26

A. 71% of investments are distributed

through a network of agents (regulated and

unregulated) as well as directly to investors.

On average those that distribute through

agents use two distribution companies.

Nearly 30% of providers have increased the

amount of direct marketing over the last

year in order to increase sales. Another 30%

have increased the number of distributors

over the past 12 months through increased

marketing, whilst 14% have decreased their

marking over the past 12 months due to

regulatory changes and restrictions.

Q. Do you pay commission to agents/

advisers?

A. Every investment provider that

distributes their investment through

agents or intermediaries pays commission,

although no respondents stated the level

of commission paid.

Q. Any planned changes to distribution

over the next 12 months?

A. Looking forward over the next 12

months, 43% of respondents plan to

increase their distribution through

regulated agents whilst a further 14% plan

to increase distribution through non-

regulated agents.

PRODUCTPROVIDERSURVEYANALYSIS

0%

20%

40%

60%

80%

2013

68%

68%

32%

32%

2012

Retail

Institutional

0%

20%

40%

60%

80%

2013

26%

74%

2012

UK

Overseas

66%

34%

SALES

Q. What is your target raise? (£)

A. Providers are looking to raise between

£10m and £200m into their forestry

investments, with an average across the

sector of £82m.

Q. How much have you raised to date? (£)

A. Every respondent has raised money into

their investment. This ranges from only

£200k to nearly £200m, with £44k raised

on average across the sector.

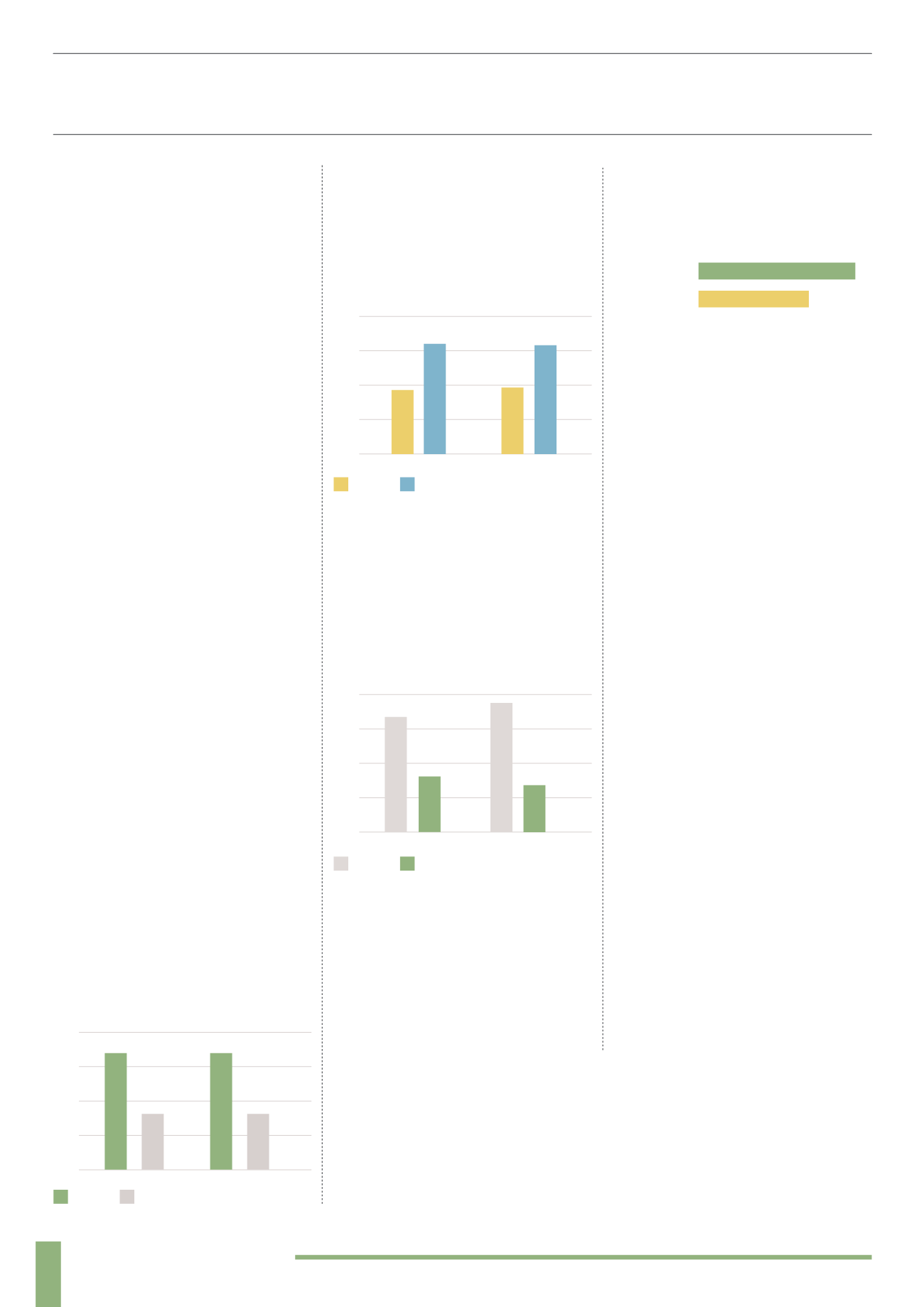

Q. Retail vs. Institutional Investment

0%

20%

40%

60%

80%

2013

62%

38%

2012

SIPP

Cash

37%

63%

A. Over 70% of respondents have

received investment from both retail and

institutional investors over the last couple

of years. On average, 68% of investment

has come from retail investors with

relatively little change over the last 2 years.

Q. SIPP vs. Cash Investment

A. There was a decrease in SIPP investment

from 2012 to 2013, although based on

these figures the reduction was not as

severe as expected after interventions

from the regulator in 2013. The proportion

of investment via cash increased from 62%

in 2012 to 63% in 2013.

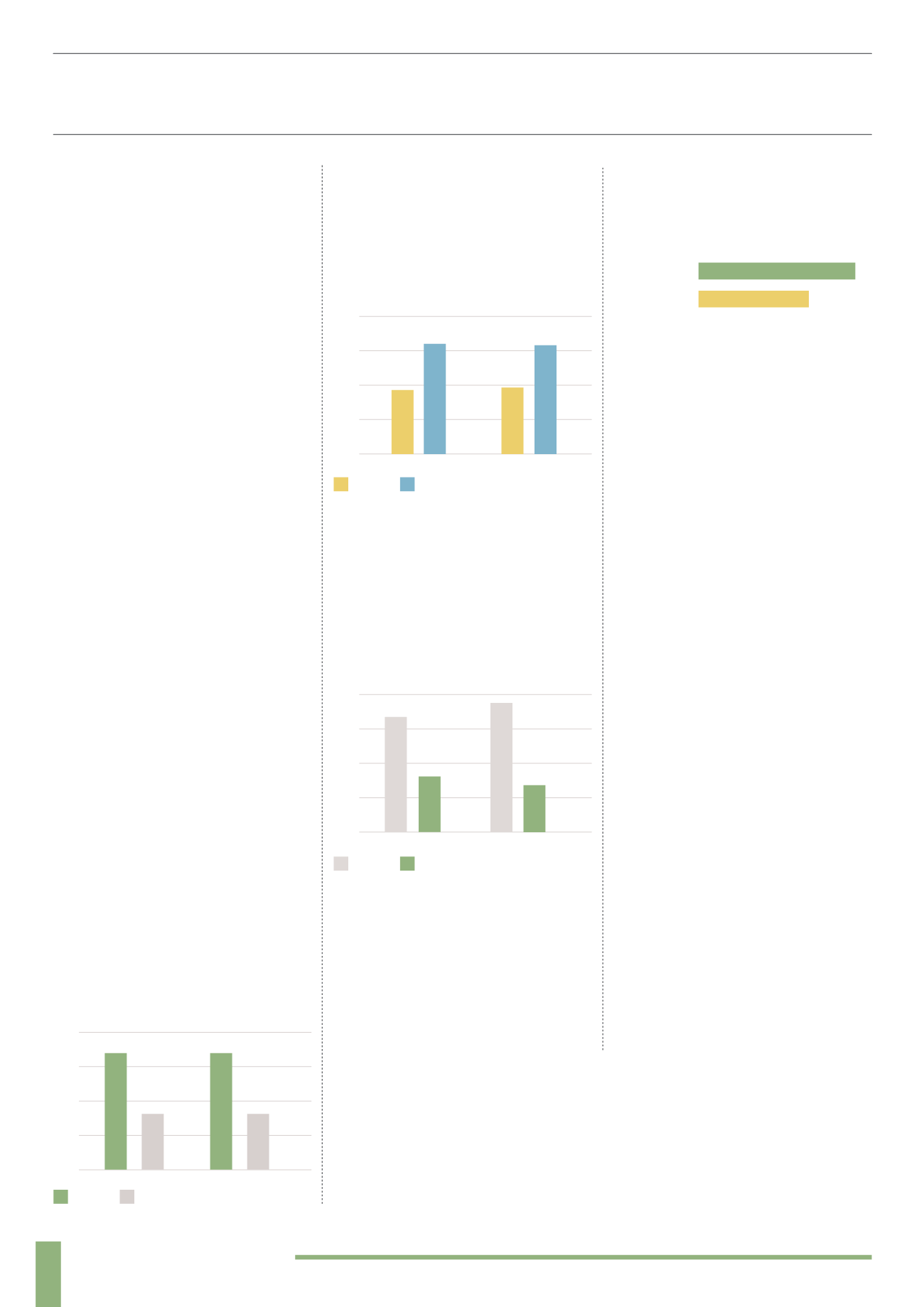

Q. UK vs. Overseas Investment

A. There was also a significant decrease

in investment from UK based investors

from 2012 to 2013 which could have

been impacted by the increased focus on

alternative investments from the FCA.

This is also likely to have been impacted

by the increased popularity of alternative

investments from emerging economies in

South America and South-East Asia.

OTHER PRODUCTS

Q. Do you have any other investment

products in the pipeline?

Available now

60%

40%

In the Pipeline

A. When asked about other investment

products, 40% of respondents currently

have another investment open and 60%

have a further investment in the pipeline.

Product providers may be looking to

take advantage of increased demand

for forestry investments from emerging

economies and expand their offerings in

the future.

CONCLUSIONS

Some of the key conclusions drawn from

this analysis include:

▲

▲

Over 85% of forestry investments are

structured as direct asset purchases

▲

▲

Nearly 60% of investments claim to be

allowed within a personal pension

▲

▲

Minimum investments start from as

low as £5,000

▲

▲

Measures to protect investors are

relatively weak

▲

▲

29% of investments charge an initial fee

(on top of the initial investment)

▲

▲

57% have charges on an ongoing basis

and 71% charge fees on exit

▲

▲

Every investment offers variable

returns which are predicted to range from

6-15% per year

▲

▲

57% of investments are sold to ordinary

retail investors

▲

▲

The vast majority (71%) of investment

providers pay commission to agents and

intermediaries in return for distribution