www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

13

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

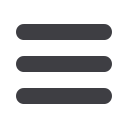

Investment Terms

Real estate is considered to be medium

to long-term investment, with annual

rental income and capital growth over the

longer term. Short term options such as

off-plan and redevelopment projects also

exist.

Equity investments are commonly into

unlisted companies with no established

secondary market. These tend to be

longer term investments ranging from 1

to 8.5 years. The average term is 4 years.

Investors should note that although the

aim will be to sell the underlying assets

after a fixed term there is no guarantee

that a sale will happen and investors

should be prepared to be flexible.

Established companies are more likely

to use debt based investments to fund

individual projects or expansion of their

activities. For this reason the average

investment term is lower at 1.5 years.

Investment terms range from only 5

month to up to 3 years. These are much

shorter than traditional real estate

investments and means investors do not

have to tie up their capital over a long

timeframe.

Investment Terms Equity vs Debt (2014)

Source: Intelligent Partnership

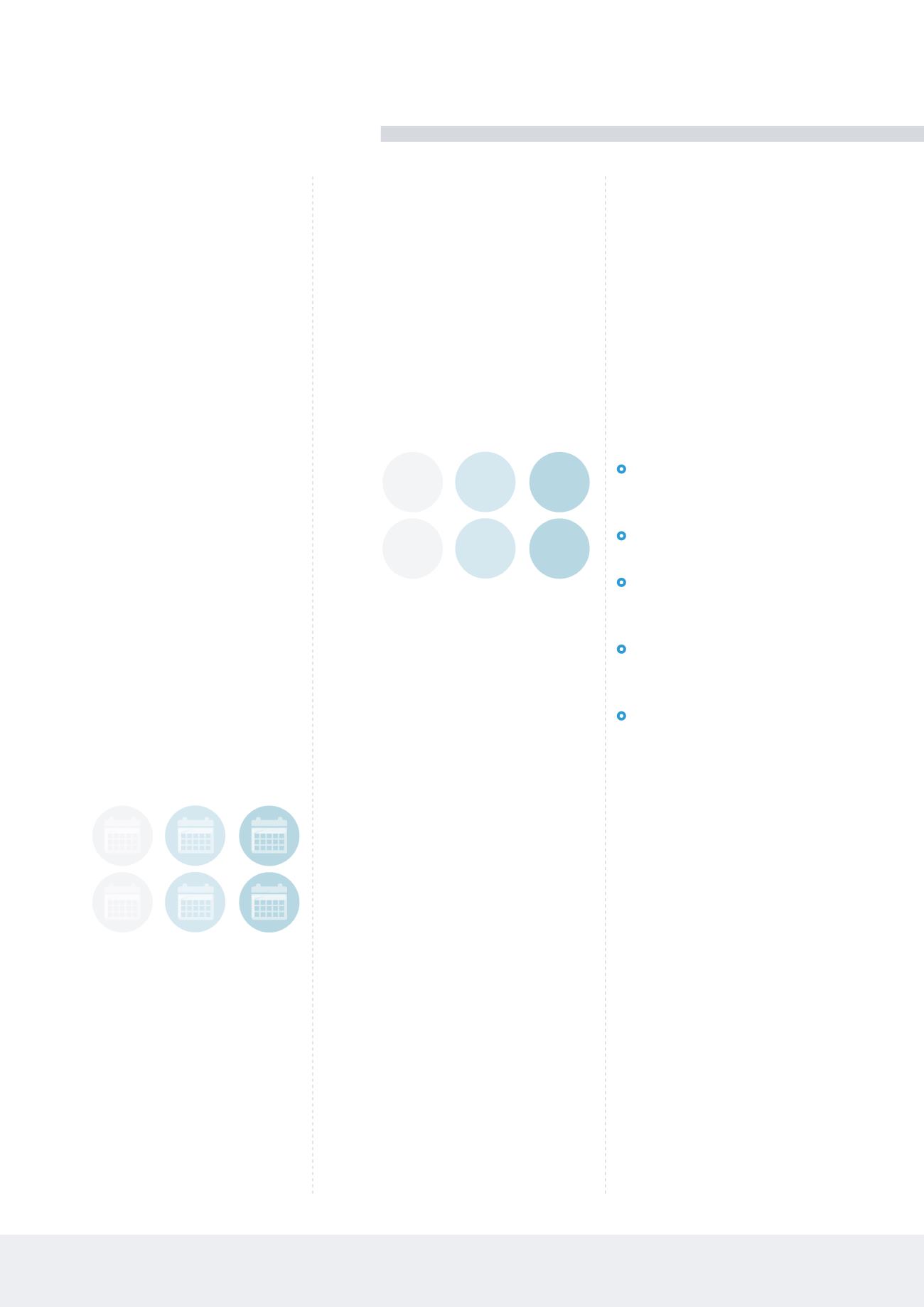

Returns

The search for higher returns is one

of the main drivers for investors to

consider crowdfunding, particularly as

bank interest rates on savings are so

low. Returns are usually predicted for

equity based investments and fixed for

debt based. Note that returns will be

influenced by location, type of property,

build stage and local market demand.

In return for taking on higher risk with

equity based investments you expect

higher returns. Forecast returns range

from 7% to 33% per year, with an average

of 18% per year. Debt investments

advertise strong fixed returns of between

7% and 19% per year. The average is

14.25% per year. These returns remain

consistent with the IDP UK Commercial

Property total return index, showing that

these returns are realistic.

Returns Equity vs Debt (2014)

Source: Intelligent Partnership

Exits

The exit for equity and co-investment

models relies on the sale of the

underlying property. Each investment

states when the developer hopes

to sell the property to achieve the

targeted return. Some equity models

allow investors to sell their shares to

other shareholders with permission

from the investment provider. As

mentioned previously there is currently

no established secondary market for

equity based crowdfunding investments

although some platforms are likely to

implement online marketplaces in the

near future.

Debt investments typically have a defined

exit on maturity of the loan, when it must

be repaid in full. It is difficult for investors

to exit before this date as yet there is

not an established secondary market,

although some platforms will look to

implement marketplaces to facilitate this,

as has been seen in the P2P markets in

the UK and US. Investors may also be

allowed to sell their investments privately

before maturity with permission from the

investment provider.

Conclusions

The real estate crowdfunding concept is

growing rapidly and in locations all over

the world, giving investors the benefit of

an asset backed real estate investment

and the opportunity to achieve stellar

returns at a much lower investment level.

Crowdfunding provides more options

to the investors around the investment

timing, type and location of the property.

71% of platforms undertake some

form of due diligence before listing

an investment

38% of investments were structured

as equity and 40% debt

Average annual returns from equity

based real estate crowdfunding are

18%

Average annual returns from debt

based real estate crowdfunding

investments are 14.25%

Residential property based

investments were the most popular

with 57% of the market

Additional Information

Angels Den

hosts free Business Funding

Clinic to educate fund seekers before

pitching to potential investors and

Speedfunding events for investors to hear

fund pitches and ask business owners

questions before deciding to invest.

Massolution

provides crowdfunding

and crowdsourcing market research,

data and updates across all sectors of

crowdfunding.

Alt Fi

provides data and news for the

alternative finance sector.

UK Crowdfunding

provides background

information and self-regulation for UK

platforms.

Times Realty

News provides market

updates and commentary on the real

estate crowdfunding sector.

Equity

Debt

Minimum Maximum Average

1

8.5

4

3

1.5

0.5

Equity

Debt

Low High Average

7% 33% 18%

19% 14.25%

7%