8

UK FORESTRY

Performance in the UK forestry sector

has been particularly strong with the

Investment Property Databank (IPD) UK

Forestry Index showing an annualised

total return of 17.7% over the past five

years and 16.3% over the past decade.

The annualised return for the 20 years

to December 2012 was 8.1%. Three-year

annualised returns rose to 23.9% in 2012,

outperforming bonds by 14%, equities by

6.7% and commercial property by 8.7%.

The IPD Forestry Index is calculated from

a sample of private sector coniferous

plantations of predominantly Sitka spruce

in mainland Britain. By the end of 2012, the

148 forest holdings in the index had a total

capital value of £220.7m.

In the 12 months to September 2013 the

FIM Timber Index increased by 3.6%,

driven by sawlog prices, which saw a 10.1%

increase in the same period. The Index

is now only 2.7% below the last peak in

September 2011.

The FIM Timber Index uses statistics

published by the Forestry Commission

(FC). It comprises an equal weighting of

the Coniferous Standing Sales Price Index

(CSSPI), being the average price of standing

conifer timber sales, and the Softwood

Sawlog Price Index (SSPI), being the

average price of all softwood sawlogs sold

on the FC estate.

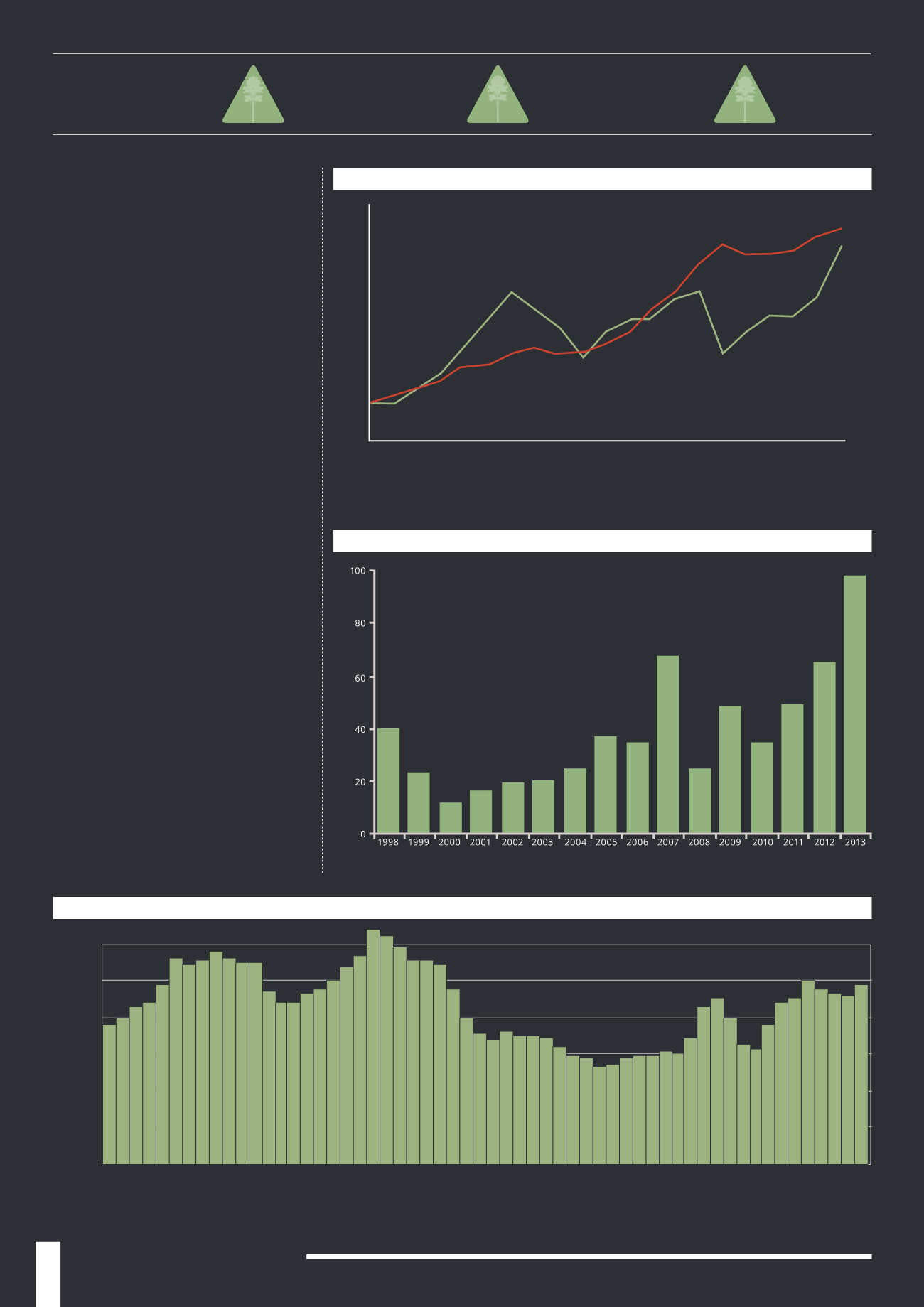

UK COMMERCIAL FORESTRY TRANSACTIONS

(1998 - 2013)

Source: Savills

FIM TIMBER INDEX

Source: FIM Services Limited, Forestry Commission (FC), Office for National Statistics (ONS)

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

0

20

40

60

80

100

120

(1985 - 2013)

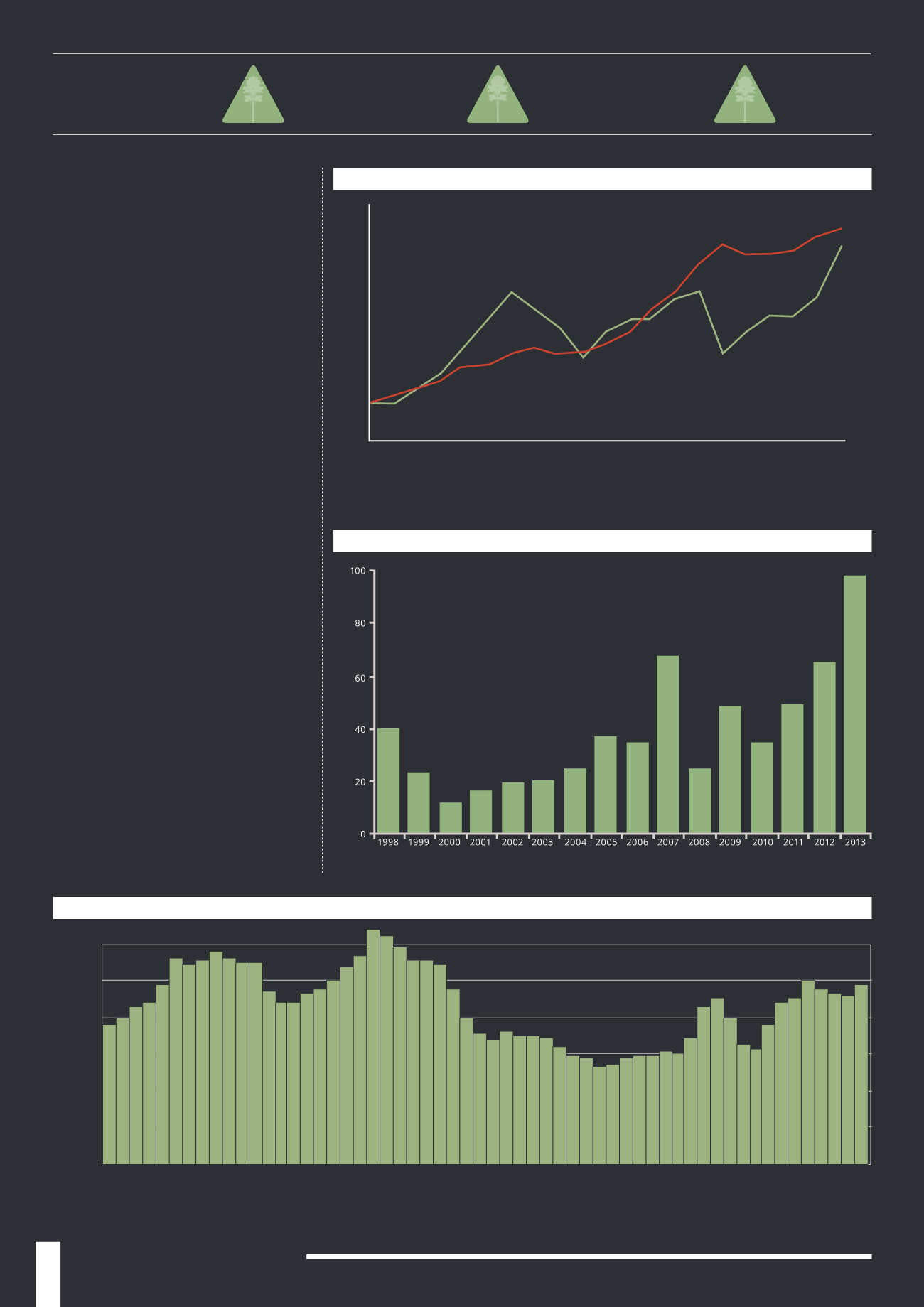

NCRIEF TIMBERLAND INDEX VS. S&P 500

(1993 - 2013)

Source: NCREIF

—

100

200

300

400

500

1993

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013

NCREIF Timberland

S&P 500

FORESTRY

ANNUALISED

RETURNS:

PAST

5 YEARS

17.7%

PAST

10 YEARS

16.3%

PAST

20 YEARS

8.1%

£ Million