25

TOTAL RETURN

-100% -75% -50% -25% 0%

25% 50% 75% 100%

-£10,000 -£7,500 -£5,000 -£2,500 £-

£2,500 £5,000 £7,500

£10,000

INVESTMENT OPTION

GAIN (LOSS) AFTER TAX AND LOSS RELIEF

Directly Held Shares

-£10,000 -£7,500 -£5,000 -£2,500 £-

£1,500

£3,000 £4,500 £6,000

Shares ISA

-£10,000 -£7,500 -£5,000 -£2,500 £-

£2,500 £5,000 £7,500

£10,000

Shares within a SIPP

-£6,000 -£3,500 -£1,000 £1,500

£4,000 £6,500 £9,000 £11,500 £14,000

VCT

-£7,000 -£4,500 -£2,000 £500

£3,000 £5,500 £8,000 £10,500 £13,000

EIS

-£4,200 -£2,700 -£1,200 £500

£3,000 £5,500 £8,000 £10,500 £13,000

SEIS

-£3,000 -£1,500 £-

£2,500 £5,000 £7,500

£10,000 £12,500 £15,000

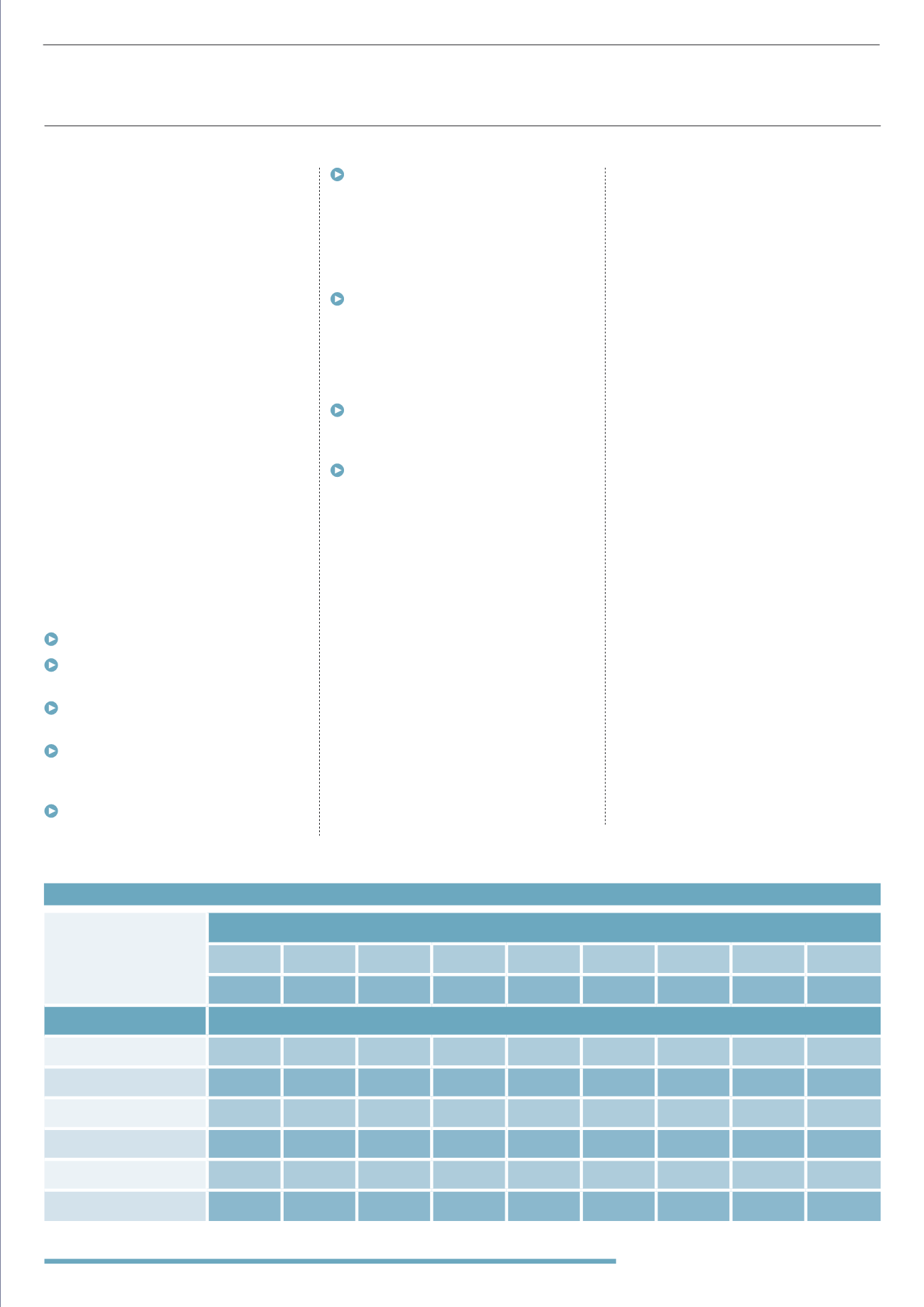

In this section, we provide a review of the

advantages of EIS investing and some

comparisons to other investment options.

This is based on simplistic scenarios to

aid your understanding of the concepts

we’re looking at. Real world scenarios

would in all likelihood be more complex,

with advisers having to build portfolios

for their clients over a period of years and

exiting over time, with considerations for

variables that we cannot predict, such as

the performance of individual investments

or changes in client circumstances.

The spreadsheet we built to help us to

conduct this research is available to

subscribers of Intelligent Partnership.

Advisers can adjust the investment

amount, tax status, timeframes and

level of returns used in the calculations

to explore alternative scenarios

they might be interested in.

METHODOLOGY

In all of the scenarios in the table

below, for simplicity’s sake, we

have assumed the following:

Initial investment of £10,000

Investor is a Higher Rate tax payer and

claims all available reliefs

Tax Relief is included as part of the return

(i.e. it was not invested)

We have not included any asset

management charges or transaction

charges in the calculations

We have assumed no dividends are paid

as they are smaller companies

This does not include the portfolio effect

of variance between underlying investments

within an EIS e.g. if one company in the

portfolio falls to zero and another increases

by 50%

FINDINGS

Investments held within a Self Invested

Personal Pension (SIPP) perform strongly

when returns are positive, due to upfront

tax relief, but of course SIPP money is not

accessible until retirement, which is a big

downside for many investors

In negative scenarios, the loss reliefs

mean that SEIS investments are the best

performers

Even relatively low investment returns

are boosted by the tax reliefs available

through SIPP, VCTs, EIS and SEIS

OTHER BENEFITS

There are four other major

investment benefits with EIS:

#1

EIS are potentially Inheritance Tax

exempt providing they have been held

for more than two years and are still held

upon death, which of course makes them

an excellent tool for IHT planning. The

government has frozen the IHT threshold

at £325,000 until 2019, creating the

need for new IHT planning solutions.

#2

The payment of tax on a capital gain can

be deferred if it is invested in an EIS (the

gain can arise from the disposal of any kind

of asset, but the investment must be made

within three years after the gain arose).

There are no minimum or maximum

amounts for deferral and no minimum

period for which the shares must be

held; the deferred capital gain is brought

back into charge whenever the shares

are disposed of. Gains can be deferred

indefinitely if they continue to be reinvested

in EIS qualifying companies and, if held upon

death, the gain is written off completely.

#3

Tax reliefs apply from the date

the investment is made into the EIS

company and that company starts

trading – which is a minimum of 3 years

for EIS compared to 5 years for VCTs.

#4

There is a ‘time value’ of money

consideration: receiving tax back within

12 months of investing is more valuable

than receiving it as a return at the end

of a much longer holding period, as

the money can be reinvested in other

opportunities, or used elsewhere.

“In uncertain economic times,

a high-alpha, low-correlation

EIS portfolio can complement a

defensive portfolio very well”

Alastair Kilgour, Parkwalk Advisors

COMPARISONSWITHOTHER ASSETS

COMPARISONS WITH OTHER ASSETS