www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

3

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

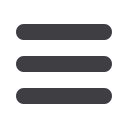

North Amercia

$1,606m

Europe

$945m

Asia

$33m

Oceania

$76m

Africa

$0.1m

South America

$0.8m

2010 $0.90 billion

2011 $1.48 billion

2012 $2.67 billion

Global Crowdfunding Volume (2012)

Real Estate

Real estate is one of the largest, most

established and best understood asset

classes. An allocation to real estate as

part of a well-diversified investment

portfolio has many benefits: capital

preservation; capital growth; regular

rental income; diversification and a hedge

against inflation.

There are two main conventional options

for ordinary retail investors considering

real estate. Direct property investments

give pure exposure to a specific project

and investing directly should provide

investors with the highest levels of control

and transparency. Successful direct

investments also have the potential for

the highest returns. However, direct

investments often require a large amount

of capital to invest; transaction and

operating costs can be high; there is no

diversification to mitigate risks and some

developments (particularly those that are

off plan) are often high risk.

Real Estate Investment Trusts (REITs)

offer a more accessible way to invest in

property, with lower minimum investment

amounts and risk spread across multiple

properties. But investors will have

little control over what properties are

bought and sold, there can be a lack of

transparency about underlying assets,

fund management costs can be high and

potential returns are much lower.

Worldwide

Source: Massolution

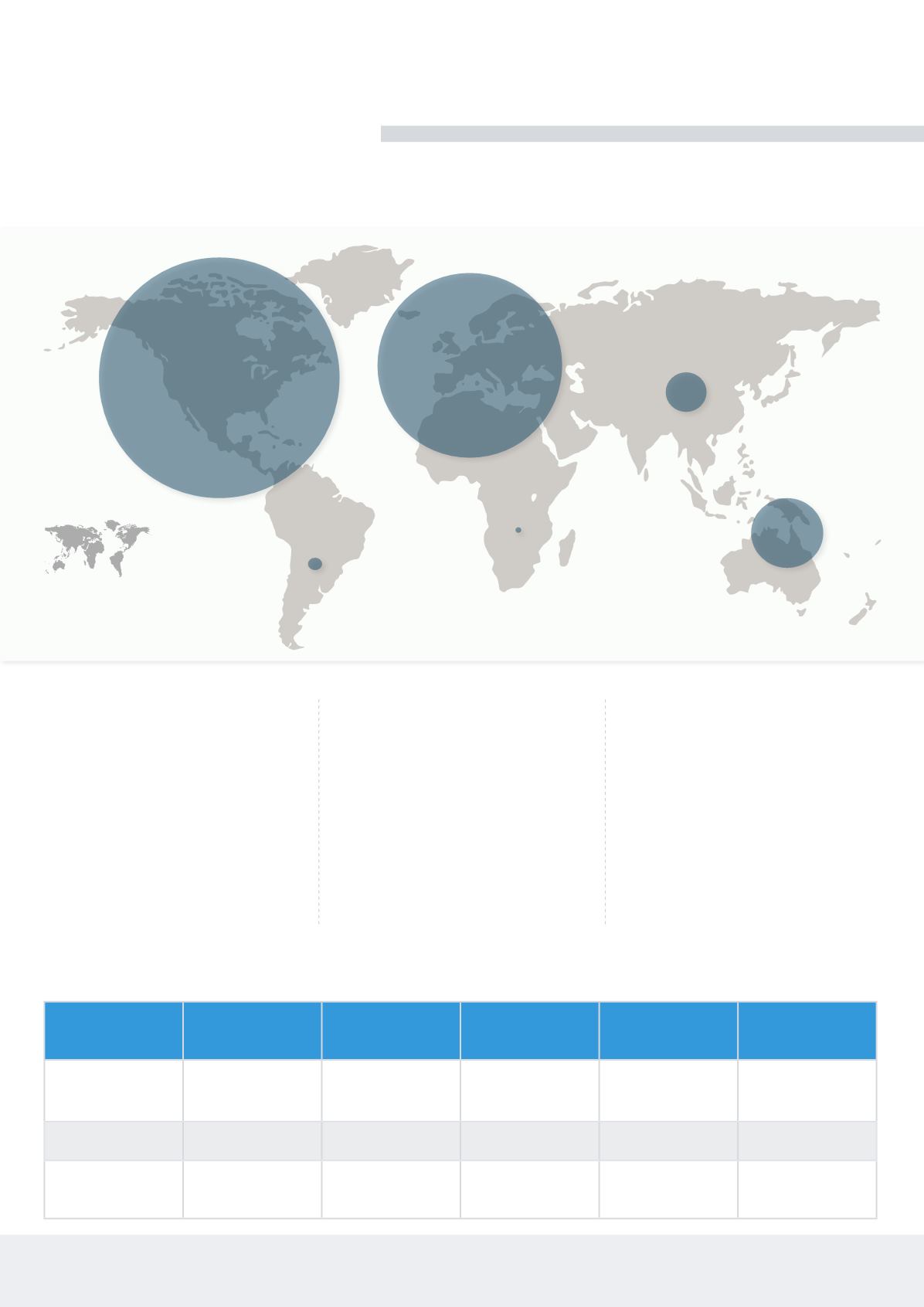

Low Minimum

Investment

Low Transactions

Costs

Ability to Easily

Diversify

Transparent

Investment

Control of

Investment

Directly Held Real

Estate

x

x

REITS

x

x

x

Real Estate

Crowdfunding

x

x

x

x

x

Direct Real Estate Investment Options