25

INVESTOR PROTECTIONS

Q. What measures are in place to protect

the investor?

CHARGES

Q. What charges are due on the

investment?

Q. Have any returns been paid to date?

YES

43%

57%

NO

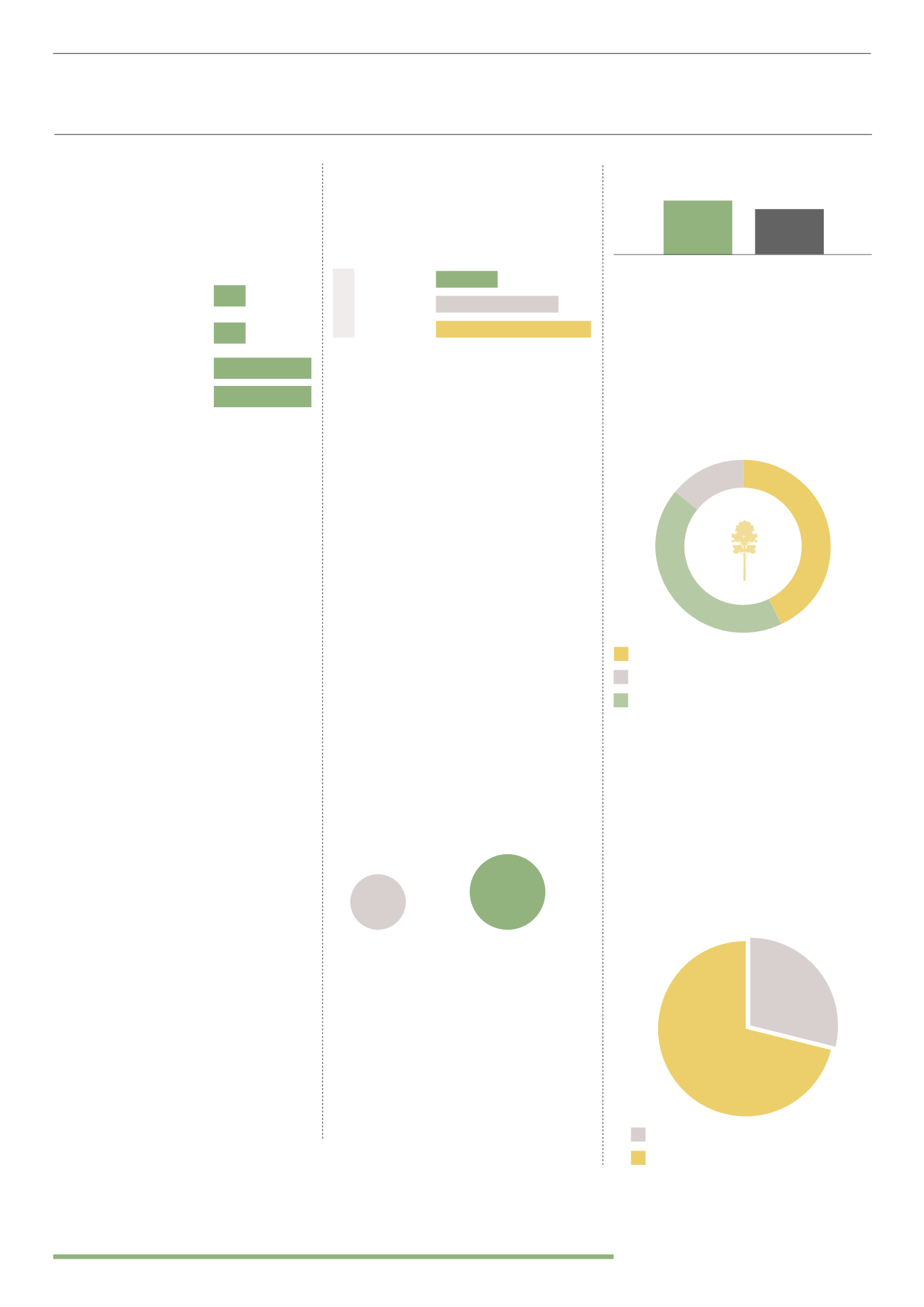

Client Funds Ring-fenced

until Required

Client Funds Held in Escrow

Guaranteed Returns

First Charge over Underlying

Asset

14%

14%

43%

43%

0%

Independent Investors Agent/

Trustee

A. There are varying measures in place to

protect investors. None of the investments

included in the survey offer guaranteed

returns, presumably due to the speculative

nature of forestry. Only 14% of investments

give a first charge over the underlying asset

or have an independent trustee in place to

safeguard the clients’ investment. 43% of

investments keep client funds in a secure

escrow account or ring-fenced until they are

drawn down for investment. This provides

some security when the investment is

initially made but this does not help to

secure the investment in the future once

money has been drawn down and invested.

Protections on offer can only somewhat

mitigate the risks to the investor.

Q. What measures are in place to mitigate

risks to the plantation such as fire, flood,

vandalism, theft and disease?

A. Measures put in place to mitigate the

risks to the investment include active

forestry management; insurance; security

and regular patrols; disease management

and full irrigation. These measures can

vary greatly by product, with the most

common measure to reduce risk being

active forestry management – therefore

verifying the experience, reputation and

reliability of the forestry manager should

be central to any due diligence procedure.

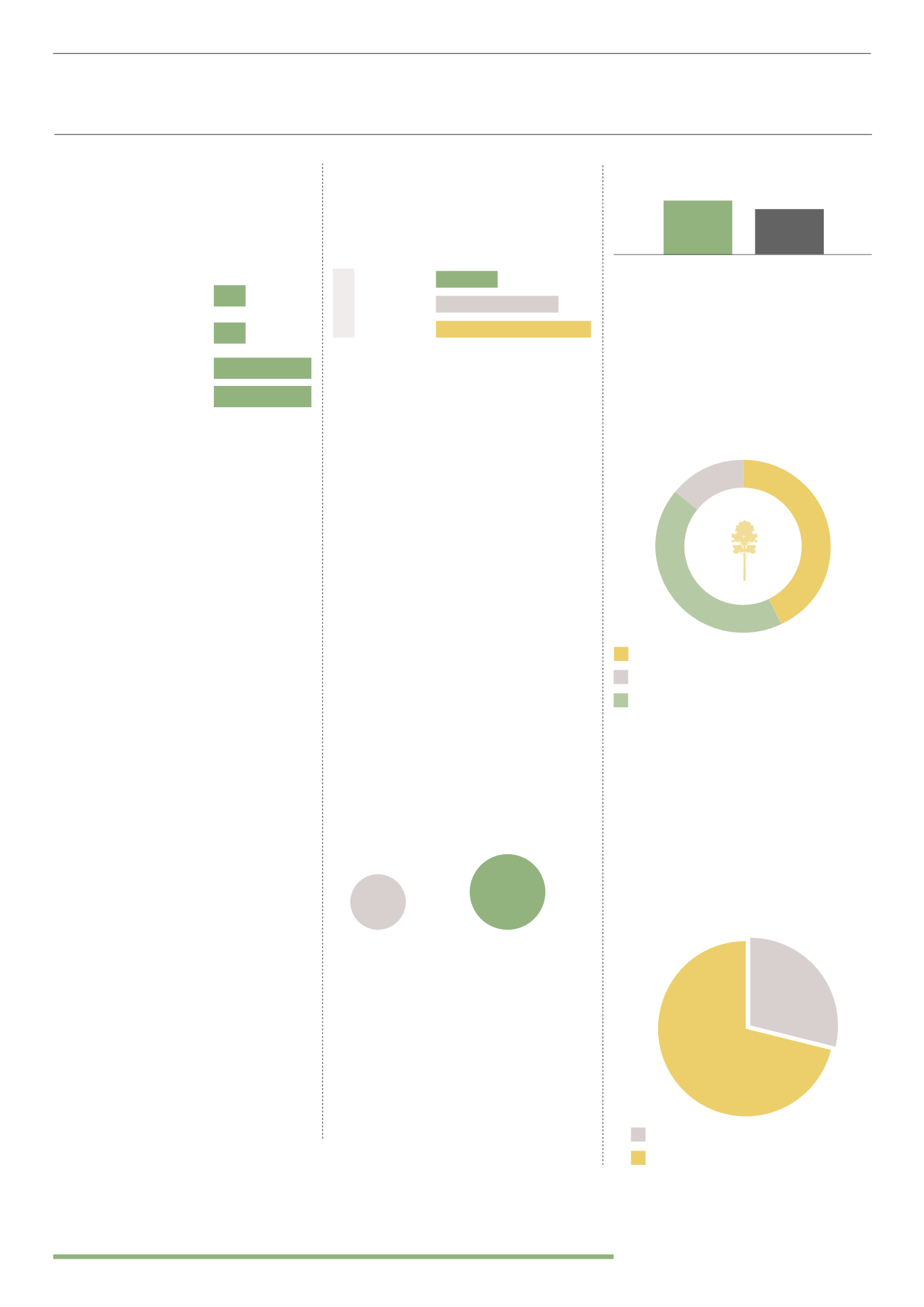

On Exit

Initial

Investment

CHARGES

29%

57%

71%

Ongoing

Through Agents and Direct

Direct Only

29%

71%

A. Charges can often be unclear with

alternative investments and can often

be quite high. This is usually because the

investment involves the purchase of a

physical asset. 29% of investments have

further charges due on top of the initial

invested capital. 57% have ongoing costs

such as forestry management and 71% take

a charge at the end of the investment term.

This charge is likely to be taken from harvest

revenues and could cover the harvesting,

processing and transport of timber.

RETURNS

Q. Are returns variable, fixed or

guaranteed?

A. Every investment offers variable returns

with predicted returns ranging from 6-15%

per year. These returns are lower and

perhaps less speculative than some of the

returns seen on the investment register.

Q. When are the returns paid?

A. As seen with the majority of directly held

forestry investments, returns will generally

come at the end of the investment term

when trees are harvested and timber

sold. Some returns may come earlier than

this during thinning years. The 29% of

investments structured as UCIS or with

a corporate element offer returns on an

annual basis.

14%

43%

43%

HNW and Sophisticated Investors

Ordinary Retail Investors

Both

A. Encouragingly 43% of investments have

already paid some sort of return to investors.

Returns paid range from 3-15% per year

and match the predicted returns originally

advertised by the investment providers.

DISTRIBUTION

Q. Target Market

A. Over half (57%) of investments are

being sold to ordinary retail investors

or ordinary retail investors and high net

worth individuals. 43% are being sold to

HNW or sophisticated investors only. None

of the survey participants have made any

changes to their target market during the

past 12 months.

Q. How is the investment distributed to

investors?

"This analysis is based on a survey of over 60 forestry investment providers who have products

listed on the alternative investment register."

71%

End of Investment term

29%

Annually