32

FINDINGSANDANALYSIS

CORPORATE ELEMENT

There are only 4 investments with a

corporate element structure available in

the forestry sector, with 3 currently open to

investment. These investments come from

4 separate providers and are currently

being marketed directly to retail investors

through a number of channels including

direct distribution and IFAs.

Investment structures include bonds,

timber batch purchase agreements and

the purchase of ordinary shares in special

purpose vehicles.

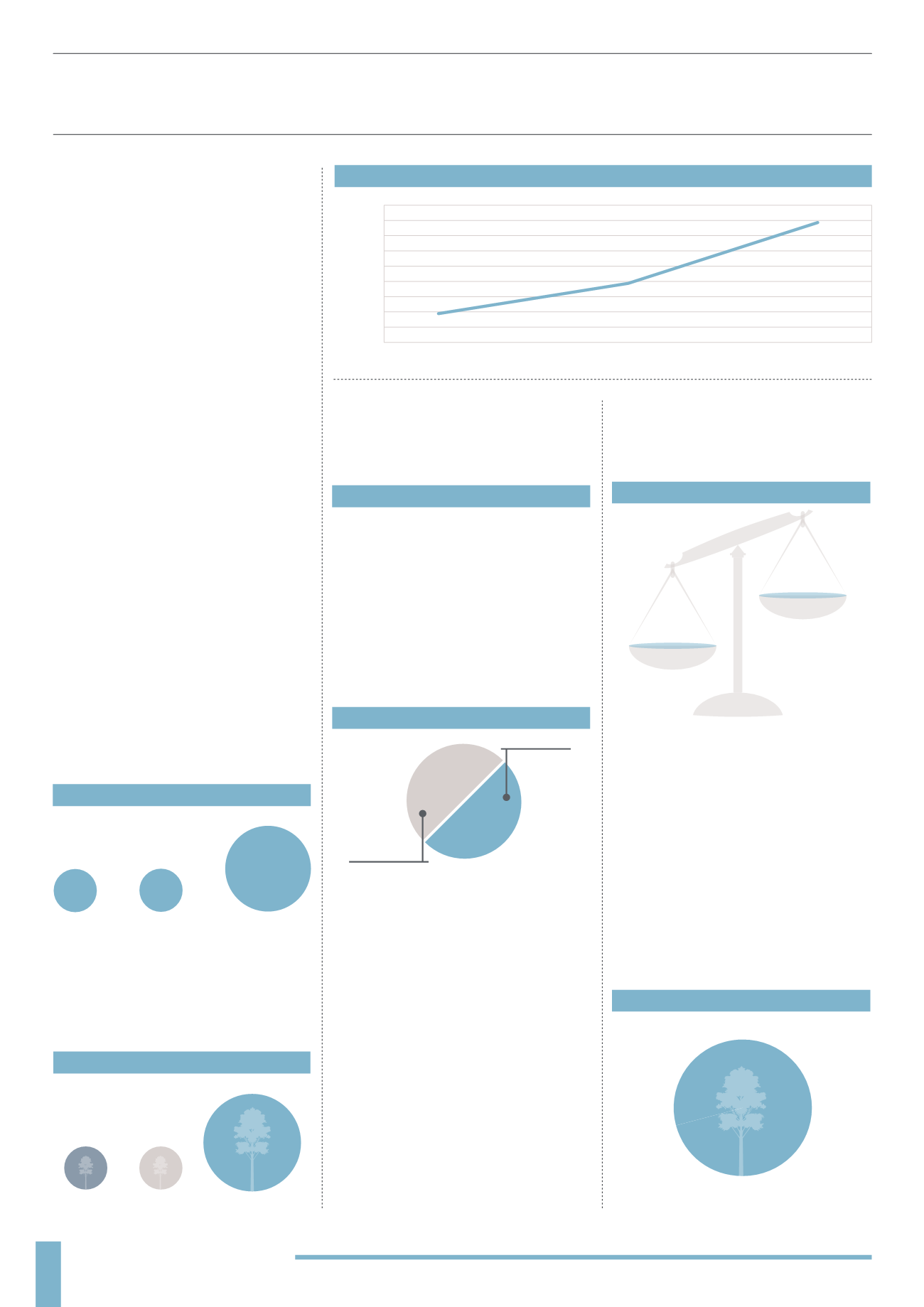

#1 LAUNCH YEARS

This is a relatively new form of forestry

investment with the first investment

product being launched to retail investors

in 2009, this product is still open for

investment. This type of structure has

increased in popularity since the 2008

financial crisis.

2013 saw 2 new product launches,

doubling the number of corporate element

investments in the sector. This sector remains

small due to the long-term nature of forestry

investment and the speculation surrounding

potential returns, often making it hard to fit

into a structured product.

SECTOR GROWTH

(2009 - 2013)

Number of Investments

0

1

2

3

4

2009

2011

2013

TREE SPECIES

(2014)

LOCATIONS

(2014)

NICARAGUA

GUYANA

BOLIVIA

BRAZIL

MINIMUM INVESTMENT

Highest Minimum

Investment Level

£ 10,500

Average

£

6,625

Lowest Minimum

Investment Level

£ 1,000

(2014)

RETURNS

(2014)

Variable

50%

Fixed

50%

LAUNCH YEARS

(2009 - 2013)

2009

1

2013

2

2011

1

#2 TREE SPECIES

As with directly held investments, teak

based products dominate the sector. This is

followed by bamboo and general forestry.

#3 LOCATION

All of the investments in the corporate

element sector are based in Central or

South America.

#4 RETURNS

Returns again vary widely with half of

investments offering fixed returns and the

other half offering variable returns. Returns

are generally paid annually in arrears and

can start as soon as one year after first

investing. The lowest return predicted per

year is 7.5%, rising to as high as 33%.

#5 MINIMUM INVESTMENT

Investments start from as low as £1,000.

The low minimum investment is achieved

due to the investment structures available,

with the investor loaning money or

purchasing equity, rather than directly

owning a specific asset. With an average

of £6,625 this form of forestry investment

may appeal to a wider range of investors

than directly held investments, who

want to allocate a small portion of their

investment portfolio to forestry.

#6 EXIT

Every investment offers a defined exit

strategy. This includes redemption of

the bond after a fixed period of time

or contractually agreed sale of timber.

Although these exits are contractually

agreed, they are by no means guaranteed.

The exit will rely on the investment

provider having the funds to repay the

investor at that point in time.

EXIT

(2014)

Teak

General

Forestry

Bamboo

(2014)

100%

Defined