www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

6

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

management team in place to handle the

day-to-day operations and this can come

at a high cost. The right management

company can be central to the success of

a property. Commercial properties are

large investments and are often valued

according to their rental yield. Therefore

it is important to have secure long-term

tenants in place, particularly when looking

to sell. Long-term rental contracts often

include break clauses and upward only

rent rises linked to inflation, which can

help to provide inflation proof returns. In

comparison to other European countries,

the UK has some of the most attractive

lease terms available, typically ranging

from 5 to 15 years

9

.

Residential Property

Residential property primarily covers

buy-to-let style investments and now

more commonly city centre apartment

blocks and holiday lettings. Long-term

buy-to-let investments can provide stable

returns as rents historically keep pace

with wage increases and inflation rates,

as long as the property remains tenanted.

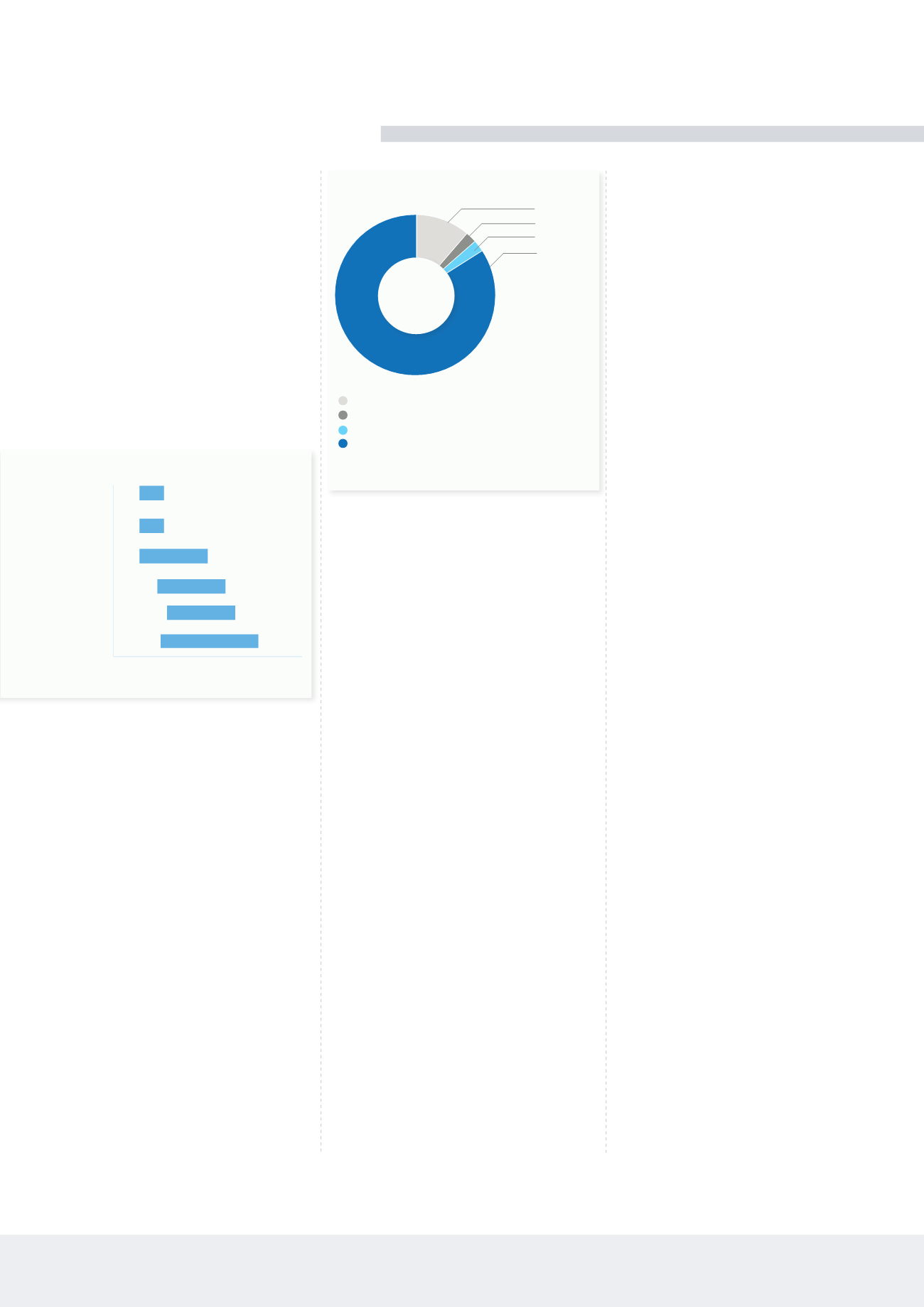

In 2013, UK real estate was worth over

£5,096 billion, with residential property

comprising over 85% of that total.

10

Residential property is uncorrelated

to mainstream investments as rents

tend to hold up during periods of

economic distress, so again this can

provide diversification within a balanced

investment portfolio.

Residential property is less exposed

to the business cycle than commercial

property but has higher management

requirements including regular

rent collection, health and safety

requirements, general maintenance and

often a higher turnover of tenants. An

experienced management company can

take care of these duties for a percentage

of rental income, which will impact profits.

If the project fails completely investors

could lose all of their investment,

depending on what assets or property the

developer owns as recourse.

Another consideration is the supply of

properties in the local market. It may take

several years to complete a property and

the market could change dramatically

over this timeframe.

Liquidity is very important, as it is very

hard to find buyers for a property which

isn’t complete or which has run into

trouble. Investors have little control

over the building works or completion

date - they are often soley reliant on the

developer. Funds are released to the

developer once specific build stages

have been met, but if the project is over

budget, they may require more capital to

move to the next stage.

Redeveloping Built Property

A property that is already built and only

in need of refurbishing or re-purposing

is usually a much lower risk proposition.

Some investment properties will already

have sitting occupants producing a

steady income. Returns will often be

easier to forecast and more predictable,

but are likely to be lower than off plan

properties. However the initial capital

outlay is much higher, especially for

established properties with a predictable

revenue stream, reducing the opportunity

for stellar returns.

Properties that have already been built

are likely to be the least risky as regards

to building stage, although this can vary

dramatically depending on the extent

of the work required. Redevelopment

projects could require a large capital

input, planning permission and specialist

skills, particularly if structural work is

required. This will be inherently more

risky than a property that already has

sitting tenants or that only needs basic

general maintenance. Of course the

scale of redevelopment will impact the

potential increase in value. Liquidity

must still be considered, alongside

the timeframe for any maintenance or

development, the performance of the

local market and transaction costs.

Redevelopment properties are often

shorter term investments which look

to add a large amount of value to the

property in order to sell it on at a profit.

Examples include splitting a large

property into flats or modernising a

property in order to add value.

Typical Lease Lengths by Country

Spain

Sweden

France

Germany

Italy

UK

Source: DTZ Annual report 2013

0

5

10

15 20

Overseas residential property

investments can be higher risk as

investors will typically have less

understanding of the local market, so

proper due diligence here is crucial.

Companies such as Savills and Knight

Frank operate on a global scale and can

provide research, market updates and

assistance for key locations all over.

Off-Plan Investments

Off–plan refers to buying a property

before it is built. Properties are often sold

at a pre-development stage as this helps

developers to secure the funding needed

to start the project. Prices are usually

greatly reduced but for obvious reasons

the risks are much higher – investors are

exposed to all of the potential delays

and risks that go with a new build - and

it is often seen as highly speculative.

However there is the possibility of much

higher returns. Once the property is built

investors can sell or lease it out for a

higher profit. In certain locations returns

can reach 25-30% per year.

11

Off-plan is the riskiest way to invest in real

estate and can include a large amount of

speculation. Several problems can arise

before the building is completed. Delays

can occur from the outset: building

permission may not have been granted or

environmental issues could halt the build

and push up costs and result in delays.

The developer could run out of funds and

be unable to finish the property, or they

could run over time which again will result

in further costs. This could make it very

hard for the investor to exit and mean they

have to hold on to their investment for

much longer than originally anticipated.

9 -

http://www.henderson.com/sites/henderson/uk_property/getdoc.ashx?ID=2015010 -

http://www.bpf.org.uk/en/files/reita_files/property_data/BPF_Property_Data_booklet_2013_spreads_web.pdf11 -

http://www.propertyshowrooms.com/guide/buying-off-plan-guide.asp)

Core Commercial Property

Other Commercial Property

Other Non-Domestic Buildings

Residential

£504bn

£65bn

£80bn

£4,447bn

Source: BPF Property Report 2013

UK Property Values (2013)