21

and Spain and in terms of consumption

per head, the leading four nations

are Italy, France, Switzerland and

Portugal. Whilst all forecast to see

declining volume by 2018, other

European nations - Austria and Greece

- are forecast to show an increase.

45

Interestingly, new interest has been

reported in Eastern Europe, with

the Wine Investment Fund director

Rodney Birrell, commenting in February

2015 that “Recently we’ve been

getting a lot of interest – although

not investment yet – from Eastern

Europe, so Slovakia, Slovenia and

Poland, but very little from Russia”

49

.

Whilst the growth of the Chinese market

in the last decade did much to eclipse

the traditional markets of Europe and

the US, for the first time in three years,

the global wine-auction market rose in

value in 2014, to $350 million - a small

increase of 5.5% on 2013, (although

still 26% down on the record results of

2011), thanks to the US market, which

surged up by 28.6% on 2013, making

up for declines in Europe and Asia. The

US has consolidated its lead on Asia in

terms of market share, now making up

just under half of live-auction revenues,

with Asia just below one third. The US

also boasts the highest percentage

of lots sold, at 95.1% compared to a

global average of 90.5%, flat on 2013.

47

It seems that the combination of low

prices and a strong dollar against the

euro means that American buyers are

returning after several years.

22

Currency

wise, Liv-ex reported that, ‘Although

the index is calculated in Sterling, the

recovery is perhaps better understood

when viewed in Euros and Dollars.

While prices have risen in Sterling, they

look cheaper still in Dollars, bringing

American and Asian buyers back into

the market’. At the end of February

2015, the dollar had strengthened to

€1.135, from the time of the last en

primeur in May 2014 when it was trading

at €1.35. “So the Euro’s down 17% on the

world’s biggest currency,” said Liv-ex

director Justin Gibbs. “That’s a great

positive for the fine wine market and

buyers are more likely to get involved”

51

.

The US, which boasts the world’s

biggest economy

52

, certainly has the

wealth to get involved, with 44,922

UHNWIs in 2014, forecast to grow

to 50,767 by 2024 compared to the

Chinese projection of 15,681 by 2024.

9

The increased interest was evident at

the Acker, Merrall & Condit fine wine

auction in New York in February 2015

which saw US buyers take

84% of the lots on offer, including 110

world records. The sale came after a

notable upturn in US interest in the

fine wine market in the last few

months of 2014, with auction house

Zachys signalling a ‘significant

shift’ back to the US.

53

The statistics for wine consumption in

the US are also strong, with January

2015 figures compiled by market

research group IWSR and released by

Vinexpo, predicting that the US would

strengthen its lead over France as the

biggest wine consuming nation overall.

US consumption is set to rise by 11% up

to the end of 2018, to 4.5bn bottles.

In fact, it is U.S. demand which

is set to drive expansion in the

world wine market through 2018

as consumption growth slows in

China and traditional markets such

as France and Italy contract.

47

USA

* Figures include still light wine, sparkling wine, light

aperitif, fortified wines and other wines

Source: Bloomberg

46

CONSUMPTION PER COUNTRY

000

s

of 9L

% charge

Source: The Drinks Business

51

20%

NA

NA

JADEWARE

18%

13%

6%

PORCELAIN

16%

13%

9%

MODERN

ART

9%

5%

NA

WESTERN

HOUSES

8%

10%

15%

CARS

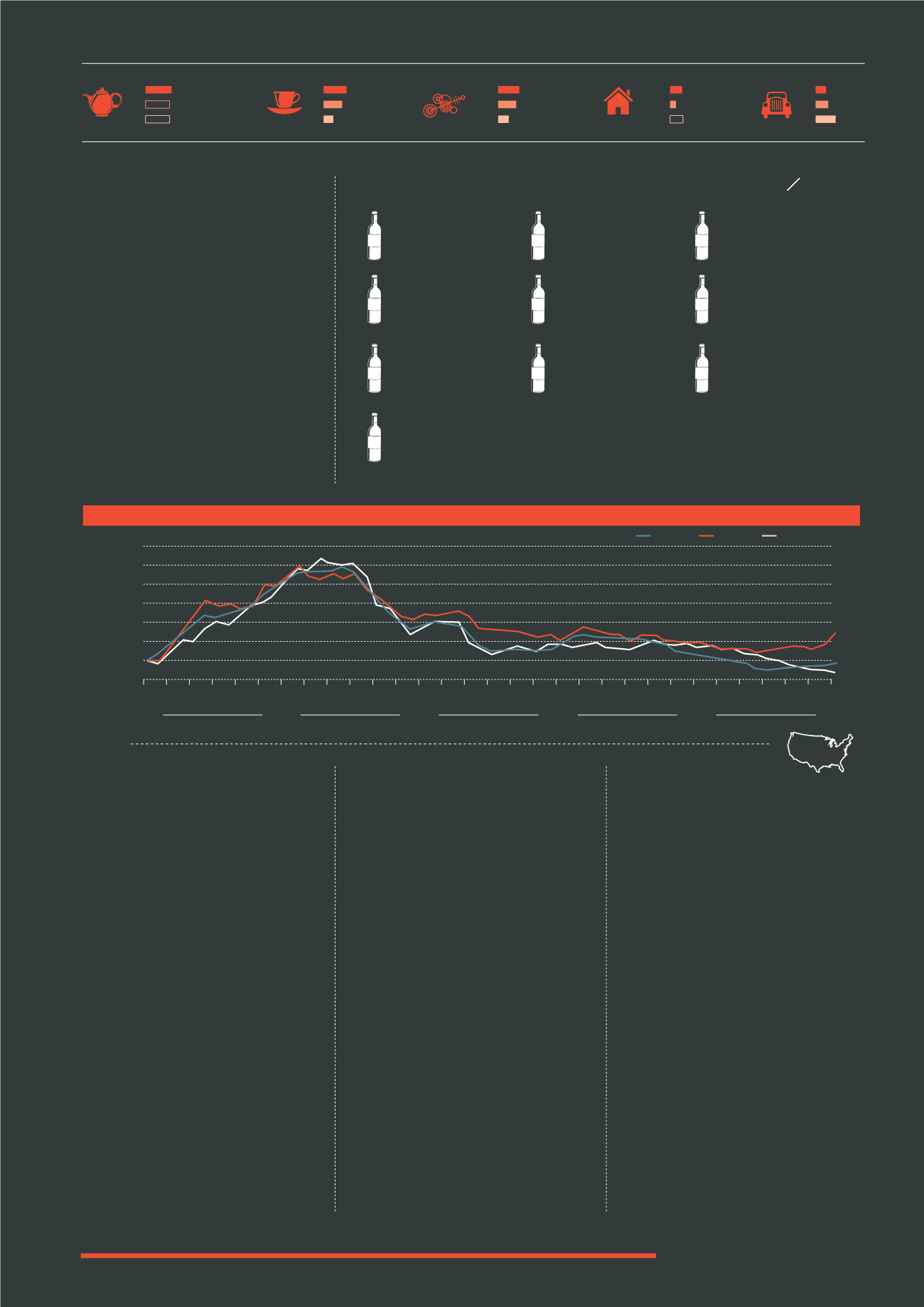

THE LIV-EX FINE 100 INDEX BY CURRENCY

(2010-2015)

Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov Jan

160

150

140

130

120

110

100

90

Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov

Index level

(rebased at 100 in jan 2010)

GBP

EUR

USD

2010

2011

2012

2013

2014

2015

CHINA

743,175

+5

USA

345,500

+1

FRANCE

310,598

-1

ITALY

294,999

-2

GERMANY

282,889

-1

UK

142,489

-1

ARGENTINA

116,935

+1

JAPAN

106,146

+3

RUSSIA

103,936

-1

SPAIN

99,443

-2