12

QUALIFYING COMPANIES

QUALIFICATION CRITERIA

The full list of rules can be found on

the HMRC website, but the qualification

criteria are quite simple and actually cover

a very broad range of companies from

start-ups to well-established firms:

Must be unquoted, i.e. not listed on the

London Stock Exchange. It can be listed on

the AIM or PLUS markets, but not the

PLUS-listed market. It can subsequently

become a quoted company and retain its

EIS status, but only if there were no

arrangements in place for it to become

quoted when the shares were issued

Must not control or be controlled by

another company that is not EIS qualifying.

It can have subsidiaries, but they must all be

qualifying subsidiaries

The gross assets of the company must

not exceed £15m immediately before any

share issue and £16m immediately after

that issue

Must have fewer than 250 full-time

employees (the definition of a full-time

employee is a standard 35 hour week)

Can raise up to £5m on a rolling

12 month basis via the EIS (up from £2m

previously), but this limit also includes any

funds raised via VCTs or any other

government backed source of funds

Funds raised must be deployed within

two years of the later of either a) the issue

of the shares or b) commencement of the

qualifying trade (this does not necessarily

mean spending the money – earmarking it

for a particular project is acceptable)

EXCLUDED ACTIVITIES

A number of activities are excluded and

have been listed below. For a full list you

should again consult the HMRC website.

Dealing in land, in commodities or

futures in shares, securities or other

financial instruments

Dealing in goods, other than in an

ordinary trade of retail or wholesale

distribution

Financial activities such as banking,

insurance, money-lending, debt-factoring,

hire-purchase financing or any other

financial activities

Leasing or letting assets on hire, except

in the case of certain ship-chartering

activities, receiving royalties or licence fees

though if these arise from the exploitation

of an intangible asset which the company

itself has created, that is not an excluded

activity (this is an important consideration

for firms in the creative arts or software

development)

Providing legal or accountancy services

Property development

Holding, managing or occupying

woodlands, any other forestry activities or

timber production

Farming or market gardening

Shipbuilding

Coal production

Steel production

Operating or managing hotels or

comparable establishments, or managing

property used as an hotel or comparable

establishment

Operating or managing nursing homes or

residential care homes, or managing

property used as a nursing home or

residential care home

Generating or exporting electricity which

will attract a Feed-In Tariff, unless generated

by hydro power or anaerobic digestion, or

unless carried on by a community interest

company, a co-operative society, a

community benefit society or a Northern

Irish industrial and provident society

Providing services to another person

where that person’s trade consists, to a

substantial extent, of excluded activities

and the person controlling that trade also

controls the company providing the services

There is some flexibility; a company can

carry on some excluded activities, but

these must not be a ‘substantial’ part of

the company’s trade. HM Revenue and

Customs take ‘substantial’ to mean more

than 20% of the company’s activities.

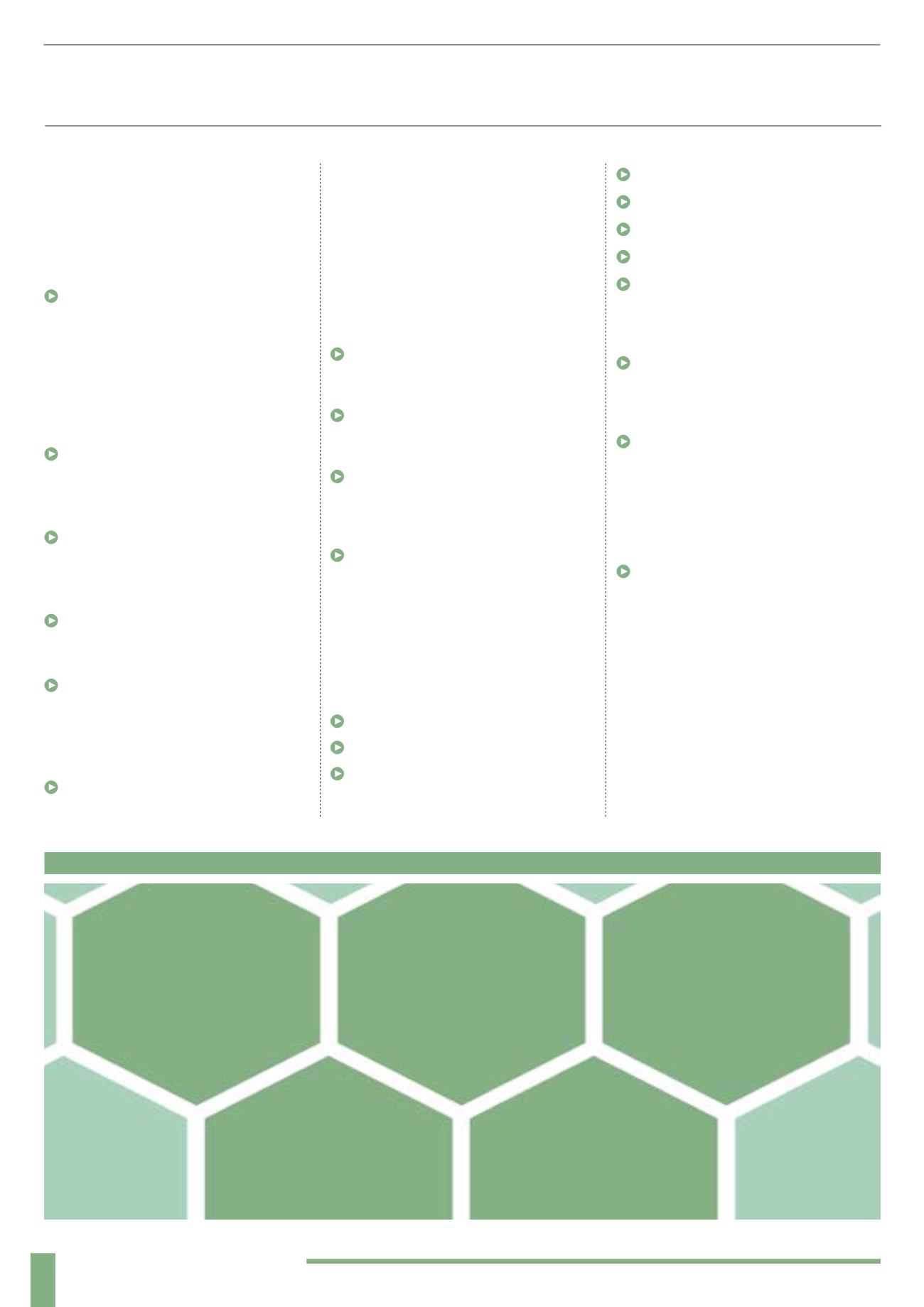

EIS QUALIFYING CRITERIA

Assets of £16m

post investment

Max investment of

£5m per company each

year from EIS or VCT

Max 250

employees

HMRC advance

assurance

Must be UK resident

or have permanent

establishment in UK