33

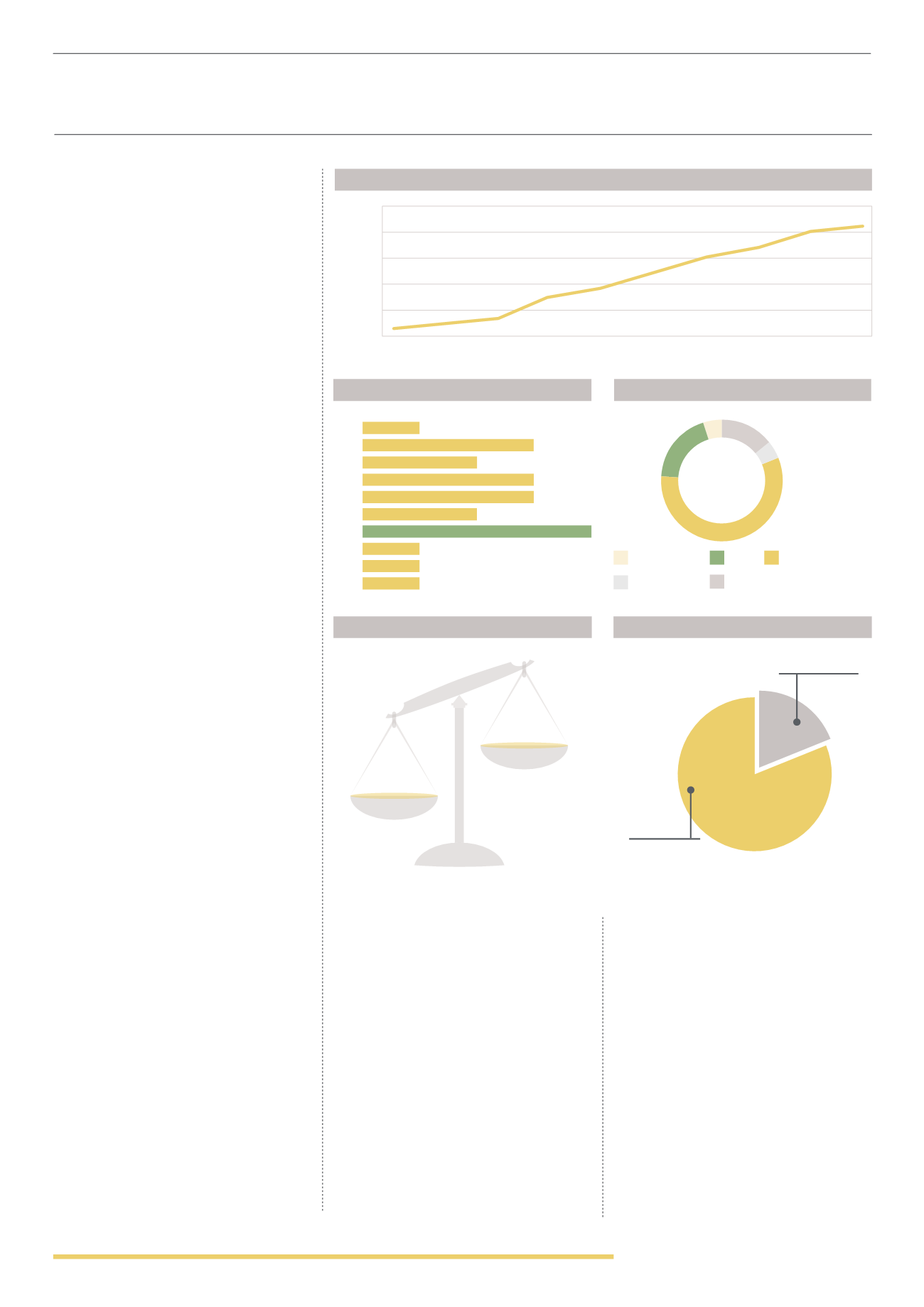

Number of Investments

0

10

5

20

15

25

2009

2010

2001

2005

2006

2007

2008

2011

2012

2013

SECTOR GROWTH

(2001 - 2013)

LAUNCH YEARS

(2009 - 2013)

COLLECTIVE INVESTMENT

SCHEME

There are 21 collective investment

schemes included on the register, from

17 different investment providers with 16

different forestry management companies.

Investment structures are dominated

by limited companies (67%) and limited

partnerships (24%).

#1 LAUNCH YEARS

New products have been launched

consistently over the last 9 years, particularly

since the financial crisis. The highest

number of new product launches was

actually in 2007, before the financial crisis,

which doesn’t seem to have had a major

impact on the sector. There has obviously

been demand in the market for collective

investment schemes over the last few years.

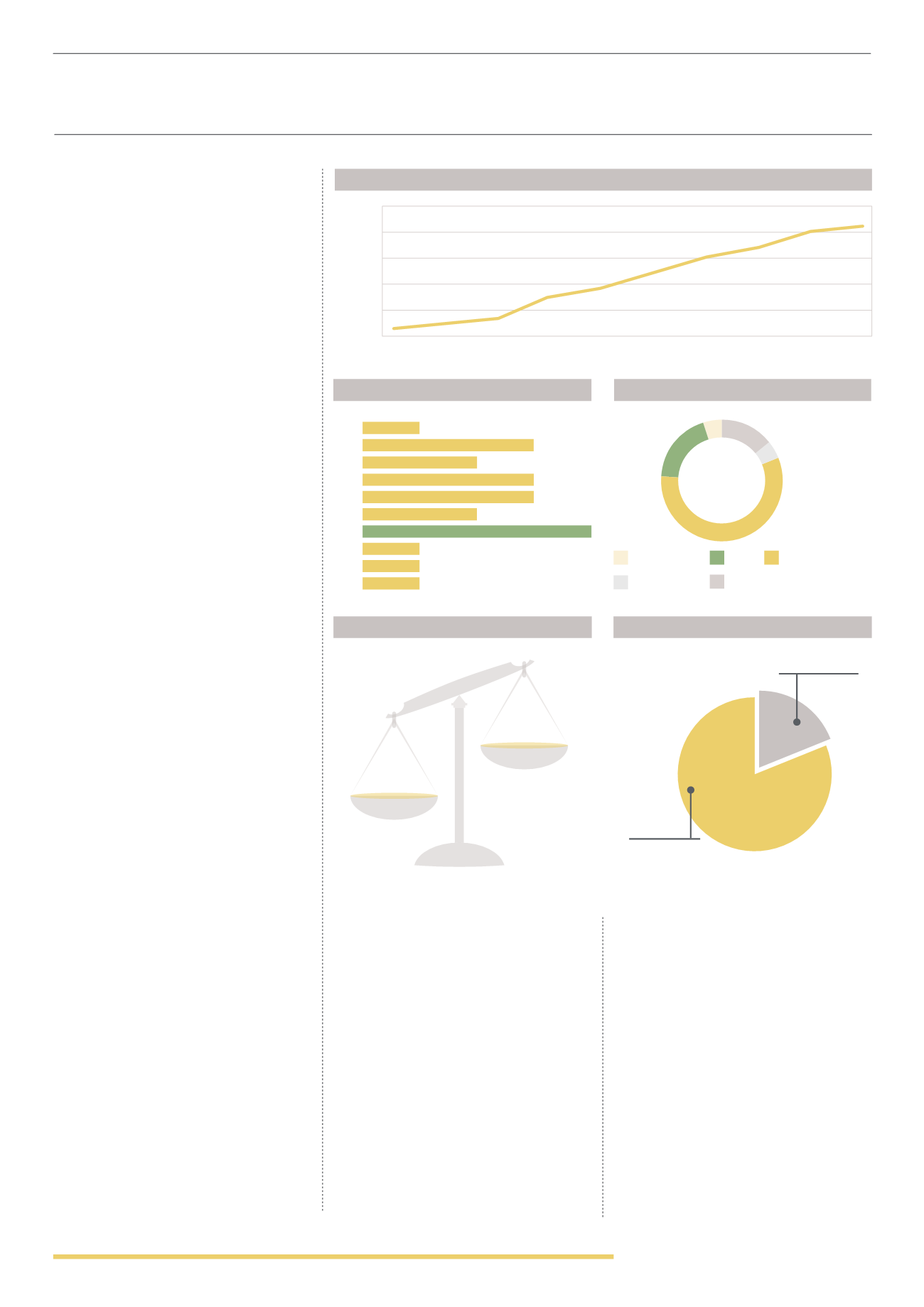

#2 TREE SPECIES

Collective investment schemes will usually

hold a wide range of underlying assets

and therefore are likely to invest in more

than one species of tree. This can provide

diversification as well as the opportunity

for returns to be realised at different

intervals. General forestry accounts for

almost 60% of underlying assets, followed

by teak (19%) and agarwood (14%).

#3 LOCATION

Investment locations can be hard to identify

as underlying assets may be located in a

wide range of different countries. Funds

are regularly structured and domiciled in

offshore finance centres such as Bermuda,

Guernsey, Luxembourg and the Isle of

Man. Underlying forestry plantations are

spread around the world and include North

America, South America, Europe and Asia.

#4 RETURNS

Returns can vary widely and be hard to

accurately predict. Forestry funds have

the advantage of diversifying underlying

assets across a number of different

forestry related sectors, in order to

spread risk and increase the potential for

long-term returns.

Every investment offers a variable or

predicted return which is dependent on the

performance of underlying assets. Returns

are paid annually in arrears and can vary

from 3% to as high as 18% per year. The

average predicted returns across the

sector are approximately 10% per year.

#5 MINIMUM INVESTMENT

Investors can gain access to forestry ETF’s

from less than £100, but this won’t give

pure exposure to timber growth. Collective

investments start from £500 but can vary

greatly with the average investment at

nearly £30,000. This is due to a number of

schemes only being considered suitable for

high net worth or sophisticated investors.

#6 EXIT

The majority (81%) of investment have

no clear exit strategy and will rely on a

secondary market sale. The exit can be

unclear and it could be hard to sell the

investment at short notice without incurring

a significant loss, particularly if the fund is

trading below its net asset value.

The 19% of investments that have a defined

lifespan are closed-ended, non-listed

funds with terms ranging from 8 years to

12 years. Investors may not be able to exit

these investments earlier should they wish,

as these products may not have the same

levels of liquidity and flexibility as listed

forestry funds.

TREE SPECIES

(2014)

2013

2012

2011

2010

2009

2008

2005

2001

2007

2006

1

1

1

1

4

2

2

3

3

3

"The number of collective investment schemes available has increased by 75% over the last 5 years."

MINIMUM INVESTMENT

Highest Minimum

Investment Level

£ 100,000

Average

£

29,632

Lowest Minimum

Investment Level

£ 500

(2014)

EXIT

(2014)

Defined

19%

Variable

0%

Teak

Agarwood

General Forestry

Sitka Spruce

Bamboo

14% 5%

19%

57%

5%