11

GROWTH OF MARKET

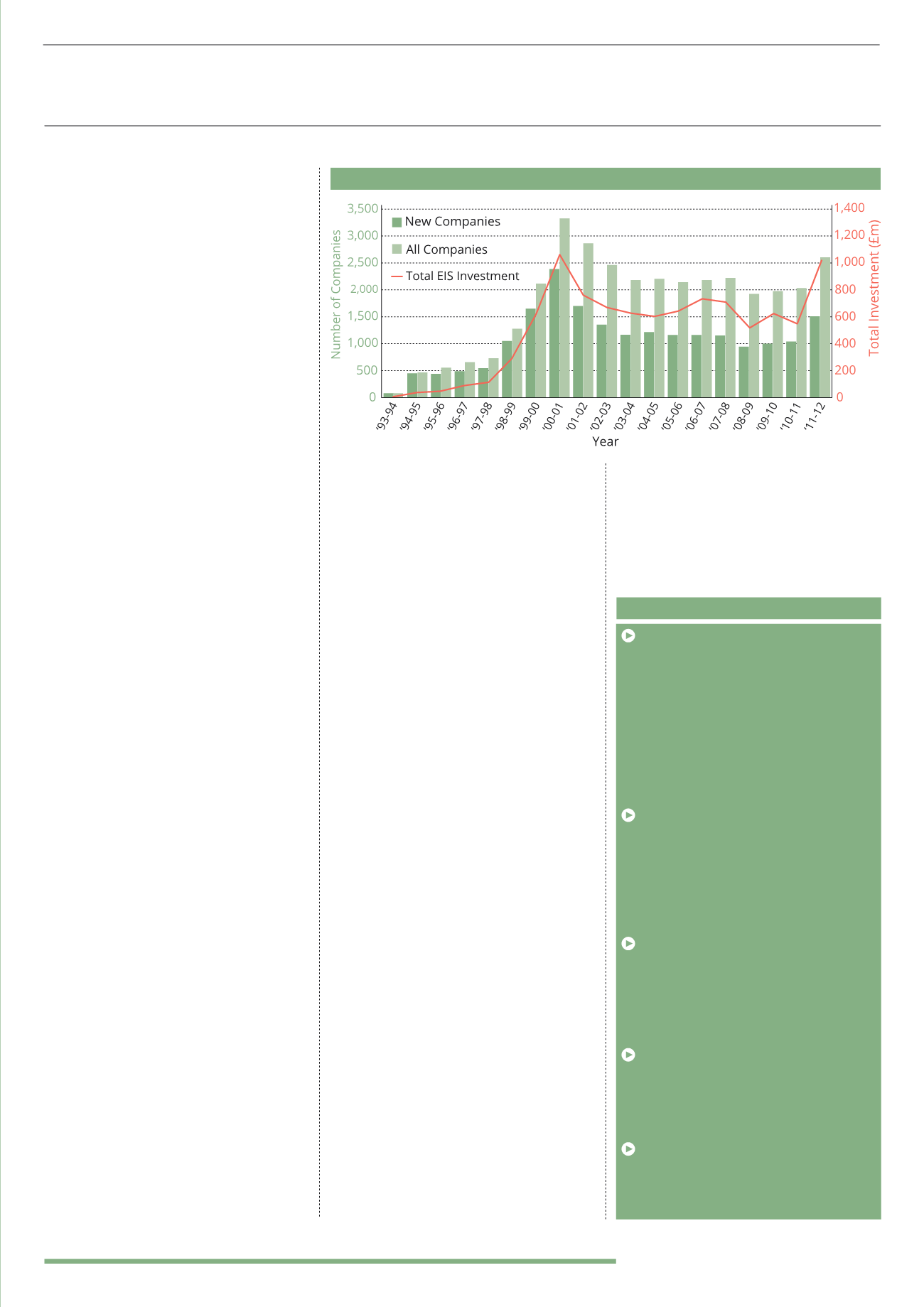

The chart opposite shows how both the

total amount of funds raised into EIS and

the number of companies raising capital

increased steadily from 1994 to 1998 and

then sharply from 1998 to 2001, in line

with the ‘tech’ boom in the stock market.

Both the amount of investment and

the number of companies raising

funds via EIS fell after 2001.

We can speculate that the tech boom in the

late nineties attracted a lot of investment

into smaller, start-up style firms and that

encouraged investment into EIS qualifying

companies. After 2001, the stock market

rallied and a strong bull market existed

until 2008 – but this market was not

associated with smaller companies in the

same way as the previous bull market was

and, consequently, we did not witness

dramatic increases in EIS fundraising.

This is actually encouraging, as it shows

that the EIS market is at least somewhat

uncorrelated from mainstream markets – at

least when it comes to fundraising success.

What is also encouraging is that after an

initial dip of companies raising funds via EIS,

from 2004 – 2011 the numbers have stayed

reasonably steady, indicating that there is

a strong foundation of engaged investors

and successful fundraisers in the market.

In the 2011/12 tax year, there was a dramatic

spike in both the amount of funds raised

(an increase of 87% to £1.017bn) and the

number of companies raising money

(including a large influx of new companies

accounting for 41% of the total).

This sharp increase can be attributed to

the increase in Income Tax relief from 20%

to 30% in 2011, historically low interest

rates and the introduction of the 50%

Income Tax rate for higher earners (over

£150,000 and since reduced to 45% again).

We can also speculate that the introduction

of Feed-In Tariffs (FITs) in 2010, stimulating

investment into renewable energy, also

played a part. The combination of the

security of revenue that FITs provide

combined with a low-risk asset backed

investment in a tax efficient EIS was very

alluring. Companies benefiting from FITs

were excluded from EIS qualification in 2011,

and Renewable Obligation Certificates,

which provide similar benefits, were

excluded in the recent 2014 budget.

The announcement in December 2012 that

the government would be reducing the

annual allowance for pension tax relieved

savings from £50,000 to £40,000 and the

lifetime allowance from £1.5m to £1.25m

may have a similar positive impact on

funds raised into EIS over the next few

years. We may well see EIS investment

used as a form of ‘pension substitution’.

Most investments are still relatively small

– 49% of investments are below £100,000

and funds are typically raised from a

number of smaller investors investing

£10,000 – £30,000. Many investors

will invest relatively small amounts

– perhaps £10,000 – but invest these

amounts regularly, perhaps every year.

However, 50% of the amount of funds raised

into investments is over £1m. Over 60% of

the companies raising money via the EIS are

in London and the South East (although this

does not necessarily mean that is where

all of their activity is based, this statistic

is taken from the companies registered

address). What is also interesting to note

is that, as of 2012, over 70% of investment

goes into three categories: Other Services

(recreational, medical and educational),

High Tech and Business Services.

In total, the Enterprise Investment

Scheme has promoted investment of over

£11bn since it started. Although there

are no official figures to support this, it

has been suggested that the Treasury

earns more in tax from the success of

the companies supported by the EIS than

they give away in relief to investors, and

the government and politicians from all

the major parties are, of course, keen to

support the important SME (Small and

Medium-sized Enterprises) sector.

As Matt Taylor of Rockpool put it at our 2013

Alternative Investment Summit in London:

“You can judge political support by politicians’

willingness to be photographed in connection

with the EIS. It does not seem rash to conclude

that the EIS will be with us for some time yet.”

Source: HMRC and EIS1 Forms

COMPANIES RAISING FUNDS AND AMOUNTS RAISED

(1993 - 2012)

“Government has done a great job of invigorating early-stage entrepreneurial activity,

and the EIS scheme has been particularly effective.”

Bruce Macfarlane, MMC Ventures

KEY POINTS

Launched in 1994, the Enterprise

Investment Scheme grew out of previous

schemes that used tax incentives to

encourage private investment into small

and medium sized companies such as the

Business Start-Up Scheme and the

Business Expansion Scheme. Fundraising

via EIS peaked in the tax year 2000-2001

and again in 2011-2012 and is set to

continue to rise

The most recent peak is associated with

an increase in Income Tax relief, increase

in the additional rate of tax, low interest

rates, and the opportunity to invest in

EIS opportunities based on revenues

supported by FITs (which no longer qualify

for inclusion in an EIS)

Decreasing annual and lifetime pension

allowances and an increasing recognition

of the need to diversify away from public

markets may mean that we see further

increases in EIS investment over the next

four to five years

It is believed that the Treasury earns

more in tax from the success of the

companies that have been supported by

the EIS, than they give away in relief to

investors

Historical statistics on the number of

EIS managers and opportunities are hard

to obtain as there is no central location or

list that covers the whole market