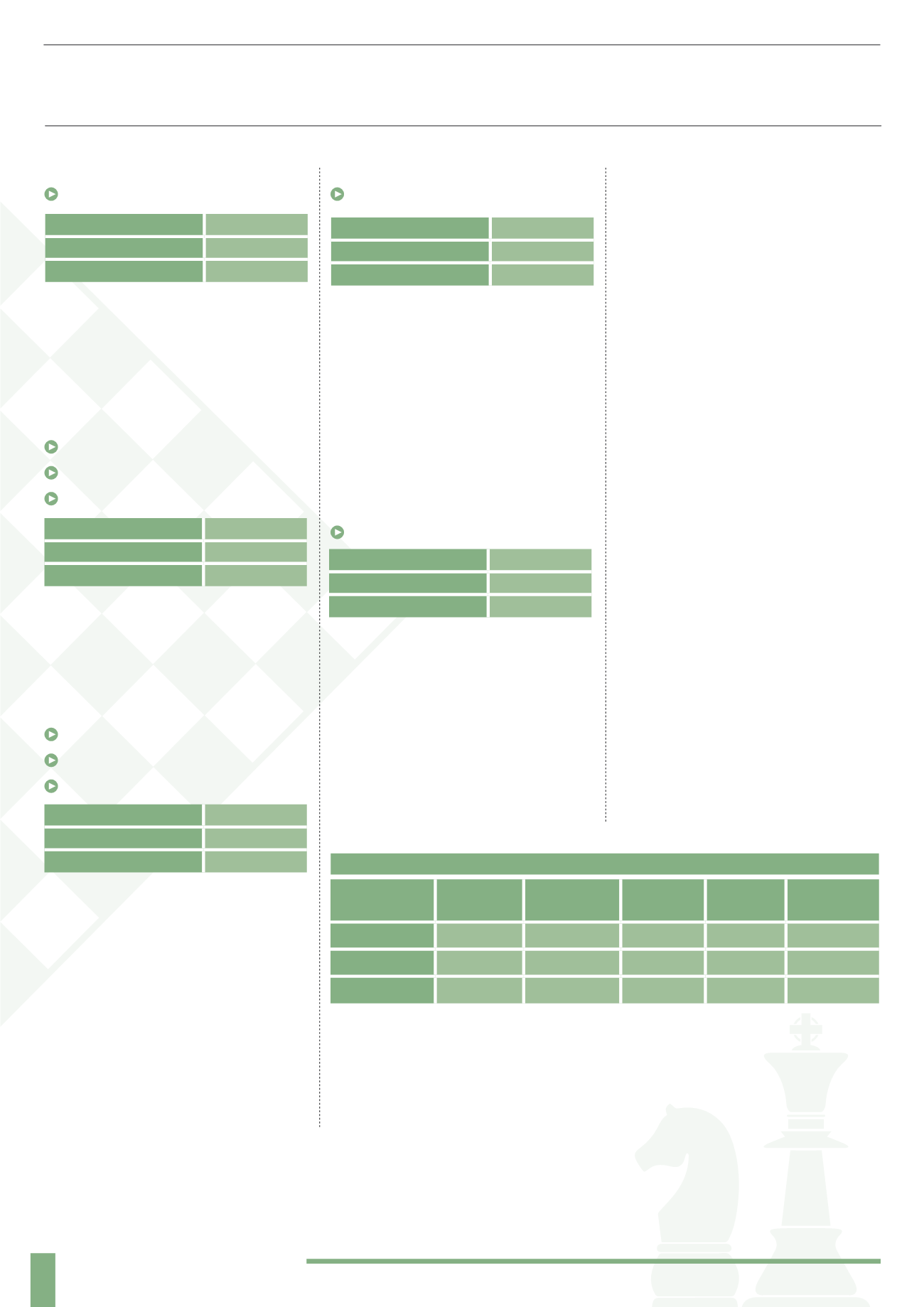

1. Worst Case

All ten investments return -90% annually

This scenario shows us that even

if all ten investments perform

catastrophically, the tax and loss

reliefs limit losses to 42% of the initial

investment, far better than a comparable

investment in traditional shares.

2. Barely Breaking Even

5 investments return -90% annually

4 investment return 0% annually

1 investment returns 7.5% annually

This scenario shows us that even if five

investments perform catastrophically,

and four under-perform, it only needs one

investment to achieve respectable annual

returns to offset the losses on the others.

3. Evidence Based

5 investments return -90% annually

4 investment return 12% annually

1 investment returns 61% annually

This scenario is based upon the figures

for returns from Angel Investing. Loss

relief limits losses on the poor performers

but has no impact on gains from average

performers or the stellar performer. Loss

relief limits the downside risk of losses to

investors. It suggests that a portfolio based

approach means four to five catastrophic

investments can be absorbed provided

these losses are offset with gains from

elsewhere. A portfolio containing less than

ten investments increases the chances of

only picking the losers and missing the

offsetting benefit of a stellar performer.

4. Boring and Mediocre

All 10 investments return 3% annually

This scenario is unlikely considering the

volatile and unpredictable nature of small

company investing, however renewable

energy investments with predictable

revenue streams may fit this profile. It

is worth noting that if all ten companies

only achieved less than market rates of

return (under-perform the FTSE 100 for

example), the tax relief means EIS investors

are still likely to receive higher returns

than from mainstream opportunities.

5. Imagine Wild Success!

All 10 investments return 10% annually

Again, this scenario is unlikely considering

the volatile and unpredictable nature of

small company investing. However, were

you able to consistently pick winners that

achieved market levels returns of 10% a

year, the overall portfolio would perform

even more strongly than that thanks to the

tax reliefs. It is worth noting, though, that

the returns in this scenario are lower than

the returns in the Evidence Based scenario

where there was only one stellar performer.

Total Return

£145,927.41

Gain

£45,927.41

Return

45.93%

Total Return

£191,051.00

Gain

£91,051.00

Return

91.05%

Worst Case Barely

Breaking Even

Evidence

Based

Boring and

Mediocre

Imagine Wild

Success!

Total Return (£) £58,000.60 £98,356.59 £222,669.58 £145,927.41 £191,051.00

Gain (Loss)

-£41,999.40 -£1,643.41

£122,669.58 £45,972.41 £91,051.00

Return (%)

-42.00% -1.64%

122.67% 45.93% 91.05%

“EIS funds allow the investor to build a portfolio of investments through an

experienced fund manager”

Total Return

£222,669.58

Gain

£122,669.58

Return

122.67%

CONCLUSIONS TO A

PORTFOLIO APPROACH

The generous tax benefits and loss

reliefs reduce some of the risk associated

with investing in smaller companies.

The power of the tax and loss reliefs can be

exploited further when they are combined

with a portfolio approach to investing: the

loss relief reduces the impact of losses

from under-performing investments,

the Income Tax relief provides a huge

immediate benefit and the CGT relief

maximises gains from out-performers – so

even a portfolio that has fewer winners than

losers will still provide positive returns.

“The EIS allows individuals

to invest in potential world

beating companies at very low

after-tax cost, and without any

obligation to make a multi-

year investment commitment.

Contrast that with the several

million dollar minimums

and ten year limited partner

structures that are providing

the subsequent growth equity

funding as these businesses

expand across the world”

Bruce Macfarlane, MMC Ventures

Total Return

£98,356.59

Loss

-£1,643.41

Return

-1.64%

Total Return

£58,000.60

Loss

-£41,999.40

Return

-42.00%

RESULTS OF A PORTFOLIO APPROACH