16

such as Italian wines, have enjoyed good

returns, even in the difficult market of

the last few years. Italian wines, with

SuperTuscans and Barolos leading the

way, are a particular example of this.

As blue-chip Bordeaux has floundered

since mid-2011, Italy has gradually filled

its shoes, in both volume and value

terms. Italy’s share of trade on the Liv-ex

exchange has climbed steadily since

2010, culminating in a record 13.4% rise

in September 2014, more than six times

its average for the last eight years.

In December 2014, the New York

Times reported that more than three

quarters of the fifty most expensive

wines in the world now come from

Burgundy, Jonathan Reeve, the content

manager of the global wine price

database wine-searcher.com, explained

that Burgundy is a “notoriously fussy

grape. It’s hard to really nail it. But

when it’s perfect, it becomes a kind

of unicorn wine. Actually finding

one is such an obsession for some

people they’ll spend anything”

34

.

INVESTMENT HORIZON

Fine wine is a medium to long-term

investment. Transaction costs can be

high and certain items can sit on price

plateaus for considerable periods

of time until a new burst of interest

pushes prices higher again. Most

investors have a 5-10 year investment

horizon as a minimum and generally,

the longer you hold the wine the more

its value will appreciate. Wine matures

and improves with age and because it

is a consumable, it becomes rarer as

more bottles are drunk. In addition

it matures and improves with age.

With most investors looking over

the medium-term, it can be a while

before certain assets resurface onto

the market. However, unlike other

passion assets which are historically

based, such as antiques, new vintages

of wines do become available annually,

which fuels speculation and gives

opportunities for market entry at more

affordable levels. (Always assuming

the right quality asset is chosen with

the potential to appreciate in value

as it matures and becomes rarer and

more popular, and whose provenance

is protected by proper storage).

An even better performer over that last five years has been Burgundy and the

strength of the region is underlined by the recent world record prices achieved

at auctions - in April 2015, Acker Merrall & Condit’s Connoisseurs’ Club sale saw

more than 50 new world records set, of which nearly 40 were from Burgundy.

32

In

November 2013, DRC, la Romaneé-Conti 1978 (12 bottle case) sold in Hong Kong for a

new world record price of $476,280 in late 2013 // $39,690 per bottle.

34

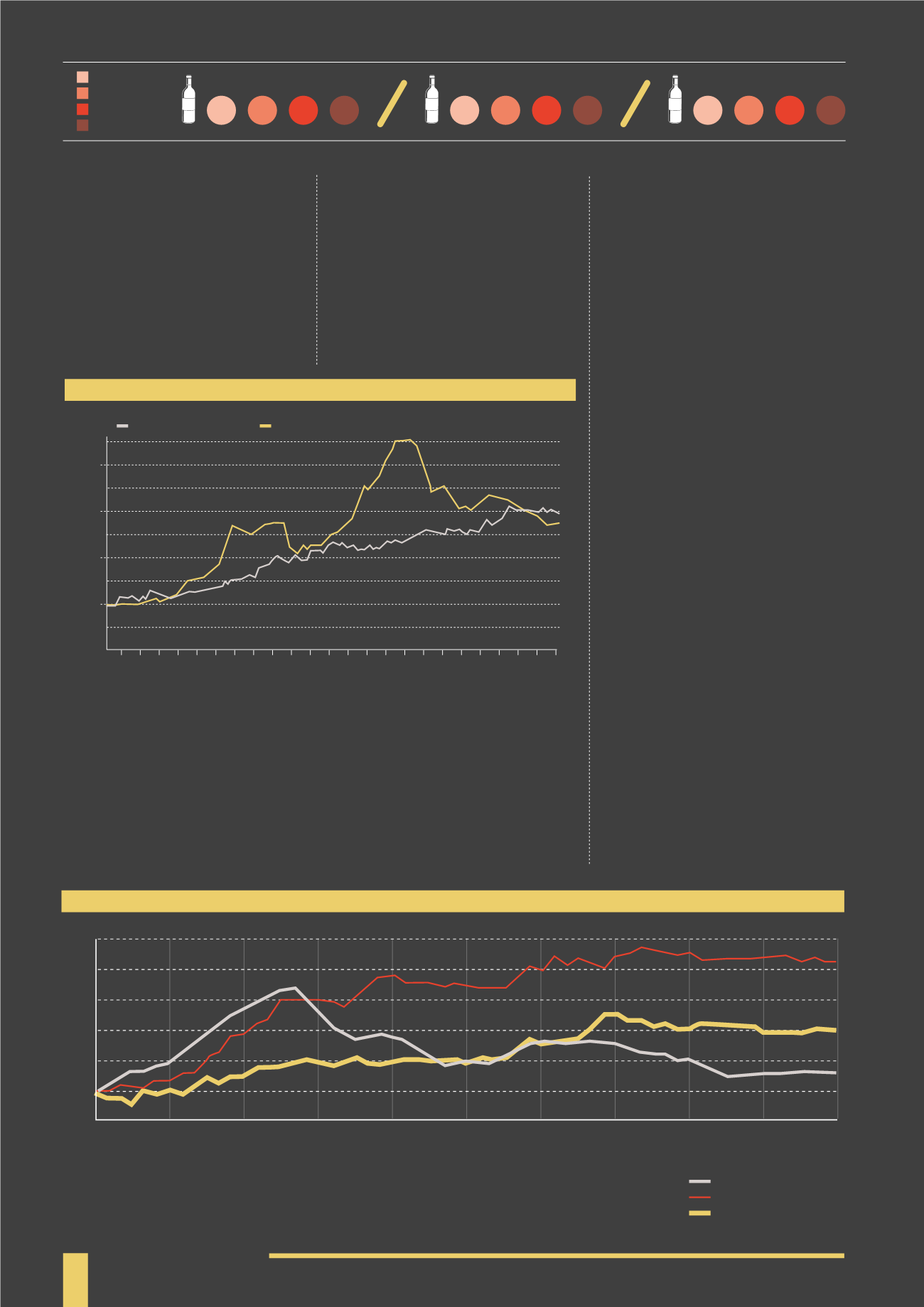

SUPERTUSCANS

VS

BORDEAUX FIRST GROWTHS

(2004-2014)

Super Tuscan Index

Liv-ex 50

Sep 2004

Feb 2005

Jul 2005

Dec 2005

May 2006

Oct 2006

Mar 2007

Aug 2007

Jan 2008

Jun 2008

Nov 2008

April 2009

Sep 2009

Feb 2010

Jul 2010

Dec 2010

May 2011

Oct 2011

Mar 2012

Aug 2012

Jan 2013

Jun 2013

Nov 103

April 2014

Sep 2014

400

350

300

250

200

150

100

50

0

Source: Decanter.com

31

This demonstrates the need for diversification within the wine portfolio itself to protect returns

and the expertise required to identify those vintages with the characteristics to achieve this.

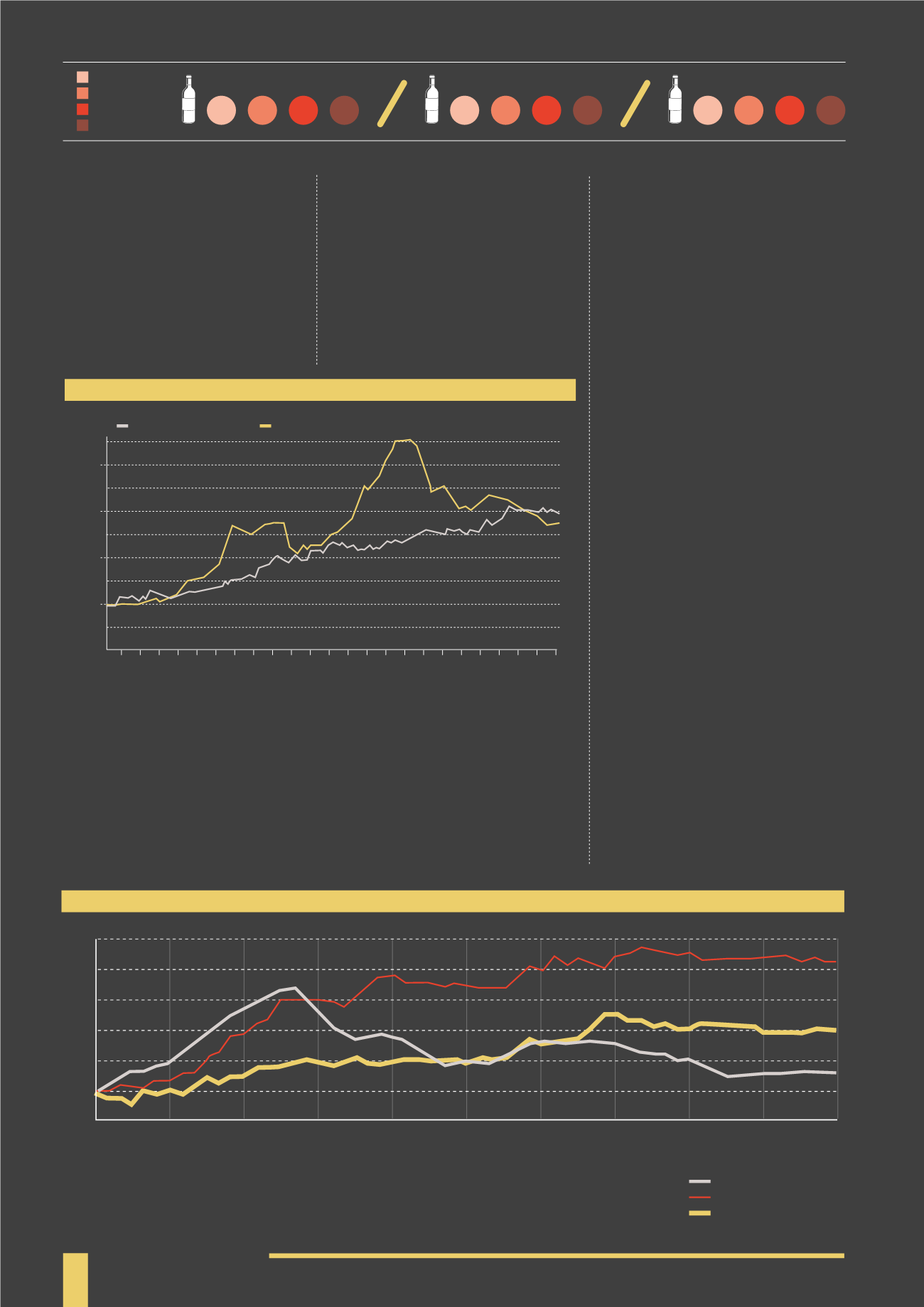

6 months

12 months

2 years

5 years

Sep 2010 Mar 2011 Sep 2011 Mar 2012 Sep 2012 Mar 2013 Sep 2013 Mar 2014 Sep 2014 Mar 2015

150

140

130

120

110

100

90

Source: Liv-ex

WINE INDICES COMPARISON

(2010-2015)

Liv-ex Bordeaux 500

Burgundy 150

Italy 100

BURGUNDY 150

-1% -2% 2% 43%

LIVE-EX BORDEAUX

0% -3% -9% 6%

ITALY 100

1% 0% 4% 21%