www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

5

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

Investment Case & Risks of Real Estate

The real estate market offers a very wide range of options. Properties are located all over the world covering mainstream commercial

and residential sectors and more esoteric opportunities such as car parks, care homes and student accommodation. Of course,

the location, property type and the stage of development all impact the risks and returns for investors. This section looks at the

investment case for real estate, considers the different types of opportunities available and the advantages that crowdfunding has for

both investors and developers.

Commercial Property

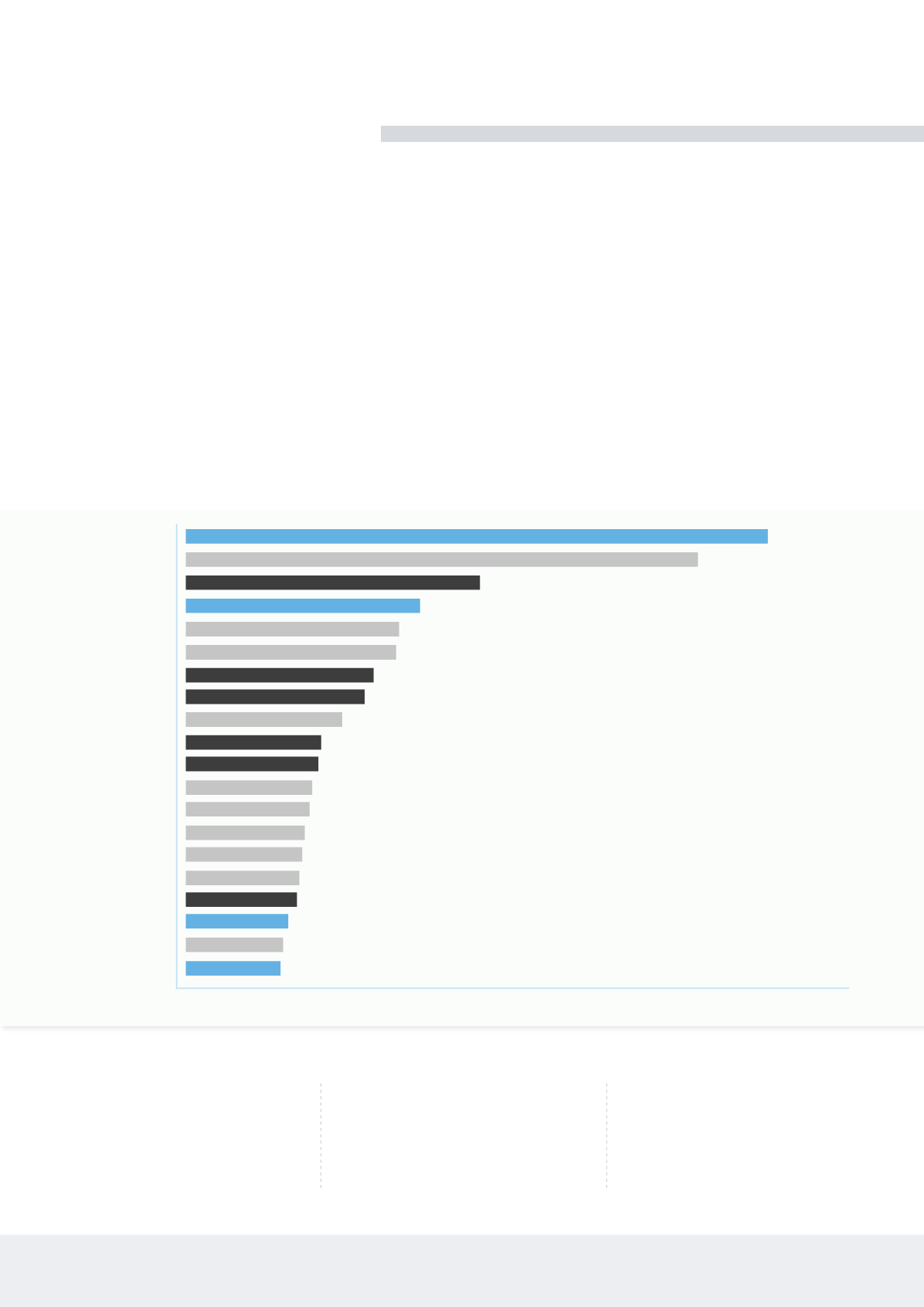

Commercial property includes retail, office and industrial space. The sector took a big hit during the 2008 financial crisis but

confidence is beginning to grow in several cities across the world. The chart below shows the top 20 cities for direct commercial

property investment during 2013.

Direct Commercial Real Estate Investment - Top 20 Cities in 2013

London

New York

Tokyo

Paris

Los Angeles

Chicago

Sinapore

Shanghai

Washington DC

Seoul

Hong Kong

Boston

Dallas

Houston

Silicon Valley

Seattle

Sydney

Munich

San Fransisco

Moscow

0

40

20

10

30

35

25

15

5

Source: Jones LAng LaSalle, January

2014

U.S.$

Billions

Americas

EMEA

Asia Pacific

Commercial property has a wide range

of investment benefits. It can provide

steady annual returns from rental

income secured on long-term contracts

and capital growth at least in line with,

and often above inflation. Commercial

property is also a source of portfolio

diversification as it is less volatile than

mainstream assets such as equities and

bonds. Returns from commercial property

are relatively strong and investment

interest is now improving across the

globe.

Management fees are a big consideration,

it is important to have an experienced