44

EIS

SELECTION

PORTFOLIO

MAKE-UP

T & C

TIME

HORIZON

ATTITUDE

TO RISK

KNOWLEDGE

& EXPERIENCE

AGE

OF CLIENT

TAXATION

BENEFITS

CAPACITY

FOR LOSS

OTHER TAX

ADVANCED

SCHEMES

SOME OF THE KEY CLIENT SUITABILITY CONSIDERATIONS

“Corporate BPR solutions, which help ensure a trading business holding excess cash continues to qualify

for BPR whilst retaining access to the capital, have the potential to help hundreds of small businesses

across the UK, representing a new income stream for many advisers”

Nigel Ashfield, TIME Investments

exemption – is not allowed to wag

the investment dog. The tax benefits

should not be looked at in isolation.

Advisers will need to consider the

suitability of any BPR investment for

a particular client, taking full account

of their detailed circumstances and

their attitude to risk. However, the

clear advantages of BPR means it could

have a significant part to play in many

investors’ estate planning.

USE OF BPR ALONGSIDE

OTHER SOLUTIONS

A BPR solution can be used alongside

trusts and life assurance, and in reality

this would be a sensible approach. If

estate planning is started early enough,

clients can maximise their use of gifts

and trusts as well as using BPR to

mitigate IHT. Indeed, if “early enough”

means affluent clients in their 50s and

60s, accessing BPR via an EIS might be

the best option if they are still looking

for some investment growth.

This would be a mixture of an “asset

reduction” strategy - gifting money to

beneficiaries to reduce the size of the

estate - and “asset conversion” strategy

- converting the estate into IHT exempt

assets. This two pronged approach

is probably going to be the most

appropriate solution in many cases.

In this scenario, life assurance and

trusts can provide a more conservative

foundation for the estate planning

- ensuring that what the client feels

is essential for their beneficiaries is

passed on in a tax efficient manner.

Alongside that, a BPR qualifying

investment will still benefit the client

with potential growth and ease of

access, whilst putting much more of

their wealth outside of the estate.

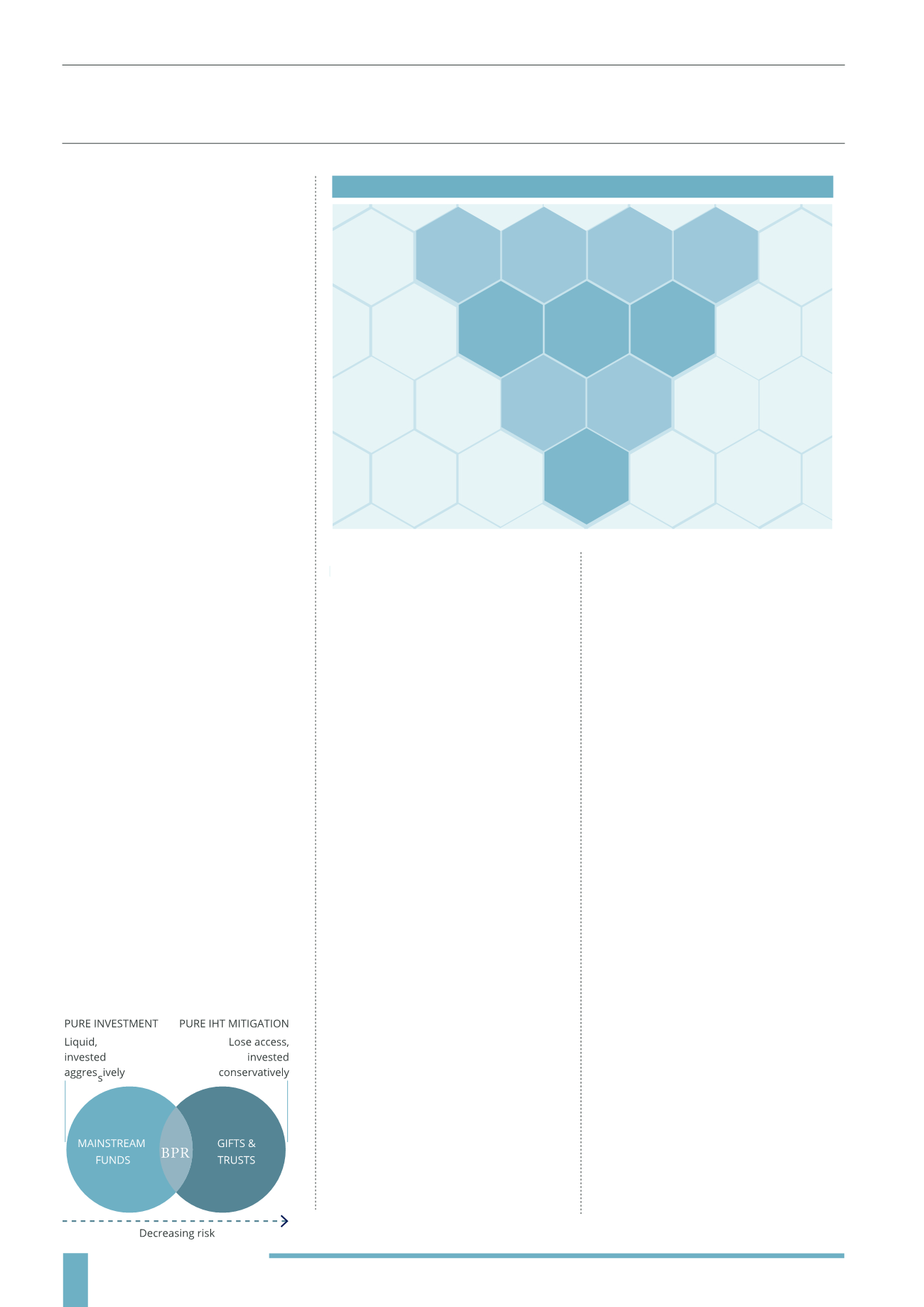

This is one way of looking at how BPR

fits into the investment versus IHT

mitigation equation.

BPR AND STAGE-OF-LIFE

If a client is still relatively young (say,

65) and healthy when they begin to

discuss estate planning with their

adviser, then traditionally the first

options to be considered would be gifts

and trusts, as the seven year timeframe

to achieve 100% IHT exemption is not

a major concern. However, now that a

healthy 65 year old could be looking at

living into 90s, losing access to those

funds could be troubling as they may be

required for future needs such as care.

This is one example where BPR should

be one of the options discussed with

the client .

One strategy that could be considered

here is a plan of rolling EIS investments

that are invested into BPR products as

they mature. This takes advantage of

the more generous EIS tax benefits,

builds up a portfolio of BPR qualifying

assets and reduces the risk profile of

the portfolio as the client ages and

capital preservation takes precedence

over accumulation. EIS is especially

powerful when you consider the ability

to defer a CGT liability indefinitely.

At the other end of the scale if an older

client in poor health has ignored the

issue of estate planning up until now,

BPR would be the swiftest way to

achieve IHT relief given that there could

be some doubt over the client surviving

the seven year timeframe involved with

other solutions

.

SPECIAL SITUATIONS:

BUSINESS AND BPR

Although BPR was originally conceived

for small businesses, many business

owners do not realise that they may

still fall foul of the rules and lose access

to the relief - particularly if they are

holding large reserves of cash. These

reserves may have been built up

over the years, or may be the result

of a recent sale of some business

assets, but if they can’t be shown to

be required for the running of the

business, they will be considered a non-

exempt asset and and could jeopardise

any IHT relief.

Some BPR providers offer a solution to

this problem by setting up a subsidiary

company that invests the surplus cash

into BPR qualifying investments. This

means that BPR and entrepreneurs

reliefs are reinstated, but the business

can still access these funds should

it need to (obviously subject to the

liquidity of the underlying investments).

These products help fulfil a real need

for the investors – anecdotally we know

that many small business owners either