18

ESTABLISHINGINVESTMENTCRITERIA

When considering forestry, common sense

investment criteria can be used to screen

for suitable investments. Each criterion

needs to be fully explored and where

possible supporting evidence gathered -

preferably independent, objective evidence,

rather than the investment provider or

management company’s opinion.

Each investment opportunity can be scored

against the investment criteria (from 0-10)

and then the final scores can be used to

compare a number of potential investments.

To do this, investors need to take a view

on each criterion, and then need to decide

how confident they are in that view. For

example,an investor may be purchasing

freehold land in an undeveloped country,

but trees may have been planted 10 years

ago and the management company has a

strong track record in the sector. Therefore

they can give a lower score.

On the other hand, they may be buying

leasehold land which is going to be planted

with saplings. The land is located in a

developed country, but the management

company is relatively new and does not

have a track record of achieving returns.

This would be given a higher score.

Using investment criteria in this manner

facilitates the screening and selection of

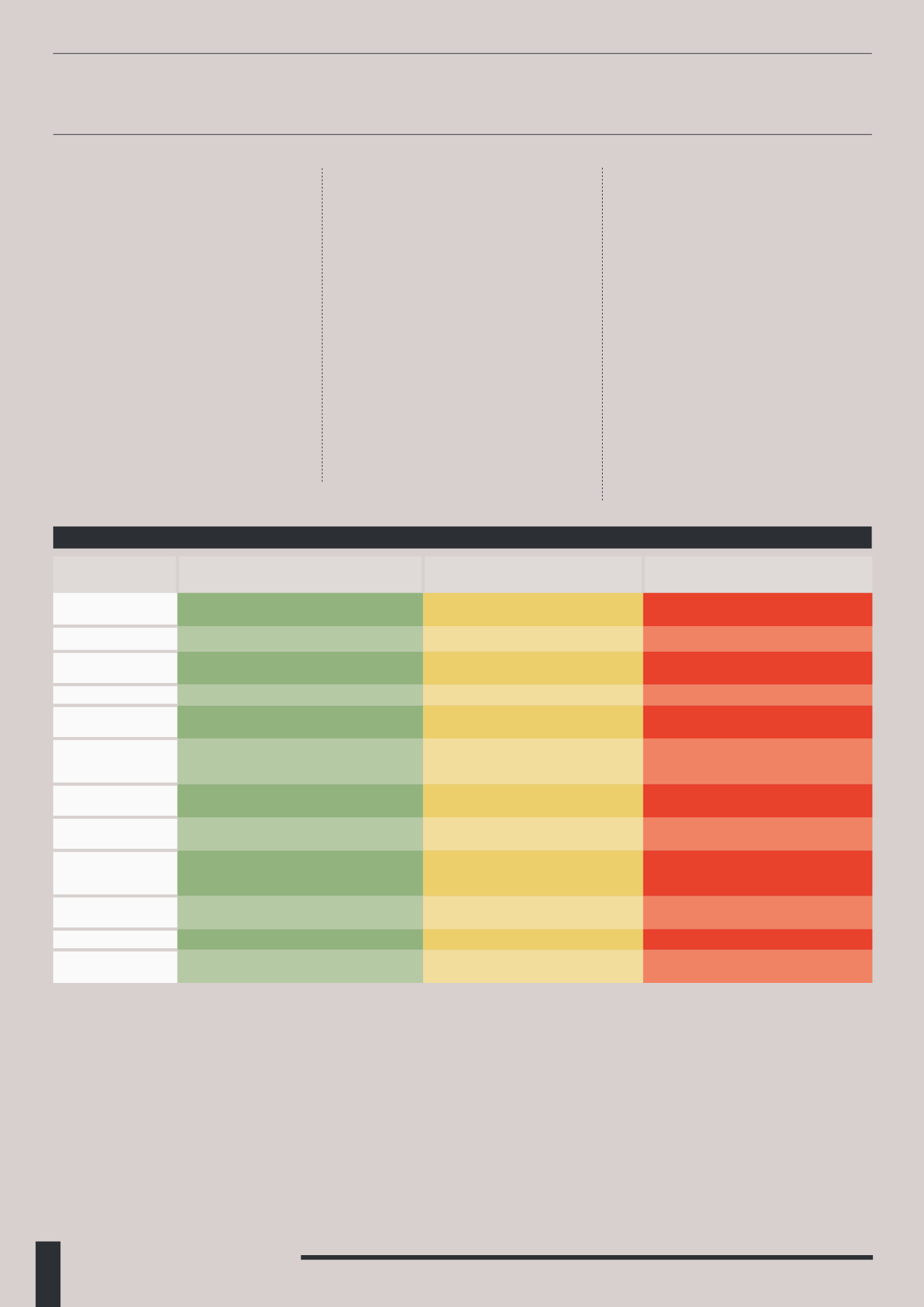

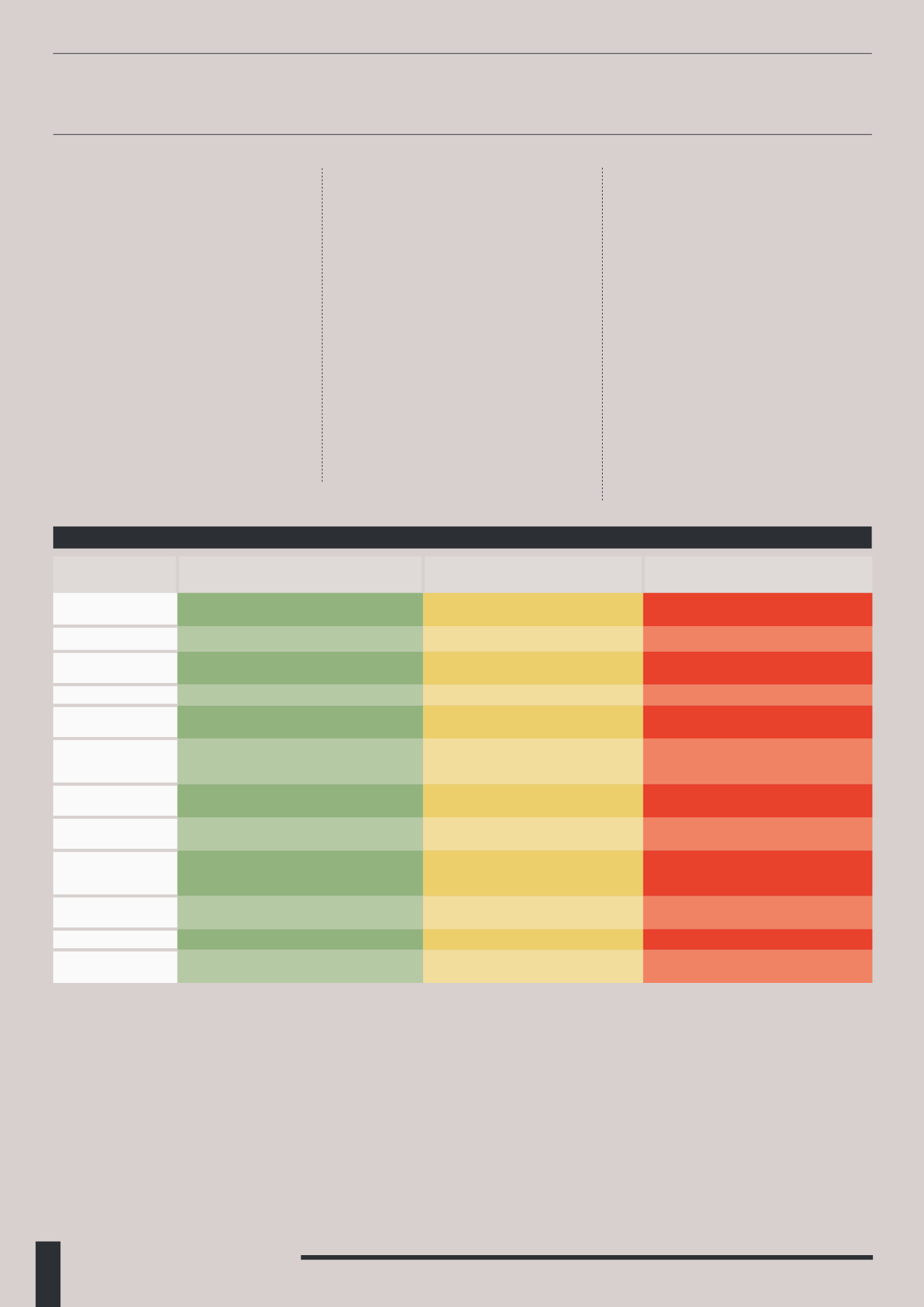

Criteria

Low Risk (0-3)

Medium Risk (4-6)

High Risk (7-10)

Ownership/

Structure

Regulated Fund

Leasehold/Freehold Land, UCIS or

NMPI

Tree Ownership or Timber Purchase

Agreement

Tree Species

N/A

Grass – fast growing

Hard or softwood – slow growing

Tree Growth Stage

Established standing wood, suitable for

harvesting

Established standing wood, not yet

suitable for harvesting

Sapling investment, number of years

until harvest

Country

Developed market

Emerging market

Frontier market

Location

Established forestry location, solid land

ownership laws

Establised forestry location,

undeveloped land ownership laws

Unestablised forestry location, poor land

ownership laws

Forestry

Management

Company

Established company, strong agreements

and track record

Relevant forestry experience, short-

term track record

New company, no solid experience or

track record

Certification

Trees certified by the FSC

Trees certified by other applicable

forestry council

No certification

Exit

Defined exit with timber purchase

agreements in place

Management company’s experience of

selling timber on secondary market

Relies upon predicted exit many years in

the future

Yield

Tree growth and predicted yields verified

by independent third party forestry

professional

Sensible yields based upon justified

predictions and market activity

Highly speculative yields based upon

predicted timber prices many years in

the future

Purchase Price

Purchase price below market value

Purchase price at market value or at a

premium

Hard to establish fair value

Ongoing Costs

Low and well-established ongoing costs

High or unpredictable ongoing costs

Hard to assess level of ongoing costs

Currency Risk

Local currency

Major currency ($, €, ¥…)

Emerging currency (Brazil, Thailand,

Cambodia)

EXAMPLE CRITERIA MATRIX

Source: Intelligent Partnership

EXAMPLE CRITERIA MATRIX

Based on the example criteria matrix, an investment that posed absolutely no risk would have a total overall weighting of 0, with an

extremely high risk investment weighted 120. Of course having a score of 0 is very unlikely, as all investments are likely to contain a degree

of risk for the investor. For an investment to be classed as “Low Risk”, it will have a total overall weighting of 0-36, “Medium Risk” from 37-

72 and “High Risk” from 73-120.

WEIGHTING

Different criteria can be given more or less weight in the assessment process as appropriate. Things that cannot be reversed or mitigated

should be given a proportionally higher weight: country, location, season, purchase price. Whatever else happens, these things will not

change, so buyers need to be confident about them.

products in a dispassionate way, which

helps to avoid being influenced by glossy

brochures and marketing promises.

However, using a screening system like

this is not flawless. Although it attempts

to be more objective, it is still more art

than science.There are many judgment

calls involved in ascribing scores to each

criterion and differences of opinion can of

course occur.

The other consideration is the risk/return

ratio. Just because something is higher risk

does not make it a poor investment, as long

as investors are being sufficiently rewarded

for taking on that risk and it is compatible

with their own appetite for risk.