www.intelligent-partnership.com

www.intelligent-partnership.com

Real Estate Crowdfunding

, ,Alternative Finance Sector Report - October 2014

14

REAL ESTATE CROWDFUNDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

October 14

AUTHOR

Samantha Goins

S

O

W

T

S

O

W

T

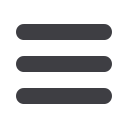

Real Estate Investment SWOT

Strengths

Provides diversification from mainstream financial assets

Portfolio benefits such as hedge against inflation and

steady regular income

Weaknesses

Lack of liquidity in the sector

High minimum investment costs

High transaction costs

Regulatory barriers in some countries

REITs are unclear about the underlying properties

Possibility of under or overvaluing the underlying property

Opportunities

Emerging countries and economies may provide stellar

returns

High rate of competition to drive out bad investment

opportunities

Alternative finance to bridge the weakness and give more

investors access to this asset class

Threats

The economic health in parts of the world

Changes in supply and demand

Market ‘bubbles’

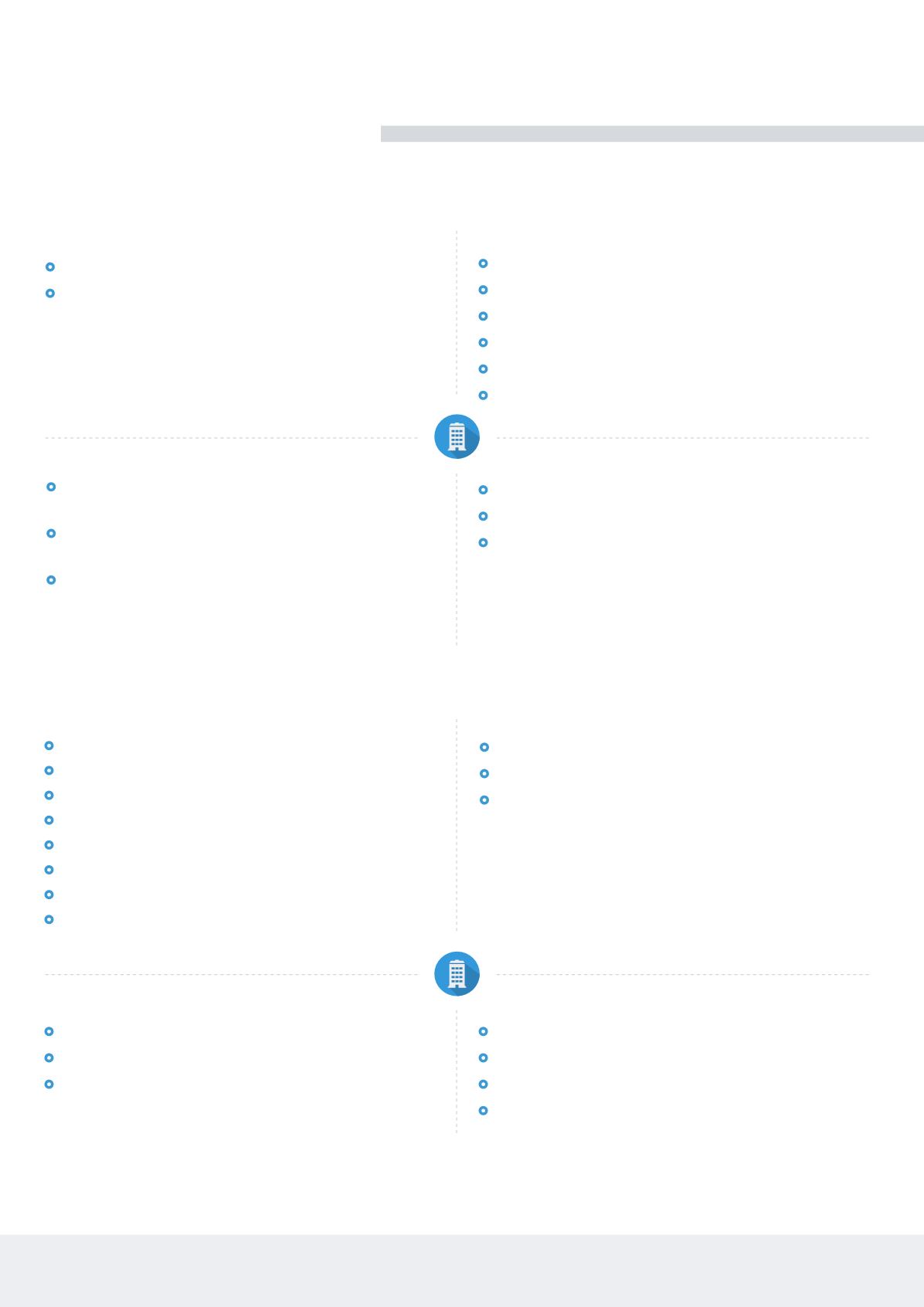

Threats

Regulatory scrutiny

Banks are of a much larger size

New lending institutions taking over the sector

Lack of regulation

Alt Fi Sector SWOT

Strengths

The availability of capital

Large amounts of deal flow

The ability to ‘test’ the market with an idea

Increased investor engagement

Usually cheaper transaction costs

Open data for clear investing environment

Strong investment returns possible

Monitoring investments live online

Weaknesses

No secondary market at present

Higher risk

Possibility of bad investment offers as companies want to

capitalise on the crowdfunding hype

Opportunities

Vast amounts of possible applications for alt fi concept

Possibility of secondary market

New investment locations