22

EMERGINGMARKETS

“Without doubt the next big

growth story will be India.

Not only does fine wine

match their tastes for tangible

assets, but the increase in

wealthy Indians is strong”

Marcus Allen, Cult Wines

Wine’s globalisation will doubtlessly

continue, with new wealth looking for

luxury, status and pleasure coupled

with potential investment benefits.

Knight Frank predicts that HNWI Growth

will be strongest in developing regions,

with Africa’s ultra-wealthy population

rising by 59% in the next ten years and

Kazakhstan set for a 114% increase in

UHNWIs in the same period, and other

CIS countries also predicted to do well.

The demand is being driven by

the very rapidly growing wealthy

emerging from Russia, Japan

45

and

an increasing interest in these goods

from other nations such as Brazil and

particularly India. In fact India could

be a candidate for the next emerging

fine wine market, especially if the

EEA and India do a deal on tariffs that

would benefit wine through lowering

import duties

14

: 4n mid-2013, in an

effort to enter a free trade agreement

(FTA) with the European Union, India

offered to drastically cut Customs

duties on wines and spirits to 40% from

the current 150%. The EU wanted a

reduction to 30% and the Indian wine

makers sector was very much against

allowing in imports at a much cheaper

price.

54

As a result, no agreement

was reached and high import tariffs

remain, but the potentially huge impact

of political decisions such as this, is

highlighted by the huge boom in the

Chinese/Hong Kong market when

import duties were slashed in 2008.

When we look at the amalgamated

expectations for growth in UHNWIs,

the MINT (Mexico, Indonesia, Nigeria,

Turkey) countries, with average

expected uplift of 76% over the

next decade, narrowly defeat the

BRIC countries (Brazil, Russia, India

and China), which have an average

forecast growth of 72%. However,

they both far outstrip global

average forecast growth (34%)

9

.

The expansion of the middle classes

in these regions, along with the

opportunities for significant new

wealth, put these nations on the list

of those which may take an increasing

interest in the fine wine market.

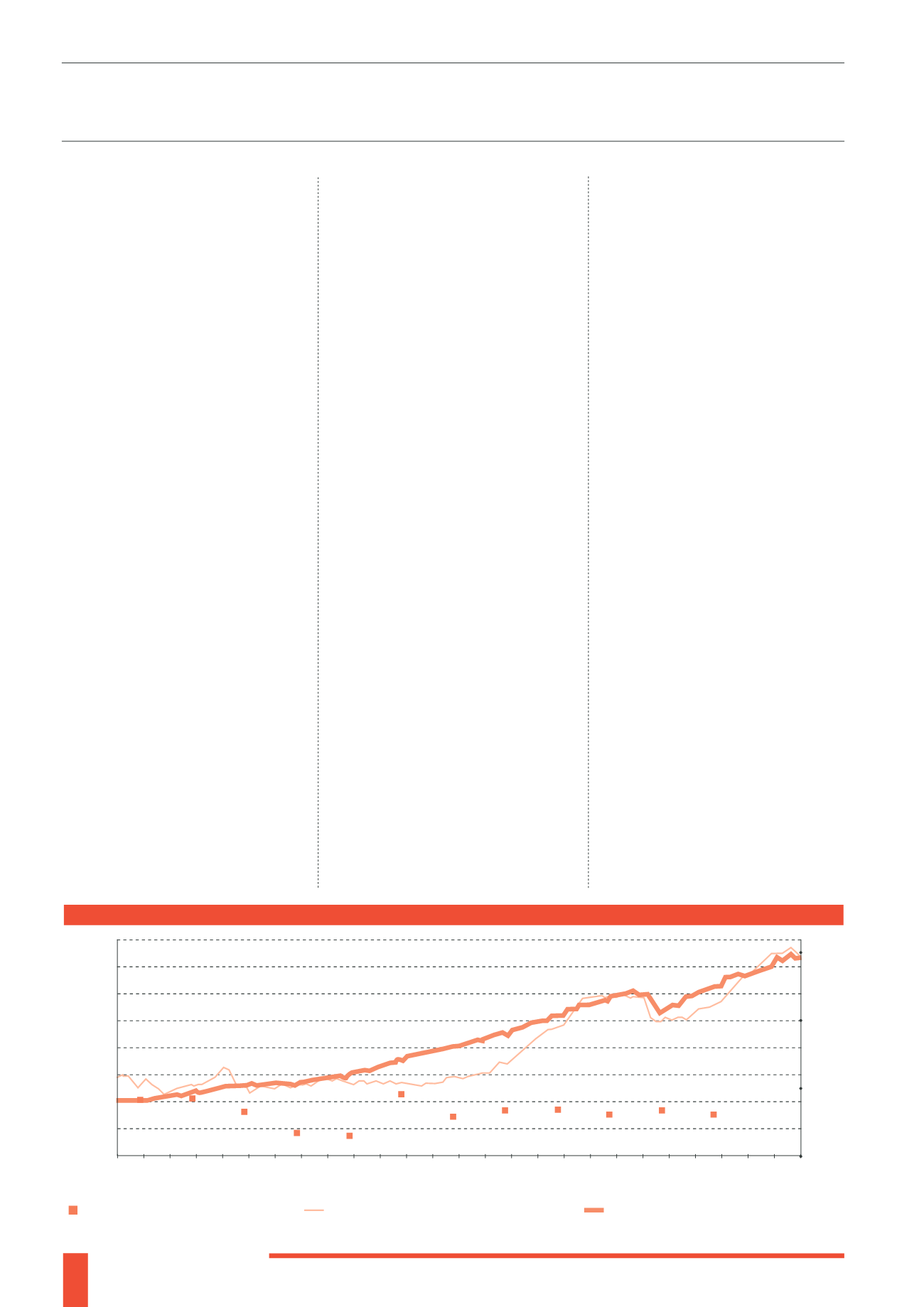

In fact, a recent paper by the IMF

demonstrated a close correlation

between fine wine prices and emerging

market industrial production,

suggesting that, as developing nations

wealth grows, the demand for fine wine,

presumably from the newly wealthy in

those regions, follows suit, increasing

consumption and pushing up values of

remaining vintages as collectors items,

status symbols and wealth stores.

19

Cult Wines sees growth in both the

emerging and traditional markets, with

Marcus Allen, Head of Global Business

Development predicting that, “Hong

Kong, Singapore and mainland China

will maintain their positions as strong

growth markets with South East Asia,

in particular Thailand, Philippines

and Indonesia, growing significantly

also. Renewed optimism from North

America with regard to Bordeaux will

bring US buyers back and in addition

we see South American buyers starting

to make an impression on statistics.

Without doubt however the next big

growth story will be India. Not only

does fine wine match their tastes for

tangible assets, but the increase in

wealthy Indians is strong”. Certainly,

Bloomberg’s June 2014 article suggests

that current conditions could support

the prediction, stating that “About 86

percent of Indians’ household assets are

in real estate and tangible investments

such as gold, the highest rate among

16 countries tracked, Zurich-based

Credit Suisse said in an October 2013

report” and that “Ultra-high-net-

worth individuals in India, defined as

having assets of more than $30 million

excluding primary residence, are

estimated to grow 98 percent through

2023 from last year’s 1,576, compared

with 28 percent growth globally”

56

.

EMERGING MARKET INFLUENCE

(1998-2011)

Aug

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Aug

Feb

Feb

Feb

Feb

Feb

Feb

Feb

Feb

Feb

Feb

250

225

200

175

150

125

100

75

50

400

200

100

50

Production of top chateaux (indexed)

Live-ex Fine Wine Investables USD (RHS log)

Emerging market industrial production (LHS)

Source: Liv-ex

13