15

MEDIUM TO LONG TERM

In the medium to long term, returns

have proven to be strong, with the

Liv-ex Fine Wine Investables Index

achieving a compound annual return of

almost 15% over the 20 years to 2011.

26

In addition, two Switzerland-based

economists who compared wine prices

with the Russell 3000 Index between

January 1996 and January 2009, a

period which covers two bull markets

and two bear markets for stocks, found

that,“the inclusion of wine in a portfolio

and, especially, more prestigious

wines, increases the portfolio’s returns

while reducing its risk, particularly

during the financial crisis”

27

.

In the even longer term, the Telegraph

reported in 2014 that red wine

outperformed government bonds,

fine art and even stamps over the 20th

century, according to research by a

team of academics from the University

of Cambridge, HEC Paris and Vanderbilt

University, Nashville, Tennessee. The

research found that fine wine investors

could have earned annualised real

returns of 4.1% from 1900 to 2012,

although British equities would have

given annualised returns of 5.2%. “The

returns are surprisingly high compared

with the returns on cash or bonds”

Elroy Dimson, visiting professor at the

Cambridge Judge Business School, said.

29

SHORTER TERM

Certainly, in the last ten to fifteen

years, it has been a very active and

growing market, with fine wine

turnover quadrupling from US$1bn to

US$4bn between 2004 and 2010.

4

However, despite rallying in the last few

months of 2014, the Liv-ex 100 closed

the year on 238.50, representing a 7.3%

drop. Although the index rose 1.9%

from July to December 2014, it was the

fourth consecutive year of declines.

30

This has been largely due to the drop

in price of Bordeaux, which makes up a

large percentage of the overall market

where values dropped sharply since

mid 2011 - ‘Some 2009 first growths

are still only nearly back to 50%’. Lafite

2008, for example, once considered

the greatest investment wine because

superstitious Chinese prize the number

eight, peaked at £16,000 a case, but

Farrs were selling it in February at

£5,200.

20

This stubbornly slow rebound

is leaving room for longer term

investors to pick up undervalued stock,

so, after a decade of being a sellers

market, it is now a buyers market,

which is certainly beneficial for new

entrants. For existing investors, who are

able to follow a medium to long term

strategy, opinion is that the increasing

demand, nature of changing tastes,

the cyclical nature of the market and

the consumption of existing vintages,

creating more rarity, will, eventually,

bring Bordeaux which were overpriced

in 2011 back to positive growth figures.

Commentators, including Cult Wines

concede that the last several years of

performance have been challenging, but

feel that “While the economic conditions

in major economies such as the US and

Japan have improved, stock markets

have already had substantial gains and

the bull market is arguably entering

advanced stages. In contrast, fine wine

investment is now trending below

average and the odds of a potential

gain from “reversion to mean trend”

has become favourable should trading

environment for the fine wine market

turn more supportive. Thus, it is

highly probable that between the two

asset classes the relative performance

in the coming few years will shift

back to fine wine investments”.

A buyers market, allied with the potential

for a low entry level, makes a small

portfolio accessible to a wide range of

investors: with minimum investment

levels as low as £5,000, in order to build

a diverse portfolio and access stock

with the strongest growth potential.

Of course, the lower the entry level,

the less real prices need to appreciate

to provide growth in the asset value.

Market participants such as World of

Wine and James Miles of Liv-ex point

out that positive signs of overall growth

are now evident: toward the end of

last year and continuing into 2015,

some indices made gains, following

17 months of decline; the Liv-ex 100

index saw four months of (admittedly

modest) gains to November 2014 and

was flat in December. Half of the eight

sub-indices in the Liv-ex 1000 made

gains from June to December 2014,

most notably the Bordeaux 500.

Nevertheless, those savvy investors

who have diversified into other vintages

where better returns can still be found

“A buyers market, allied with the potential for a low entry level, makes a small portfolio accessible

to a wide range of investors”

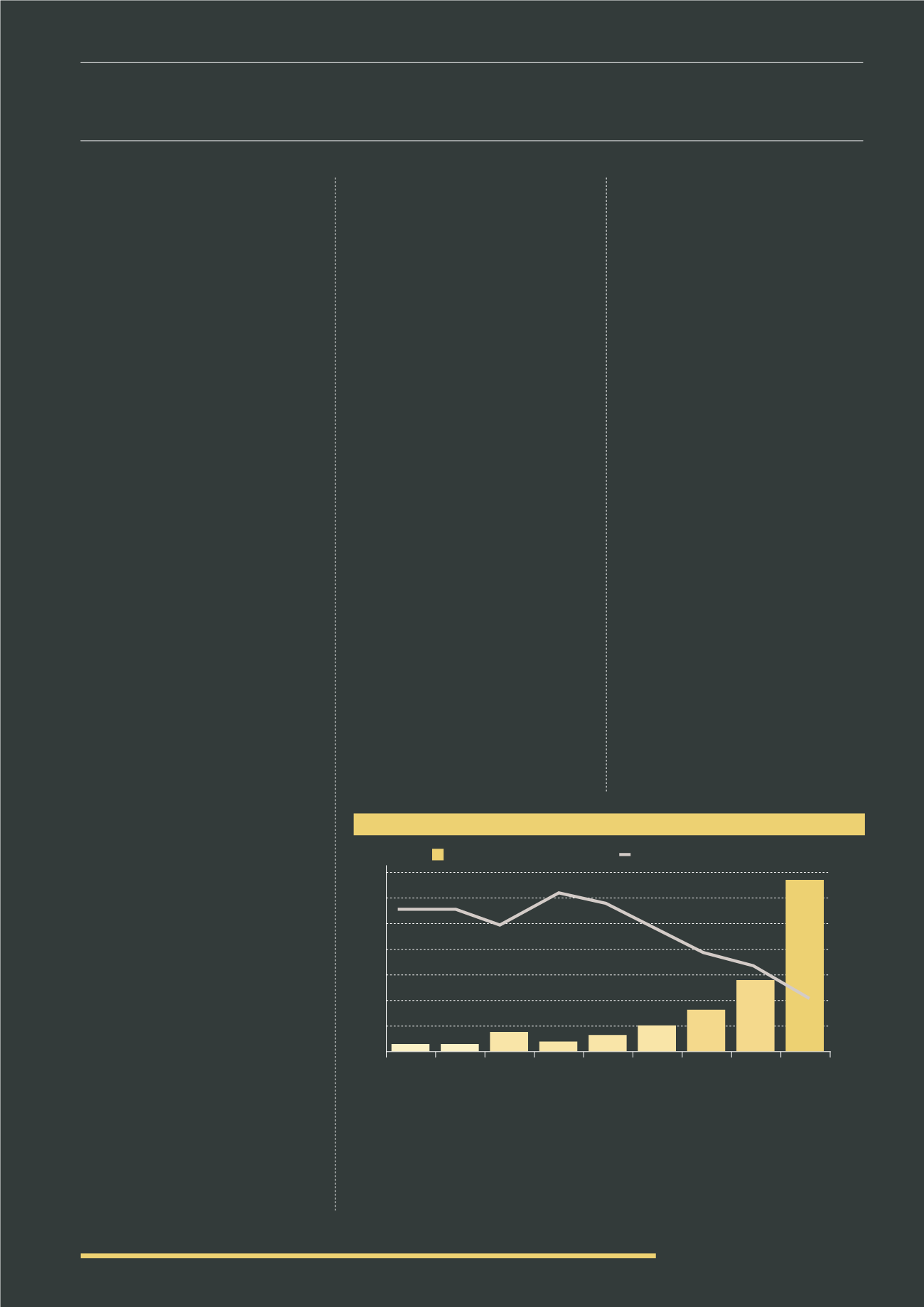

Italy’s modern-day status as a source of investment-grade wine began with what are

now widely known as SuperTuscans, and these remain the key focus of investors,

tripling in price over the last decade (Chart on the next page). The Liv-ex SuperTuscan

index has not seen the peaks and troughs of the Bordeaux first growths, but has

climbed steadily, and despite flattening out over the last year, has proved a better

investment over two, five and 10 years.

ITALY SHARE OF TRADE ON LIV-EX

VS.

BORDEAUX (%)

(2007-2015)

2014

YTD

2014

Sep

2007 2008 2009 2010 2011 2012 2013

100%

95%

90%

85%

80%

75%

70%

65%

Italy (left hand axis)

Bordeaux (right hand axis)

Source: Liv-ex

14%

12%

10%

8%

6%

4%

2%

0