8

THE ASSET CLASS

PASSION ASSETS

Since the recent financial crisis,

the demand for more diversified

investments has been fuelled by volatile

markets and record-low interest rates

and this has led to intensified interest

in many physical assets that have

intrinsic value, particularly where supply

is limited. In turn this has created an

upsurge in the value of many so-called

alternative investments, including

passion assets which encompass

tangible items that are not financial

assets, which are not securitised, with

no income stream to which traditional

valuation techniques can be applied. In

essence, they are essentially high-value

luxury items – the primary purpose

of which is enjoyment. Examples of

passion assets include: antiques,

furniture, Chinese ceramics, vintage

watches, jewellery, fine wine, fine art,

rare coins, rare stamps and classic cars.

Some investment professionals view

investments of passion as problematic

within a traditional portfolio as they

are subject to fashion, taste, supply

and other esoteric market forces that

make them difficult to value: they are

not fungible (individual units are not

capable of mutual substitution in the

way that say a barrel of oil or a gold bar

is - each asset has to be valued

individually). But just because items are

hard to value doesn’t mean that they

don’t have value

6

, a unique quality and

the benefit of being a real asset whose

value will not disappear overnight in the

same way as equity in a failed company.

Coutts private bank certainly recognises

the value of passion assets, and

assesses the market worth in its Objects

of Desire Index; “We understand that

wealthy individuals own and acquire

passion investments primarily because

they are attractive assets, inspirational

and have emotional attachment.

However, their investment performance

is difficult to ignore. The Index,

which includes 15 passion assets

across two broad categories; trophy

property and alternative investments,

which are broken down into fine art,

collectibles and precious items, rose

by 2.8% during the first six months

of 2013 and rose by 77% from the

beginning of 2005 to mid 2013”

7

.

In the Coutts Index, fine wine falls into

the collectibles category, along with

Stamps & Coins, Classic Cars, Rugs &

Carpets and Rare Musical Instruments.

Fine Wine and Classic Cars both

The strong performance demonstrated by the Coutts findings are backed up by the

Knight Frank Luxury Investment Index, with fine wine experiencing a 234% growth in

the ten years from Q4 2004 to Q4 2014.

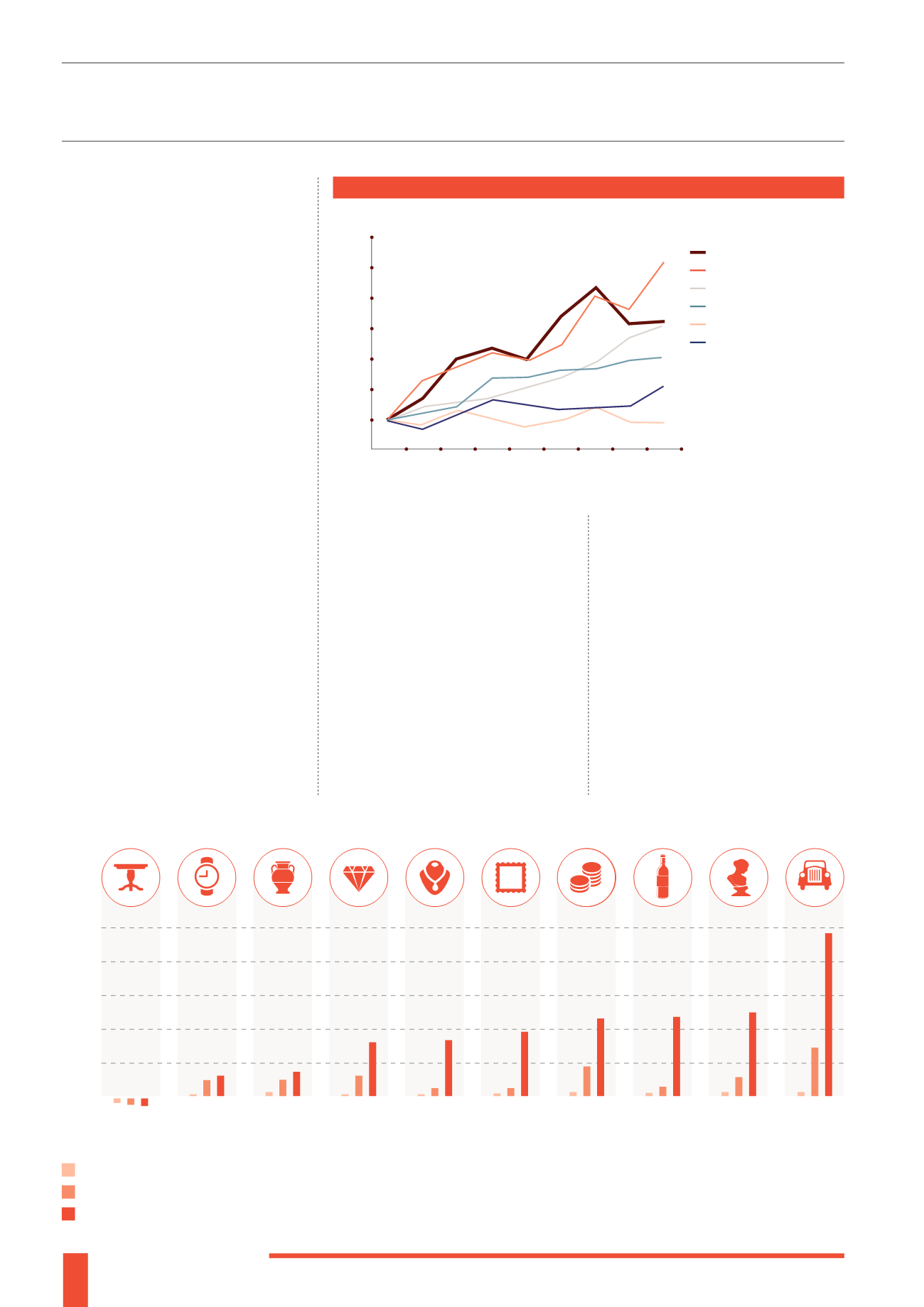

COUTTS OBJECTS OF DESIRE INDEX

(

2005-2013)

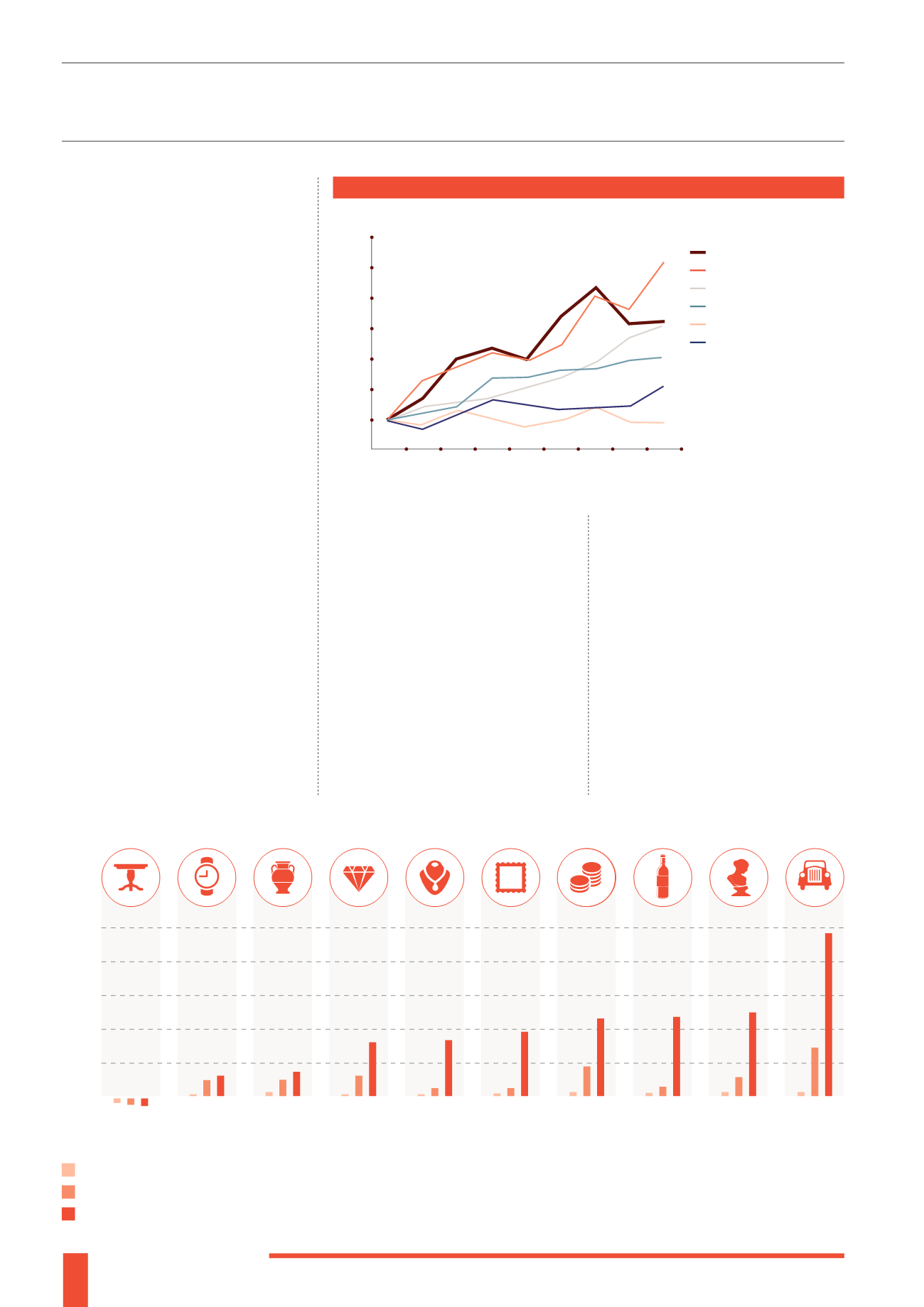

KNIGHT FRANK LUXURY INVESTMENT INDEX PERFORMANCE

(2004-2014)

Fine wine

Classic cars

Coins

Stamps

Rare musical instruments

Rugs and carpets

2005 2006 2007 2008 2009 2010 2011 2012 2013

400

350

300

250

200

150

100

50

Furniture

Watches

Chinese

ceramics

Coloured

diamonds

Jewelery

Stamps

Coins

Wine

Art

Classic

cars

Source: The Knight Frank Luxury Investment Index

9

500%

400%

300%

200%

100%

0%

12 month performance

5 years performance

10 years performance

4

-9

49

-25

68

-28

9

2

2

3

13

7

15

16

46

73

34

34

92

38

61

140

69

167

195

195

232

234

252

487