22

▲

▲

Limited flexibility in the business model

- reliance on somewhat unproven secondary

markets

▲

▲

Long investment terms

– returns are weighted towards the back end of the investment

or at maturity, making the investment extremely illiquid

▲

▲

Information on costs is very unclear

– land/forestry management, insurance/security,

harvesting and sale of trees

▲

▲

Little risk diversification built into the business model

– only one type of wood,

relying on one revenue stream from the plantation – this relies on the demand from a

single market

▲

▲

Quality

– the sale price of timber can vary depending on its quality. Soil fertility, pests,

diseases and climatic conditions can all dramatically affect returns

▲

▲

Yields

– yields directly affect investors’ returns. Research by CATIE (Centro Agronmico

Tropical de Investigacin y Ensenanza)(1995) on teak plantations in Costa Rica found that teak

growth in perfect growing conditions would be 12 to 18 cubic meters p/ha per year. Many

projects have far higher projections than this

▲

▲

Use of funds

– What does the investor actually own and what are their investment

funds used for? Are there a number of people to be paid out of these funds (Commissions,

Marketing)

▲

▲

Finally fraud

– in some cases, no underlying land was purchased, no accounts were kept

for the companies involved and investors were mislead as to what they were investing in

A number of timber funds and plantation

schemes have caused controversy over

the last 25 years. Several funds based in

Costa Rica, India and the Netherlands went

bankrupt or were marred by scandals and

fraud. In the Netherlands alone at least

seven funds went bankrupt with the loss of

more than 100 million Euros.

A number of these products were launched

back in the early 1990’s, advertising very

optimistic returns and putting a large

amount of money into marketing and

promotion. Investors took advantage of what

were seen as sound investments. However,

the actual performance of these investments

was very poor (Canby and Raditz, 2005).

There have been more recent examples

of poor investments and outright fraud in

the forestry sector. The FCA have issued

alerts advising investors to be very wary

of overseas schemes offering investment

opportunities in trees and other ethical

investments. A previous alert from the FSA

on their website stated that they “have heard

reports of promoters using aggressive, high-

pressure sales tactics, and often claiming

we (the FSA) do not need to authorise

the schemes, as they are not collective

investment schemes (CIS)” (2011).

A prime example is Forestry for Life which

opened in 2009 with offices in the UK, Dubai

and Hong Kong. The company aimed to raise

US$1b by the end of 2011 and US$5b by the

end of 2013. The investment promised to

pay fixed returns of 12% for the first three

years, from the sale of carbon credits. The

company brochure boasted this would be a

“low risk ethical investment opportunity”.

Forestry for Life and a second company, the

Investor Club, claimed to invest money in

teak tree plantations that generated carbon

credits, which would then be traded for profit.

It is claimed that no land was ever purchased

and not a single tree was ever planted.

According to the Crown Prosecution

Service, Forestry for Life ad the Investor

Club were found to be “large-scale Ponzi

schemes” which defrauded investors out

of more than £1.35m over a three-year

period. It is believed only £250,000 was

ever returned to investors.

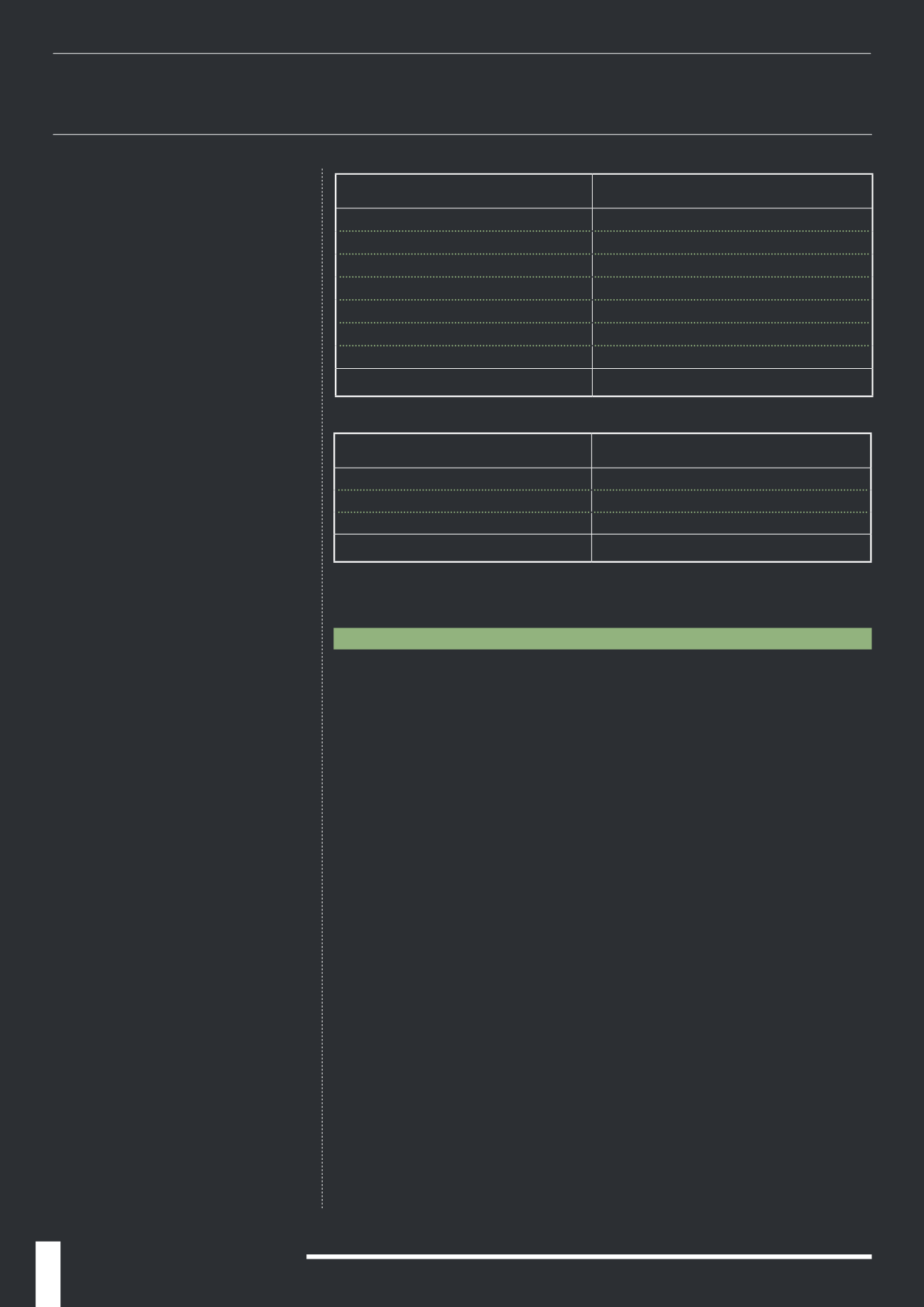

Bankrupt Funds/Investments

Invested Money (million Euro)

Sintrex/CO2 Invest

Unknown

Global Green

10.8

Eco Brazil

38

Eco-Sure

Unknown

Green Capital

22

United Green

7

Robinia Gold

15

Total

92.8

Source: Scholtens & Spierdijk 2008

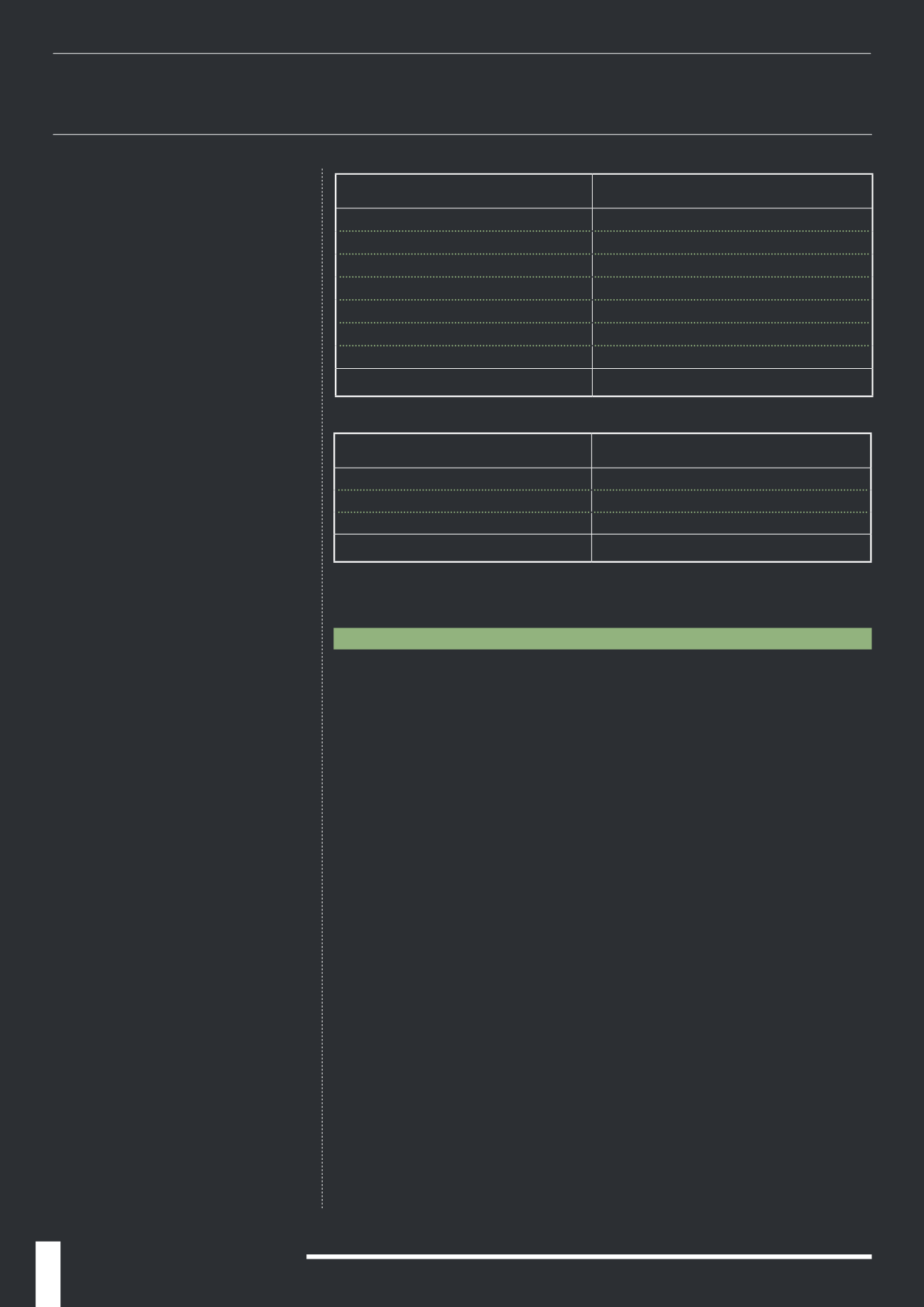

Fraudulent Funds/Investments

Invested Money (million Euro)

Ecobel

5.5

Euro Greenmix BV

3

Green Fund Nederland BV

Unknown

Total

8.5

LESSONS FROMFAILED INVESTMENTS

KEYREASONS FORFAILURE