www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

12

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

risk and therefore minimum investment

levels should reflect this. The lowest

equity investment was US$5,000 and the

average was much higher at US$25,600.

As debt based investments are often

offered by relatively established

companies they are seen as lower risk.

The minimum investment is as low

as US$1,000 with the average at just

US$7,000. The lower capital requirement

and less stringent regulation means

debt based investments are more widely

accessible to investors.

Minimum Investment Equity vs Debt

Offerings (2014)

Source: Intelligent Partnership

Due Diligence

71% of platforms identified undertake

some degree of due diligence before

allowing an investment to be listed.

Although we do not know the exact

criteria each platform requires of the

developers, providing some form of due

diligence will ensure that only qualifying

opportunities are available to investors.

Just because the platform undertakes

some due diligence it doesn’t mean that

the investment is safe, or that it is suitable

for the investor. Investors should always

perform their own due diligence to verify

any checks undertaken by the platform.

Locations

The crowdfunding concept is spreading

rapidly and covers a number of countries

around the globe. The majority of

platforms are based in the US, followed

by the UK and Canada. There is a lot of

potential for growth into new markets

over the coming years, particularly Asia

and South America.

Platform Locations (2014)

Source: Intelligent Partnership

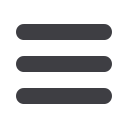

Investment Structure

The ratio of equity and debt structured

investments was relatively evenly

distributed across our sample with 38%

and 40% respectively. Restrictions on

debt based investments are less stringent

and there are a number of opportunities

available. Co-investment accounted for

22% of our sample, with every investment

coming from one platform that specialise

in this investment model.

Investment Structure (2014)

Source: Intelligent Partnership

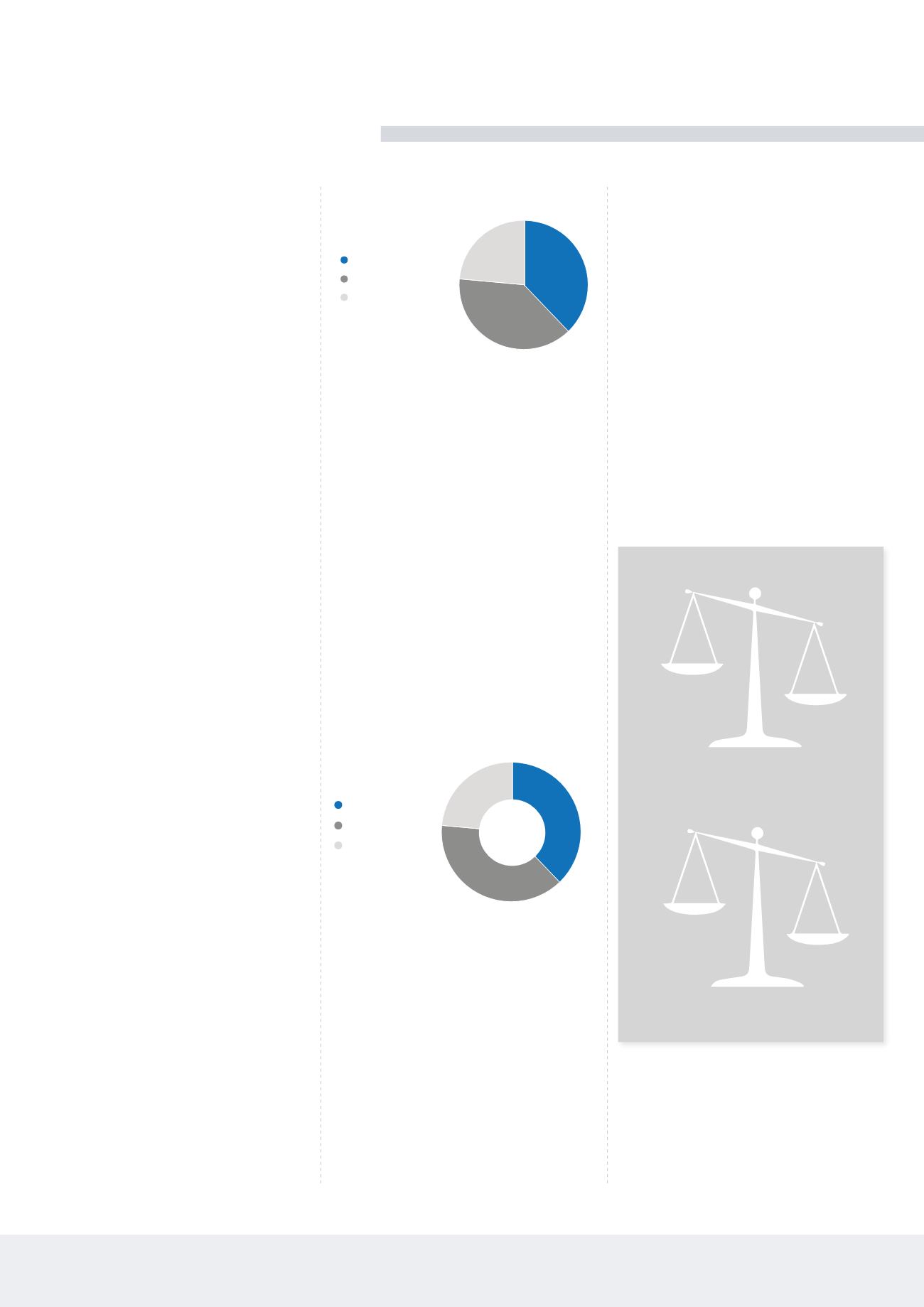

Property Type

Real estate investment opportunities were

found across residential, commercial and

mixed use (commercial and residential)

properties. Residential accounted for

the highest proportion on investments

with 57%. These range from single

family homes to large scale apartment

complexes. Commercial property,

including mainly retail and office space,

accounted for 26% of investment

offerings. The remaining 17% consisted of

mixed use developments.

Property Type (2014)

Source: Intelligent Partnership

Minimum Investment Levels

The minimum investment (capital

required to invest) shows how accessible

the real estate crowdfunding market is.

Data was collected from several platforms

from across the world in local currencies

and have been converted to USD [x1.70

for GBP] for analysis purposes.

Equity crowdfunding is generally higher

Domestic Equity

Foreign Developed Equity

Emerging Market Equity

Debt

Equity

Co-Invest

Real Estate

US Treasury Bonds

US Treasury Inflation -

Protected Securities

30%

15%

5%

15%

15%

20%

40%

38%

23%

Commercial

Residential

Mix Use

26%

57%

17%

Domestic Equity

Foreign Developed Equity

Emerging Market Equity

Debt

Equity

Co-Invest

Real Estate

US Treasury Bonds

US Treasury Inflation -

Protected Securities

30%

15%

5%

15%

15%

20%

40%

38%

23%

Commercial

Residential

Mix Use

26%

57%

17%

Equity

Debt

Minimum

Minimum

Maximum

Maximum

Average

Av rage

US$5,000 USD

US$1,000 USD

US$250,000 USD

US$8,400 USD (5000 GBP)

US$25,600 USD

US$7,000 USD

Americas

UK

EMEA

Asia Pac

US and