11

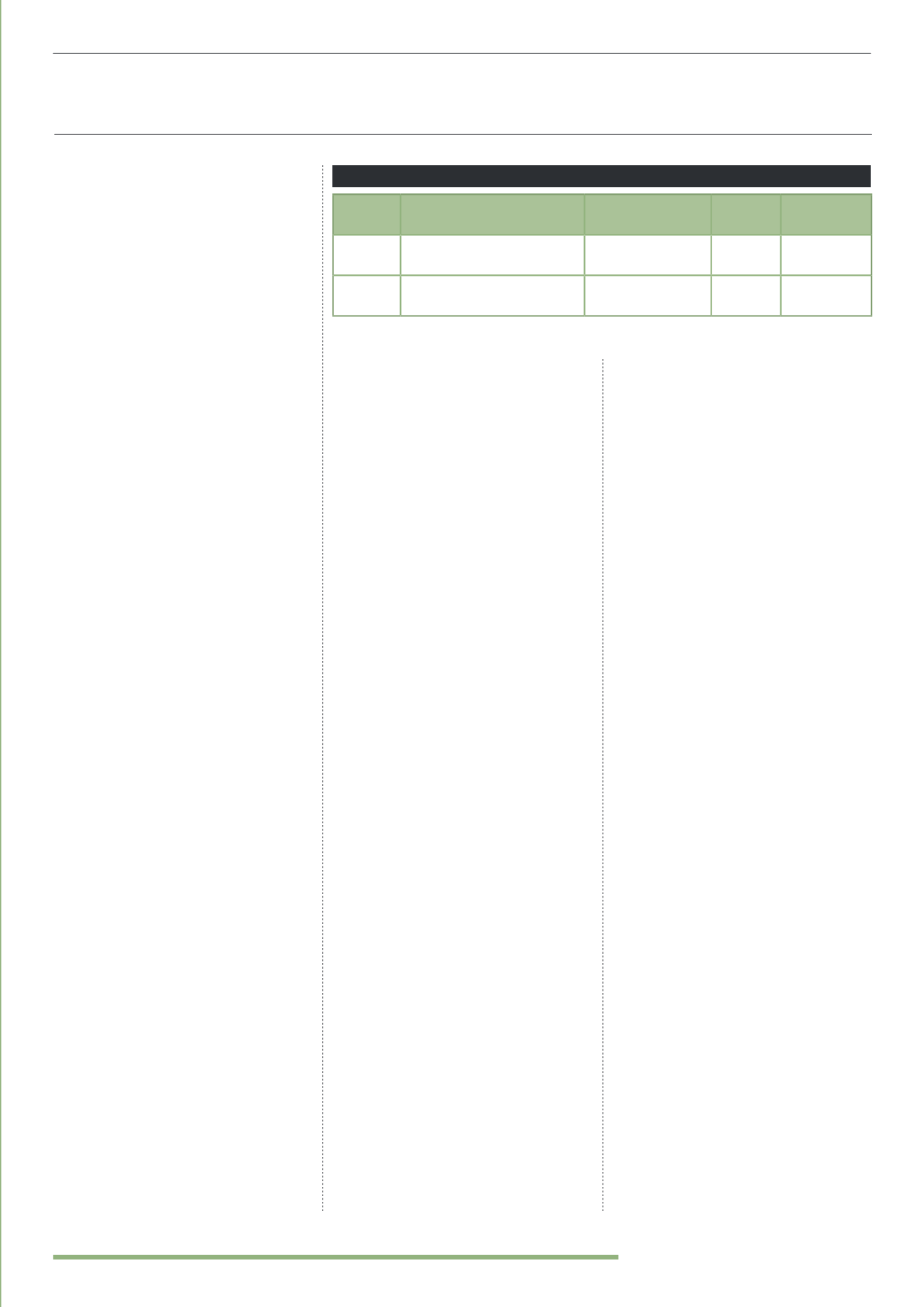

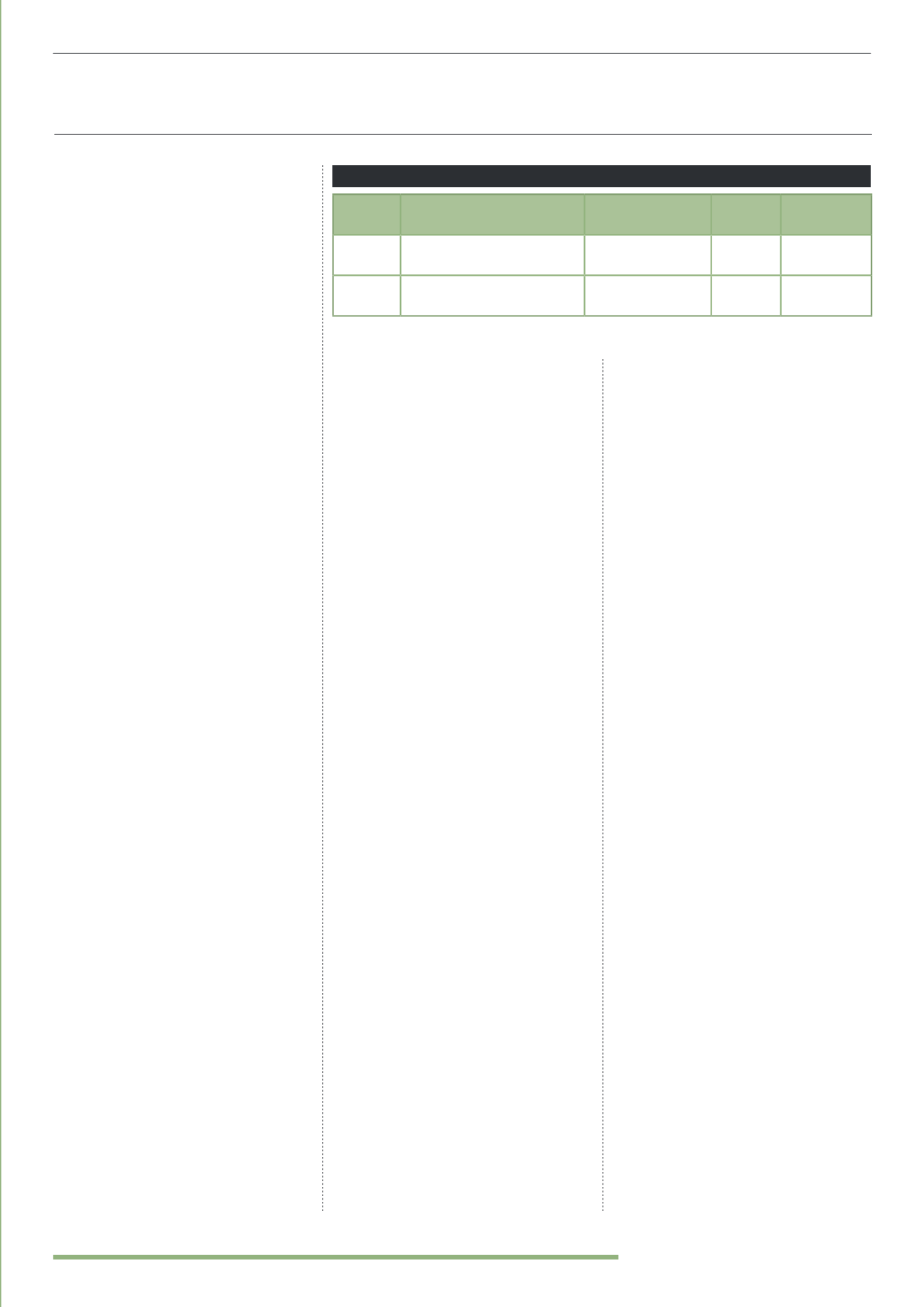

Symbol

ETF Name

Index

1 Year

Return

Launch Date

CUT

Guggenheim Timber ETF

Beacon Global

Timber Index

+23.34% 11/09/2007

WOOD

iShares S&P Global Timber &

Forestry Index Fund

S&P Global Timber

& Forestry Index

+12.73% 24/06/2008

TIMBER ETF

S

Source: Morningstar

INVESTMENT OBJECTIVES

Ordinary retail investors who want daily

liquidity, affordable entry levels, low

transaction costs, the assurances that

come with investing in a well regulated

environment and the protections afforded

by the FSCS should stick to mainstream

investments. A number of large, well-

diversified funds will have an allocation to

forestry as part of their holdings. Forestry

has also traditionally been favoured by

pension funds and hedge funds as an

investment. But few of these options give

retail investors direct exposure to the sector.

Investors can gain exposure to the global

forestry sector through exchange traded

funds (ETFs) which follow a global timber

index. The main two timber indexes are

the Beacon Global Timber Index and the

S&P Global Timber & Forestry Index.

Both indexes measure the performance

of companies engaged in the ownership,

management, or upstream supply chain of

forests and timberland. This can include

owning or managing forests and harvesting

trees for timber and other wood-based

products. The main issue with these

indexes is that they only track the very

largest companies and are spread across

a wide range of forestry related practices.

The two largest ETFs are the Guggenheim

Timber ETF and the iShares S&P Global

Timber & Forestry Index Fund.

However, as these ETFs are invested in

the listed equity of companies within the

forestry industry, they still have a high

degree of correlation to the stock market,

which reduces the diversification benefits

of investing in forestry.

Investors who want direct exposure to the

sector are usually looking for higher returns

and greater diversification. This will mean

investing outside of the public markets,

either in an unregulated fund structure or a

direct purchase of land or trees.

Direct investments usually come with

larger up-front financial commitments,

higher transaction costs, lower liquidity

and lower levels of regulatory scrutiny.

These risks can be mitigated by researching

the right opportunities, or added to

INVESTINGINFORESTRY

by investing into speculative forestry

investments in unproven locations. That

isn’t to say that all forestry investments

are bad, but investors must undertake a

large amount of research to identify an

investment that suits their appetite for risk

and capacity for loss.

RETAIL INVESTMENT

OPPORTUNITIES

Forestry investment opportunities

generally consist of the direct purchase

of trees or land on managed plantations.

The tree types available fall into the three

main categories of hardwood (Teak,

Paulownia, Robinia, Eucalyptus & Melina),

softwood (Spruce & Acacia) and grass

(Bamboo). Ownership structures range

from leasehold or freehold title to a piece

of land where trees are grown or, in most

cases, full title and harvest rights to a set

number of trees. The planting, growth and

harvesting of the trees is carried out by a

forestry management company which is

often appointed by the product provider.

LOCATIONS

Investments (plantations) are primarily

located in developing countries, with

a handful of investment opportunities

available in Europe and Australia. The

higher risks associated with investing in

these countries is compensated for by the

potential for very high returns. Investments

are spread across countries in Africa,

Central and South America, Central and

South-East Asia, Australasia and Europe.

INVESTMENT TERMS

Investors can invest into saplings or

standing wood. Sapling investments

can run for up to 24 years and will often

span the entire growth cycle of the trees.

Standing wood investments will often

have much shorter terms than this, with

some providers offering investments of

3-6 years. Forestry is generally considered

a long-term investment, as trees grow

relatively slowly and returns only come

once trees reach a sufficient size.

MINIMUM INVESTMENT REQUIRED

Sapling investments tend to require a low

minimum investment of between £5,000

and £15,000. The investor is paying for the

planting of the trees and the freehold or

leasehold of the land, which in many of

these countries is quite cheap. Standing

wood investments will usually have higher

minimum investments which can range

from £20,000-£50,000. The investor is also

paying for the freehold or leasehold land,

but will pay a premium price for having

more established trees. The price is likely

to vary depending on the age of trees, how

many trees are purchased and how long the

investment is predicted to run for. Product

providers differ on the number of trees

planted per hectare. Some product providers

will replace trees free of charge that perish in

the first three years of the investment.

RETURNS

Returns are paid once the trees can begin

to be harvested and the timber sold on

behalf of the investor. This usually occurs

4-6 years into the investment, and then

at 1-3 year intervals. This is referred to as

thinning, whereby a small number of young

trees are cut down (harvested) and sold

in order to create room for the remaining

trees to continue growing. The main

harvest will be at the end of the investment

term, where the remaining trees are cut

down and sold.

This final harvest is where the bulk of the

investment returns come from, and means

investors have to wait a long time in order

to recoup their initial investment. Returns

(2014)