45

sell and let their relief lapse (not taking

advantage of the three year window to

buy replacement BPR qualifying assets)

or they keep running a business they

would ordinarily have retired from

years ago - solely in order to retain the

IHT relief. Neither of these outcomes is

necessary, but low levels of awareness

of BPR investment products mean these

are common mistakes.

One of the issues is that the problem

might not ever come to the attention of

a financial adviser: it tends to sit with an

accountant who doesn’t ask the same

sort of financial planning questions that

advisers do. The fact that the business

owner wants to exit but has concerns

around estate planning doesn’t come

to light, and they are never made aware

that they have other options. This is

almost the worst of all possible worlds,

as very often the business is ran down

as the owners age or lose interest –

when in fact it could have been sold at

the height of its value.

So, as in the case with other tax efficient

investment products, it often pays

advisers to leverage their network

of professional connections to help

identify potential clients. The advice

process for a corporate BPR client will

look slightly different: they already

own BPR qualifying assets, so there is

no need to introduce them to a new

concept; they will already be well aware

of the legislation and be sophisticated

enough to easily pass suitability and

appropriateness tests. However, very

often there will be more stakeholders

advisers need to engage with if the

decision is taken by a board, or involves

other owners or family members

connected to the business.

This is good, new incremental business

for advisers, as it doesn’t cannibalise

anything from existing business – and if

they are likely to continue to advise the

client’s beneficiaries, they have a vested

interest in preserving as much of the

estate as possible.

When it comes to the products

themselves, there are only a small

number on the market (four according

to our research), but there are some

differences in terms of the levels of

liquidity and flexibility that they provide

- some are more bespoke than others

and will allow any trades within the

providers’ structure, some stipulate

that only the provider will manage the

trades, some allow the client to retain

the subsidiary company structure even

after they dispense with the providers

services, some are structured as a

single entity that all investor companies

participate in. Even in this narrower

niche, it is still worth the adviser

exploring which product is the best fit

for a particular client.

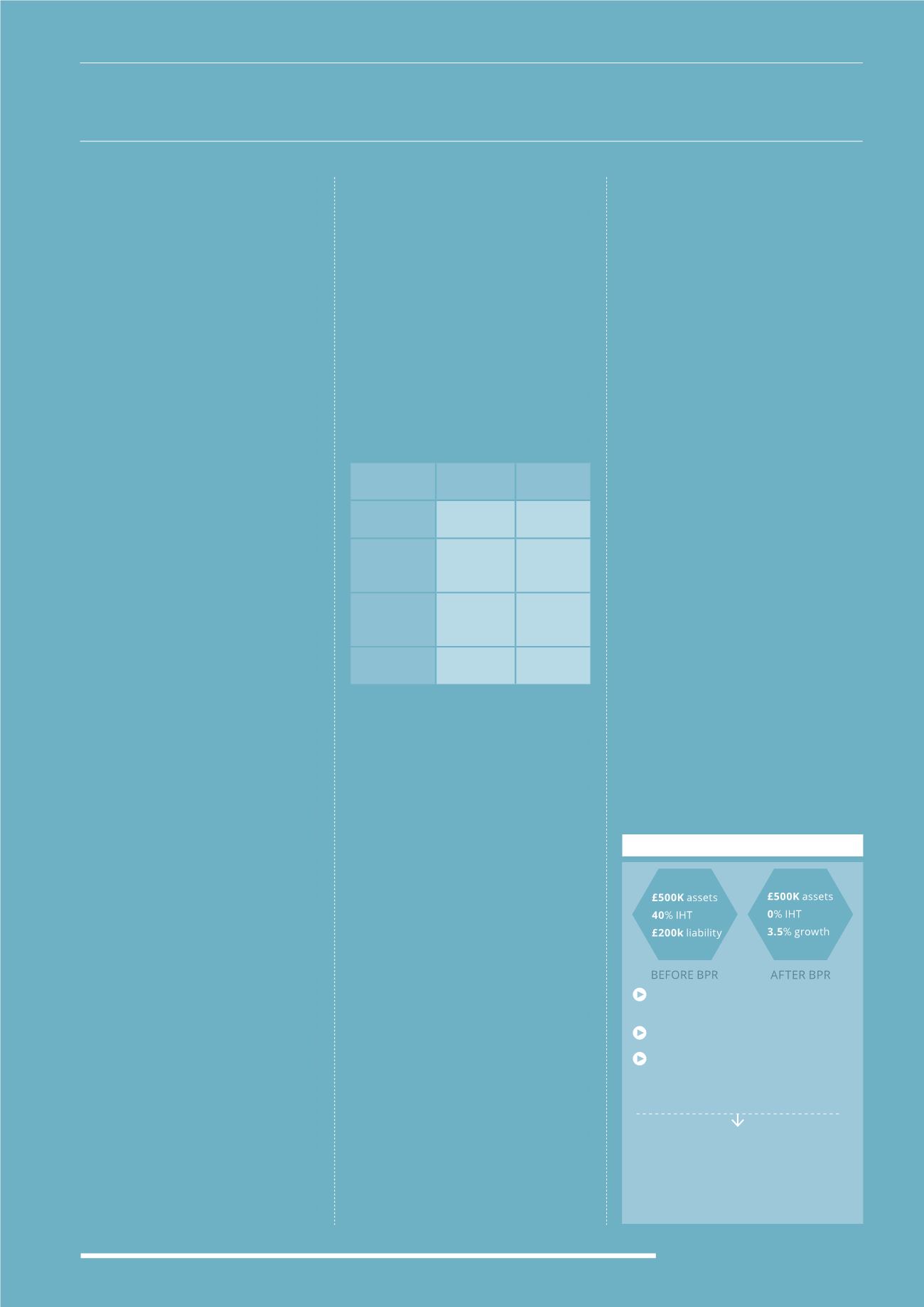

No action

taken

Planning

with BPR

Business

Value

£5m £5m

Capital

Reserves

£2m £0

(invested in

BPR trades)

BPR

Qualifying

Amount

£3m £5m

IHT Liability £800,000

(40% of £2m)

£0

Two final post scripts to this segment:

some firms with a large excess cash

balance choose to invest in BPR as an

alternative to keeping cash on deposit at

paltry rates of interest and some clients

use a BPR investment to turn a cash

shell company into a trading company

(and hence BPR qualifying).

BUDGET UPDATE:

ENTREPRENEUR’S RELIEF

These corporate BPR products were

impacted by changes that were

announced in the small print of the

2015 Budget. The products structure

the subsidiary company as an LLP or JV.

These are qualifying trades for BPR, but

after the 2015 budget these structures

no longer qualify for Entrepreneur’s

Relief (which reduces the tax that is paid

on any gains in the value of the business

from 28% to 10%).

So although the products remain very

attractive for providing the IHT relief,

for some businesses they’re going to

be less appealing in the future. Broadly,

businesses that are going to continue as

an ongoing concern are not impacted

at all, but businesses where the owner

was planning an exit have to consider

that any investment in a corporate BPR

product will be liable for CGT at the full

rate. This will impact products that use

both UCIS and non-UCIS arrangements,

and as BPR is a retrospective relief

(the estate applies for the relief upon

the death of the investor) it is likely

to capture people who have already

invested in these products – highlighting

the risks of changes in legislation for all

tax efficient investment products.

SPECIAL SITUATIONS:

POWER OF ATTORNEY

Of course it is unfortunately common

for the elderly to have to cede control

of their finances to their beneficiaries

using a power of attorney.

However, power of attorney does not

normally permit gifting and often

the seven year time frame of a trust

solution is not realistic. This is another

scenario where the simplicity and speed

of a BPR product can meet the needs of

the client. Full IHT relief can be secured

within two years, but the flexibility to

make withdrawals to cover expenses

such as care costs is retained.

It’s especially pertinent if the nil rate

band will be used up by property

or other assets and there are still

significant levels of wealth to consider.

“An asset-backed investment within a BPR environment allows you to preserve and grow the value

of your client’s estate, whilst allowing them to retain ownership and control of their investment”

Edward Grant, Ingenious

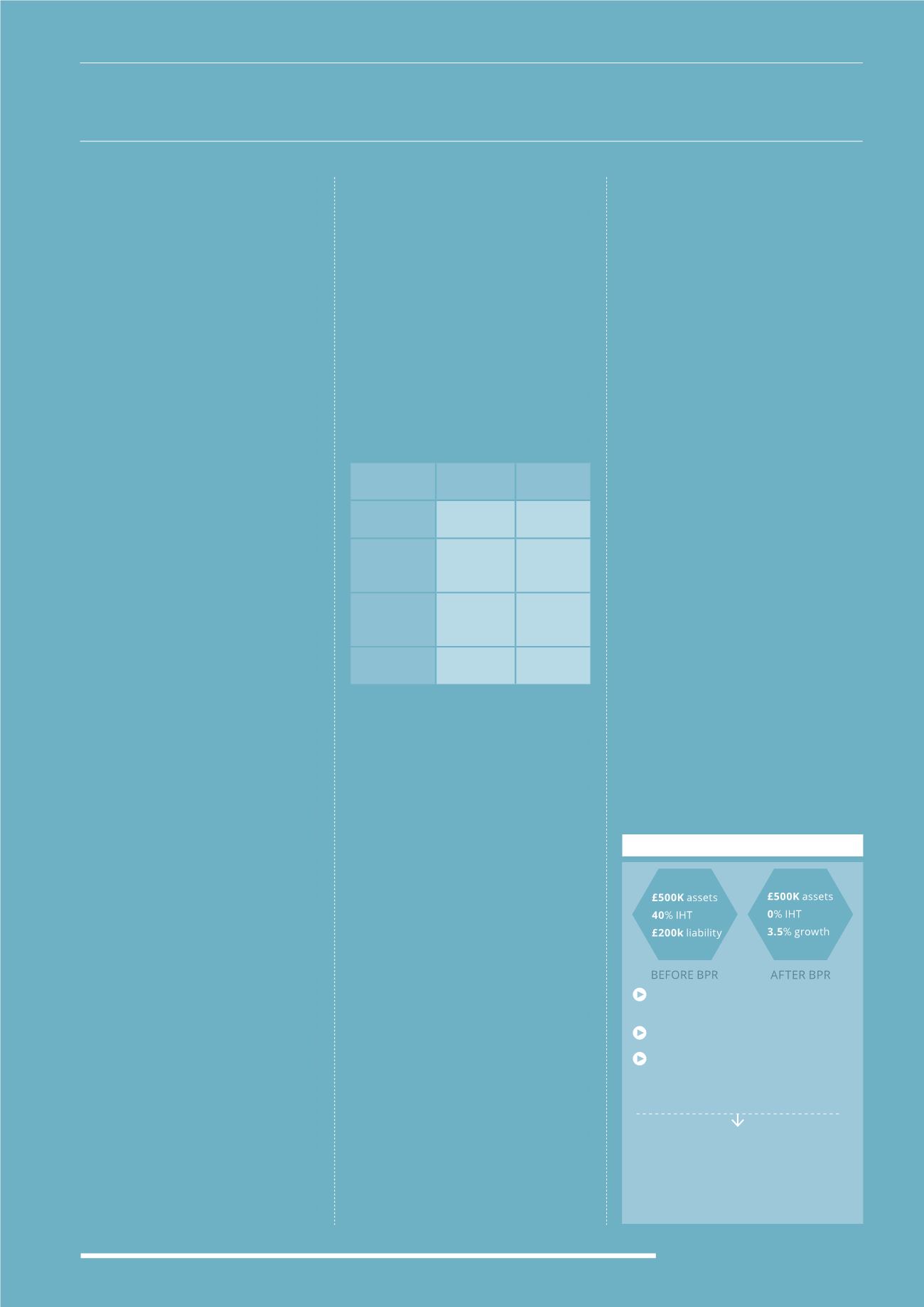

BEFORE AND AFTER BPR

Converting assets into BPR qualifying

assets is one of the few options open to

clients granted power of attorney.

Transfer assets to

a BPR investment

product and

achieve IHT

exemption in

2 years while

retaining access

to the funds

£650K house uses

up nil rate band

POA prevents gifts

Ill health requires

quick solution

Regular withdrawals for expenses

(eg care costs)