17

INHERITANCE TAX RELIEF

Business Property Relief (BPR) applies

after an initial holding period of two

years and means that qualifying shares

fall outside the estate for IHT purposes.

Shares in an unquoted company qualify

for 100% BPR, as long as the assets are

held at death. (Full details are included

in the HMRC guide here:

)

Business property relief can be

claimed on the following:

A business or an interest in a business

(such as a partner in a partnership)

Unquoted shares – including shares

traded in the Unlisted Securities Market

(USM) or the Alternative Investment

Market (AIM)

A holding of shares or securities owned

by the transferor, which are fully listed on a

recognised Stock Exchange, which

themselves or with other listed shares or

securities give control of a company

Land, buildings, plant or machinery

owned by a partner or controlling

shareholder and used wholly or mainly in

the business of the partnership or company

immediately before the transfer (this applies

only if the partnership interest or

shareholding would itself, if it were

transferred, qualify for business relief)

Any land, or buildings, machinery or

plant which was used wholly or mainly for

the purpose of a business carried on by the

transferor and was settled property in

which the transferor was beneficially

entitled to an interest in possession and

used in the transferor’s business

TAX RELIEFS FOR NON-DOMICILED

INVESTORS

Resident non-domiciled investors can take

advantage of Business Investment Relief

(BIR) to bring money into the UK tax free

if that money is then invested into a BIR

qualifying company within 45 days. (Full

details can be found in the HMRC guide

here:

.)

This means there is a double benefit of a

tax-free remittance into the UK plus the

tax reliefs available via EIS investing and

often this money will have been untaxed

offshore income or gains, so continuing to

shelter this wealth from tax makes sense.

This is designed to encourage non-domiciled

individuals to invest in UK trading companies

(note that such companies may also qualify

for tier 1 Visa Investment purposes).

On exit from the EIS investment, any

profits can be retained onshore, but the

principal (less any losses) must be returned

offshore within 45 days of the exit.

The conditions for Business Investment

Relief are slightly tighter than for EIS:

Investors must subscribe in cash for new

shares (although BIR is also available for

loans to qualifying companies)

The investment must be in a private

limited company or an AIM listed company

It must be a trading company (but

companies which invest in eligible trading

companies may qualify)

Property rental companies may qualify

There are restrictions on receiving

‘benefits’ (if provided on non-commercial

terms for BIR)

There are penalties if the qualifying

conditions are breached. Usually, the asset

must be disposed and the proceeds sent

offshore

BIR has its own advance assurance

procedure

Not only is this a great benefit for non-

domiciled investors, but it is fantastic for the

UK economy as well, as it is bringing in new

money from overseas that otherwise would

not have been invested here. Several EIS

managers are now developing BIR products.

Full detail of the available tax benefits can

be found in the HMRC manual:

PRINCIPAL RISKS WITH EIS

Although the EIS is designed to mitigate

some of the main risks associated with

investing in small companies, there are a

number of considerations to be aware of

which are particular to EIS investments.

FINANCIAL SERVICES COMPENSATION

SCHEME (FSCS) STATUS

Whether or not an EIS investment is covered

by the FSCS depends upon the structure

of the investment. Single company EIS

investments and investments that are

not held within a traditional fund (where

investors’ money is pooled and invested

collectively) would not be considered

to be retail investment products and

therefore would not be covered by the

FSCS. Note, that this means that a managed

portfolio service in

not

covered by FSCS.

However, many EIS funds are now

structured so that they are appropriate for

Ordinary Retail Investors, and these will

be covered by the FSCS. In these cases,

if the fund manager was unable to meet

its liabilities and the clients lost money

as a result of this, then eligible claimants

will be covered for up to £50,000. In

addition, un-invested cash will be held

in a segregated client account that also

benefits from FSCS cover. The normal

£85,000 per person, per institution rule

applies (and therefore it’s always best

to check which bank holds the cash).

LOSS OF EIS STATUS

If firms make changes to their structure

or activities that result in the loss of their

EIS status, this will have a dramatic impact

on investors’ returns. Investors in single

companies must assure themselves that

the company management are cognisant

of this and have their investors’ interests in

mind when making key business decisions.

“Retirement and Inheritance Tax planning and the wish to shelter capital gains made on other

transactions are increasingly important drivers for EIS investment”

SarahWadham, EISA

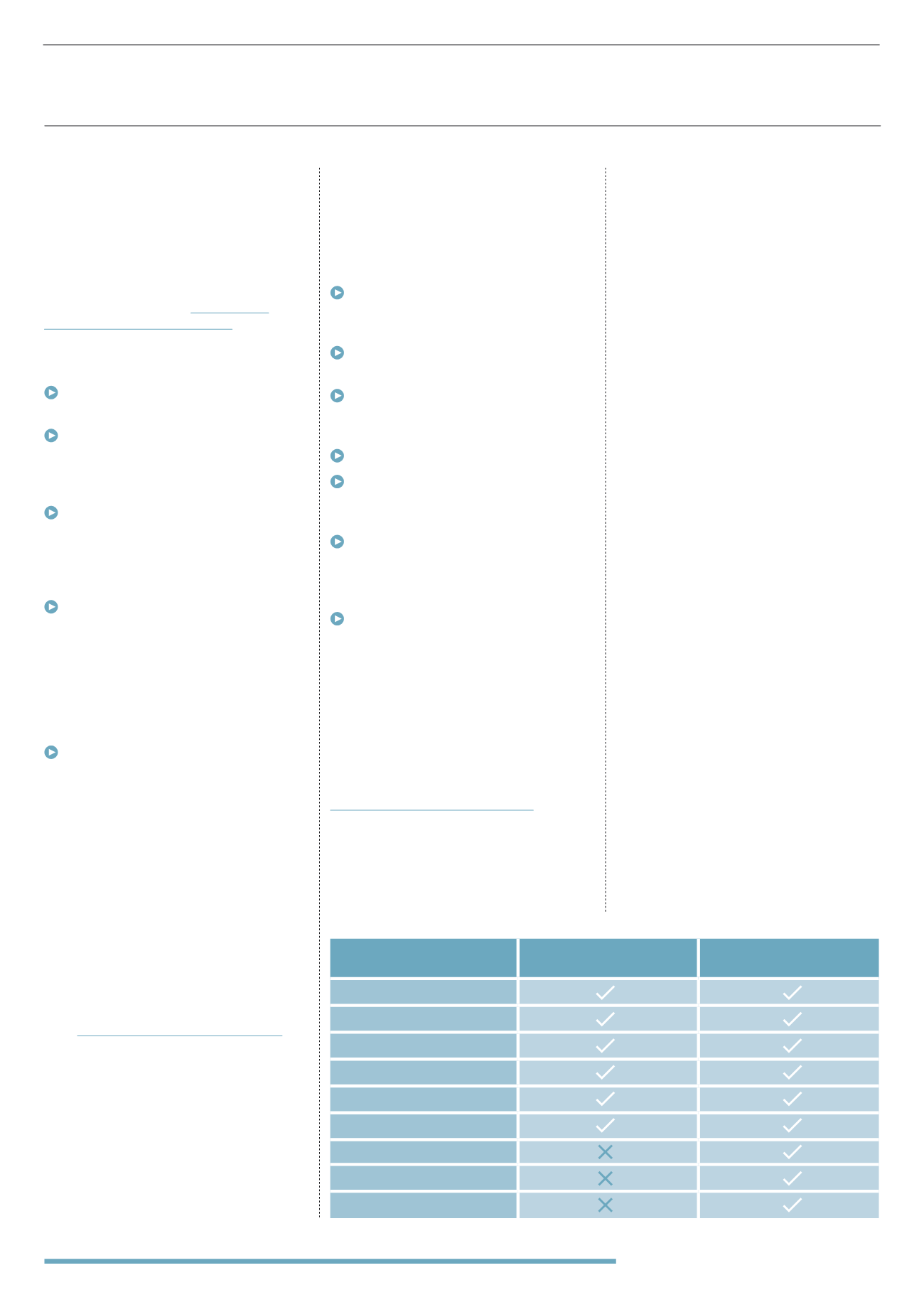

RISK

SMALL COMPANY

INVESTING

SPECIFIC TO EIS

INVESTING

Company Failure

Lack of Influence

Modest Performance

Inexperienced Management

Illiquidity

FSCS Status

Loss of EIS Status

Deal Flow and Cash Drag

Scams and Frauds