24

PRODUCTPROVIDERSURVEYANALYSIS

Taking the research and analysis a step

further, 60 forestry investment providers

were identified and surveyed, including

all of those that have a product included

within the investment register.

Due to the diverse nature of the forestry

sector, only a 17% response rate to the

survey was achieved. Which, although

disappointing, it has allowed for

proprietary analysis of the providers and

highlights some very interesting trends in

the sector.

The survey was dynamic and included up

to 90 questions depending on which route

the respondent took. Some questions were

mandatory but others were not answered

by all respondents. The most relevant and

insightful questions have been included in

this analysis.

STRUCTURE

Q. Investment Structure

A. For direct asset purchases the investor

will directly own freehold land, timber

ownership rights or loan notes. For UCIS,

the investor owns shares in the investment

company.

Q. What is the term of the investment?

A. Investments are predominantly

structured as direct asset purchases but

there are also UCIS investments available.

Q. Underlying Asset

NO

43%

57%

YES

A. 57% of investments were able to be held

within a SIPP. From these, on average they

are currently being accepted by 2 SIPP

providers. 14% of respondents said that

the number of SIPP providers accepting

their investments had increased during the

last 12 months, the other respondents did

not comment on this.

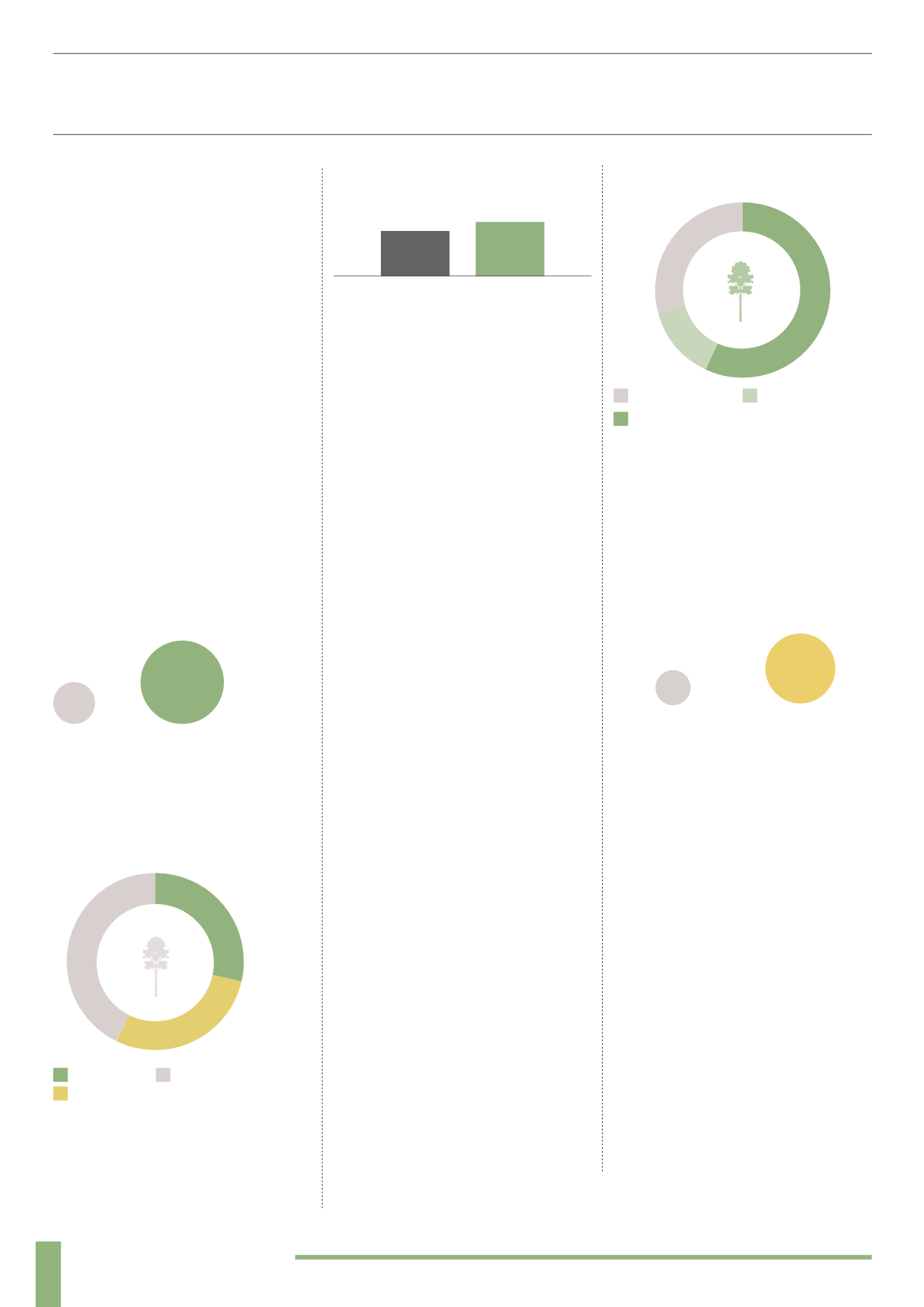

Q. In which country is the land located?

A. Investments are located in Thailand, Sri

Lanka, Brazil, Malaysia and the UK. This

correlates to the investment register which

shows a number of investments based in

tropical locations with fast growing native

tree species.

Q. What tree species is planted on the

land?

A. Teak is the most popular tree species,

accounting for almost half of investments.

Other tree species include agarwood,

eucalyptus and sitka spruce. Again this

correlates closely to the investment register.

CHARACTERISTICS

Q. What is the minimum investment? (£)

A. Minimum investments range from

£5,000 to £40,000. There is one investment

that is focused purely at institutional

investors which starts at £5m. Out of the

investments targeted at retail investors the

average minimum investment is £16,500.

There is no cap on the maximum that can

be invested on any investment.

57%

14%

29%

Open-Ended

Variable

Fixed Term

A. Investment terms are generally open-

ended or variable depending on when the

investor choses to harvest their trees and

sell the timber. Only a small number (14%)

of investments have a fixed term, meaning

that the timber will be sold after a defined

period of time.

Q. What is the planned exit?

A. The planned exit correlates closely

to the investment term, with those

investments that offer a fixed investment

term also offering to pay the principal back

to investors as part of the exit. The vast

majority (86%) of investments rely on the

open-market sale of timber. This supports

the investment register.

Q. What currency is the investment in?

A. Almost half the investments are sold

in sterling. Other currencies include US

dollars, Sri Lankan Rupees, Thai Baht

and Brazilian Real. Underlying assets

are predominantly valued in US dollars

and sterling. All returns are paid in the

same currency as the initial investment

way made in. For 50% of investments the

underlying asset is valued in a different

currency than the investment was made in,

meaning that there is added currency risk

to the investment.

86%

Open-Market Sale

86%

Direct Asset Purchase

14%

UCIS

14%

Repayment of Principle

Q. Can the investment be held within a

Personal Pension (SIPP)?

29%

29%

43%

Freehold Land Timber Ownership Rights

Other (Shares / Loan notes)