18

Investors in EIS funds obviously delegate

this task to the fund manager and it is

worth checking that the manager has a

good track record of picking firms that

do not lose their status (although this is

one of the pieces of information that fund

managers can be reluctant to disclose – see

the section on Measuring Performance).

EIS managers may use the services

of an external company (tax experts

or accountants) to check and verify

the EIS status of their underlying

companies and support ongoing

monitoring of qualifying status.

Advisers should be aware of this and

satisfy themselves that the investments

qualify for EIS status as part of their

due diligence process. They should

consider what effect loss of status would

have on a client’s financial plan.

ADVANCE ASSURANCE

Companies raising money can get

advanced assurance from HMRC that

they will meet the necessary criteria

and will gain EIS qualifying status.

HMRC can give an opinion as to whether

they would be able to authorise the issue

of EIS or SEIS certificates in due course.

The assurance is based on

information supplied:

Company statutory details

Financial statements

Activities

Funds to be raised and their use

Investment documentation

HMRC need to be satisfied that:

The company will meet the conditions to

be a qualifying company structure

Purpose

Activities

The shares will be ‘eligible’ shares

The shares are issued to raise money for

a qualifying business activity

The money raised is to be employed in

accordance with the requirements

Advance Assurance enables appropriate

changes to be made prior to investment.

It’s not a statutory procedure but can be

relied upon, provided matters proceed as

described and there are no

material differences.

If a company does make material changes,

they are obliged to inform HMRC.

However, an advance assurance

does not mean:

That any particular investor will receive

tax relief

That the company will continue to meet

the requirements

Alternatively, it could be more sophisticated

– a fund could invest in zombie companies

that are only just surviving (probably thanks

to the low interest rate environment),

investors could collect their tax relief and

the manager could collect their fees even

though the capital had not been invested

productively. This sort of fraud could carry

on for years without coming to light – and

in fact, even if it did it could be hard to

prove that it was a fraud and not just a

spectacularly bad investment manager.

Thorough due diligence on the underlying

investments or simply investing through

reputable managers with proven track

records is the key to avoiding this

particular pitfall.

Film Investment Schemes:

EIS investments

are sometimes used to fund the production

of films and provide some of the more

glamorous headlines attached to the

EIS sector. However, there have been

some widely publicised cases of film

investment schemes that have been used

for tax evasion, by exploiting clauses in

section 42 of the Finance (No 2) Act 1992

and section 48 of the Finance (No 2) Act

1997 (designed to encourage the UK film

industry) with no intention of putting

capital to work in order to produce a film.

This has led to a widespread reluctance

to invest in any film-related investment

scheme even though there have been no

frauds exploiting the EIS tax breaks.

In summary, the primary risks around

investing in EIS qualifying companies are

really the same risks associated with small

company investing – smaller companies

can and do fail. However, the EIS tax

benefits tilt the risks back in favour of the

investor somewhat. There are also some

additional risks to be mindful of when

investing in an EIS opportunity, but these

can be mitigated through thorough due

diligence. Overall, the risks in EIS investing

are not really unique to EIS. At its heart, it is

a tried and tested investment proposition

– providing capital to companies to help

them grow, in exchange for a share of

the company profits at a later date.

KEY POINTS

Tax reliefs tilt the risk/reward ratio back

in favour of the investor

Non-domiciled investors can

combine EIS investments with Business

Investment Relief

Many EIS investments will not be

covered by the FSCS

“The current enterprise landscape in the UK has led to increased entrepreneurial activity and

seed funding, resulting in many fantastic early stage opportunities”

BruceMacfarlane, MMC Ventures

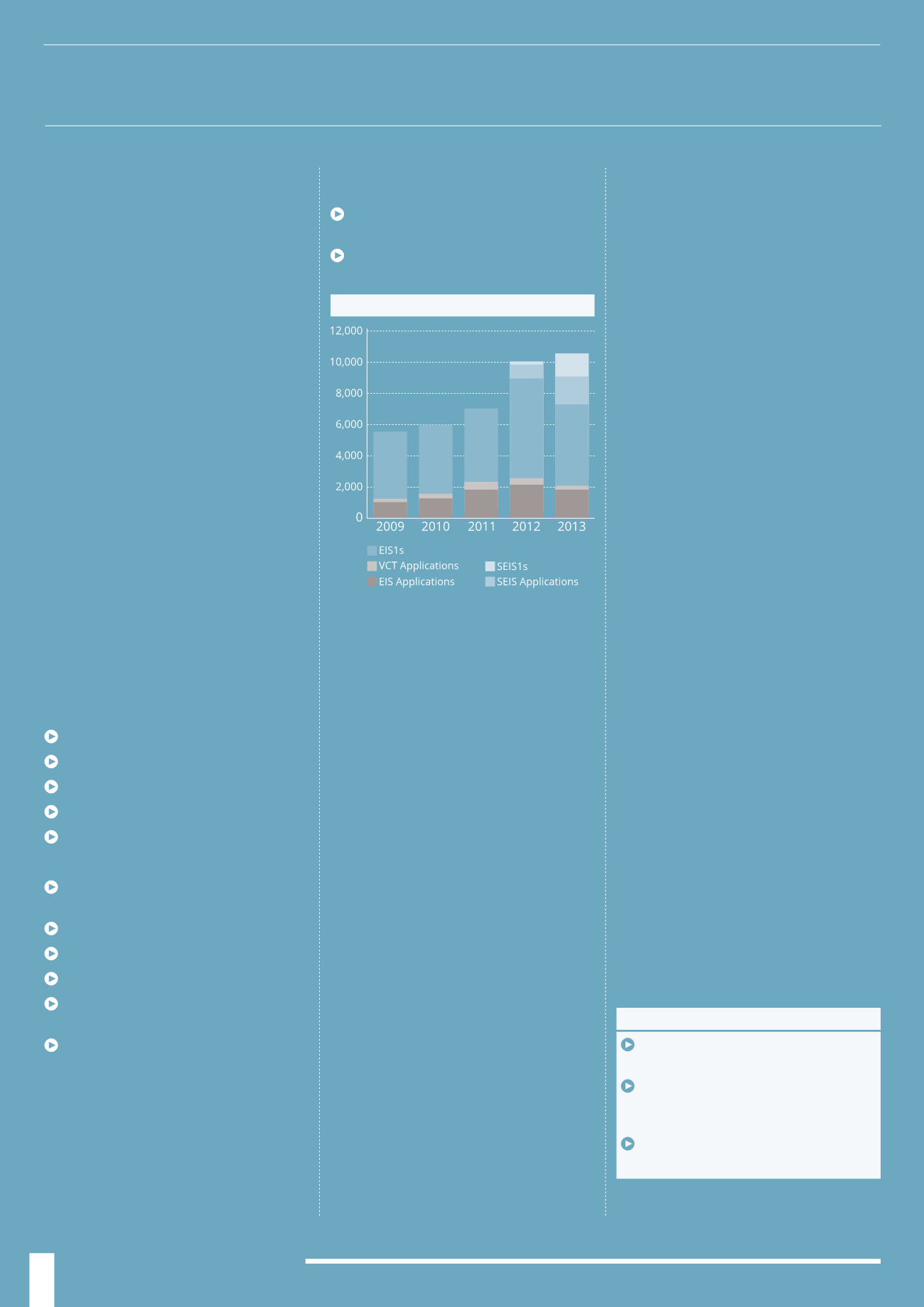

ADVANCE ASSURANCE STATS

DEAL FLOW AND CASH DRAG

This risk is particular to EIS funds: they

should deploy cash relatively quickly to

start earning returns. Failure to do so leads

to cash drag – a drag on performance.

Speaking with EIS fund managers and the

EISA, there appears to be no shortage of

deal flow, so this is not a risk right now.

However, if the deal flow dries up, we could

see instances of cash drag, or if managers

start to feel pressure to deploy their cash

they could be rushed into poor investment

decisions. It is down to the expertise of the

manager to ensure that they do not raise

too much money that they then cannot

allocate. Managers will have foresight over

their pipeline of investment opportunities

and therefore raise funds accordingly,

with a lower and upper fundraising limit.

SCAMS AND FRAUDS

To date, there has not been any major

fraud using EIS investments. However,

several industry participants have privately

acknowledged that fraud is a concern as

any incident of fraud would taint the whole

sector. Some have expressed a concern that

fraudsters who previously targeted the UCIS

(unregulated collective investment scheme)

market are now focusing on EIS, after the

regulators new policy (PS13/03) narrowed the

market for the promotion and sale of UCIS.

How could a fraud occur?

It could be an

outright fraud – setting up a fund, using the

EIS status as a marketing tool, collecting

investors’ money and running off with it.

Source: EISA Autumn Seminar 2013