www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

7

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

Diversification Benefits of Real

Estate

Modern portfolio theory tells us that to

decrease risk investment should spread

across several uncorrelated assets.

Global mainstream financial markets

are becoming increasingly correlated

and effective diversification is difficult

to achieve. Real estate is not entirely

removed from the financial markets,

especially in periods of austerity or

recession, but can provide a number

of diversification qualities. Prices and

occupancy rates do fall and experience

periods of volatility, however property

is a physical asset and a long-term store

of wealth. The recommended allocation

to real estate for an equity-oriented

portfolio is 20%

12

.

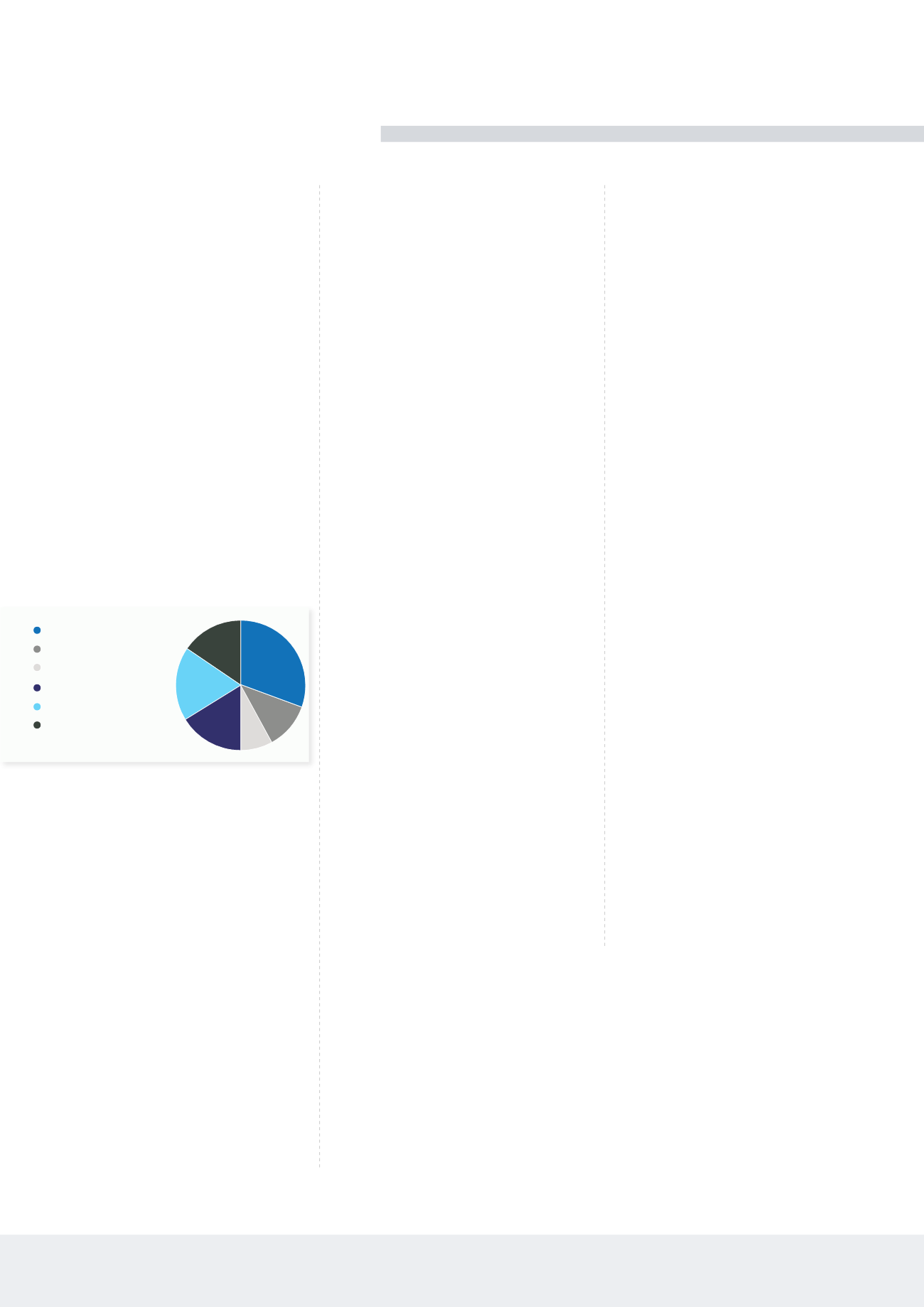

David Swensen Asset Allocation Model

In addition, real estate has also

traditionally been a very good hedge

against inflation. It can benefit from

capital growth and regular income with

returns often outperforming inflation,

providing a real return on investment.

Risks Unique to Crowdfunding

The risks to consider with crowdfunding

include the total loss of investment, lack

of regulation and liquidity.

Many countries are struggling to create

regulation and policy changes fast

enough to accommodate the evolving

world of alternative finance. The US and

UK have both created new regulation

with the objectives of better protecting

consumers without hindering deal flow

and have both restricted investment for

ordinary retail investors who do not have

a high capacity for loss. Where there

are no regulations in place, consumers

should be wary of poorly structured

platforms that do not segregate client

money, do not have any capital adequacy

requirements or do not have business

continuity plans in place if the platform

goes out of business.

Although some platforms offer a

provision fund if the borrower defaults

and doesn’t repay their loan, many still

do not. In the unfortunate event of a

complete company failure the possibility

of zero returns is very real. Some

investments are asset backed and if a

failure unfortunately occurs, selling the

underlying asset may recoup some of the

initial capital, but there is no guarantee

that the assets will be sufficient to recoup

the initial investment.

In addition, the lower levels of scrutiny in

the crowdfunding model mean that there

is an increased risk of fraud or failure as

scams or poor quality projects find an

easy route to market.

Finally liquidity will always be a risk,

particularly as there is currently no

established secondary market for real

estate crowdfunding investments.

However, this situation is likely to improve

over time as wider and deeper secondary

markets are established.

Mitigating the Risks

There are several ways to mitigate the

risks when investing in real estate through

a crowdfunding platform. The first would

be to choose a reputable platform,

which is preferably regulated and carry

out due diligence on the underlying

investments. The stricter the rules and

criteria imposed by platforms the better

the investments listed there are likely to

be. It is not enough to trust the platform

alone, investors should undertake their

own research and due diligence and

only invest in projects that they are

comfortable with and fully understand.

Platforms will have certain processes

in place to further protect consumers,

particularly in the UK and US where

crowdfunding is covered by new

regulation. If the platform fails they must

have a process in place to pass on equity

investments to experienced managers,

and to ensure the ongoing administration

of debt based investments. Many

platforms will hold the investment in trust

or beneficially on behalf of the investor,

and to ensure it is kept separate from the

assets of the platform.

Crowdfunding platforms do not offer any

recourse (to financial services protection

schemes) for investors if the investment

fails, but asset-backed investments

can mitigate the risk of a total loss as

underlying assets will be sold to repay

investors. Some platforms even have

a provision fund to protect investors if

the borrower defaults, but this is not

mandatory.

Diversification across several properties

can enable investors to create a well-

balanced portfolio which is suitable and

meets their needs. They can mitigate the

risk of a total loss by offsetting riskier

investments against solid asset-backed

opportunities. The minimum investment

seen with crowdfunding means

investors can diversify across several

properties which wouldn’t be possible

with traditional real estate investment

opportunities.

Domestic Equity

Foreign Developed Equity

Emerging Market Equity

Debt

Equity

Co-Invest

Real Estate

US Treasury Bonds

US Treasury Inflation -

Protected Securities

30%

15%

5%

15%

15%

20%

40%

38%

23%

12 -

https://www.realtymogul.com/blog/asset-allocation-in-real-estate