14

The right fine wine investment can

be a very defensive holding as it

has the capacity to remain stable

under difficult economic conditions.

Additionally, it has the advantage of

not necessarily following the general

trend of lagging behind the rest of the

market during economic expansion

because demand is consistently strong.

TANGIBLE ASSETS

The concept of spreading risk is clearly a

sound investment strategy and in times

of unstable stock markets, real assets

are attractive as they tend to change

in value independently of the core

financial markets. It is very unlikely that

the value of tangible assets will ever fall

to zero, except in the case of serious

damage, whereas shares can plummet

overnight and in 2008, even the security

of cash came into question as Northern

Rock, RBS and other high street

banks encountered serious issues.

INFLATION HEDGE

An “inflation hedge” is an investment

that will typically rise in value during

periods of above-average inflation,

thereby protecting the investment

from losing value in real terms.

During the recent economic

downturn, the value of cash was

further undermined by the actions of

governments and central banks whose

policy was to print money to stimulate

the economy thereby devaluing cash

and penalising savers. The erosion of

the value of cash makes tangible assets

more attractive as their monetary

worth tends to rise with inflation.

Rupert Robinson, Chief Executive of

London-based Schroders Private Bank,

sees the benefit of purchases of items

like these with HNWIs not just using

them to indulge an expensive hobby,

but increasingly using these items to

diversify a traditional portfolio; “Not only

are they tangible investments and an

inflation hedge, but they can diversify

exposure away from the movements in

traditional fixed income and equities”

6

.

There is no doubt that fine wine has

diversification benefits, but investors

should remember that prices are

broadly linked to the spending power

of the collector base, which may fall

in times of economic uncertainty.

This was demonstrated when

reduced expenditure on investments

of passion was noted in the 2009

issue of the World Wealth Report.

RETURNS

Clearly, a bottle of wine will not create

an income and its investment benefit

is as a vessel to accommodate capital

preservation and hopefully make

capital gains. As collectibles have no

positive cash flows (and in most cases

deliver negative cash flows due to

insurance and storage costs), valuing

these gains can be difficult, particularly

given their non-fungible nature.

Nevertheless, research and indices such

as Liv-ex do provide useful historical

data and an indication of trends, and

valuation services are available from

reputable brokers and dealers.

Modern portfolio theory suggests

that the less an asset moves with the

market, the smaller should be that

asset’s expected return. In recent

years, however, hobby investments

have offered the best of both worlds:

low correlations and high returns.

In the case of fine wine, in August

2014, Forbes reported that, between

1993 and 2013, a diverse portfolio of

investment grade wines would have

returned 13.62%, more than double

that of the S&P 500.

25

A word of caution

in relation to returns though – the last

four years have shown that significant

price corrections can occur, making fine

wine not suited to short term investors.

“Not only are they tangible investments and an inflation hedge, but they can diversify exposure

away from the movements in traditional fixed income and equities”

Rupert Robinson, Schroders Private Bank

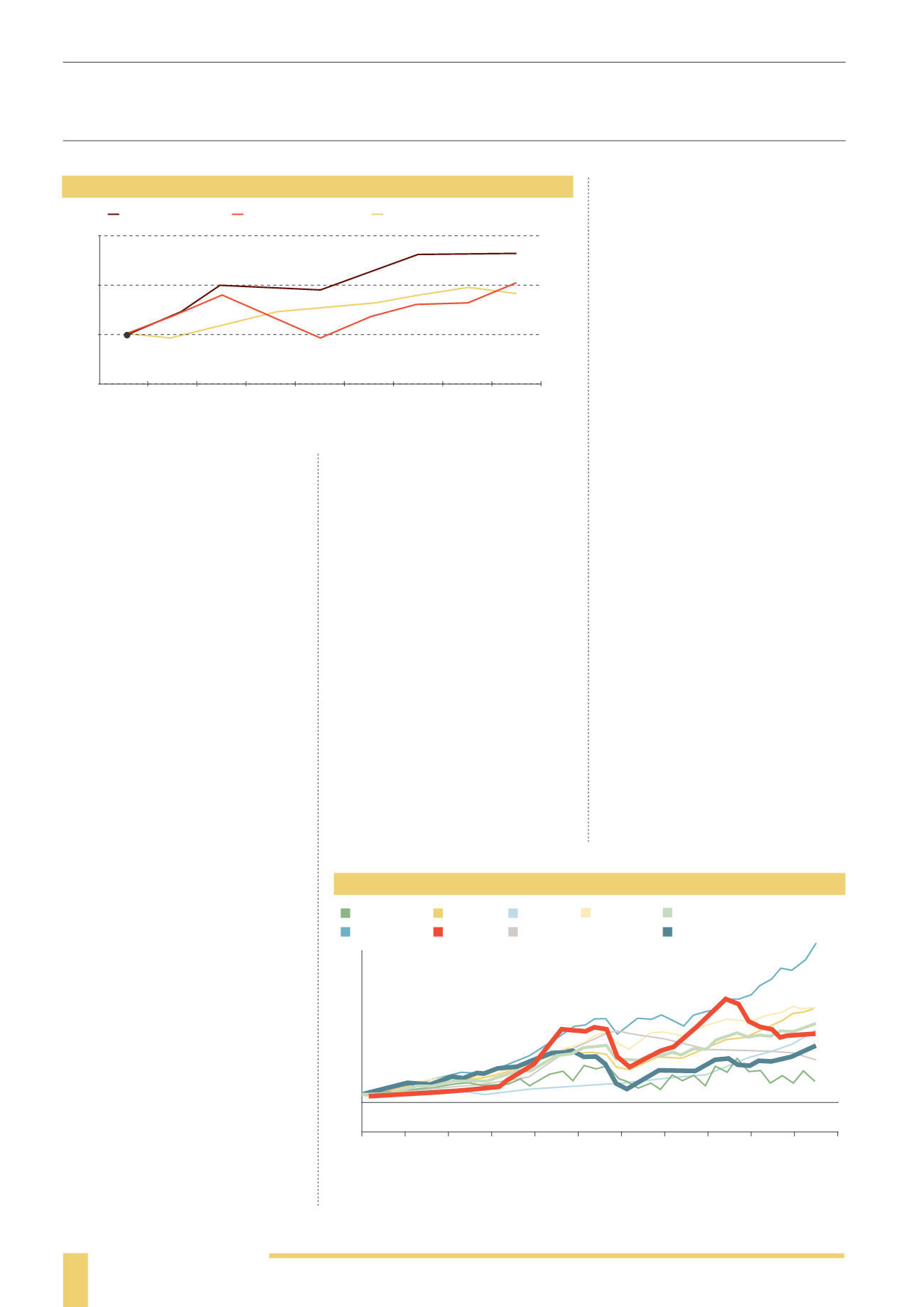

PRICE INDICES,

$

TERMS

(2003-2013)

500

400

300

200

100

0

Sources: Art Price: Vintage Guitar magazine; Florien Leonhard Fine Violins; Hagi; Liv-ex; Stanley

Gibbons; Thomson Reuters; The Economist

29

*Including dividend income

**Underlying data not for publication

Q1 2003 = 100

Art

Coins

Violins

Stamps

The Economist Valuables index

Classic cars

Wine

Guitars

MSCI World

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

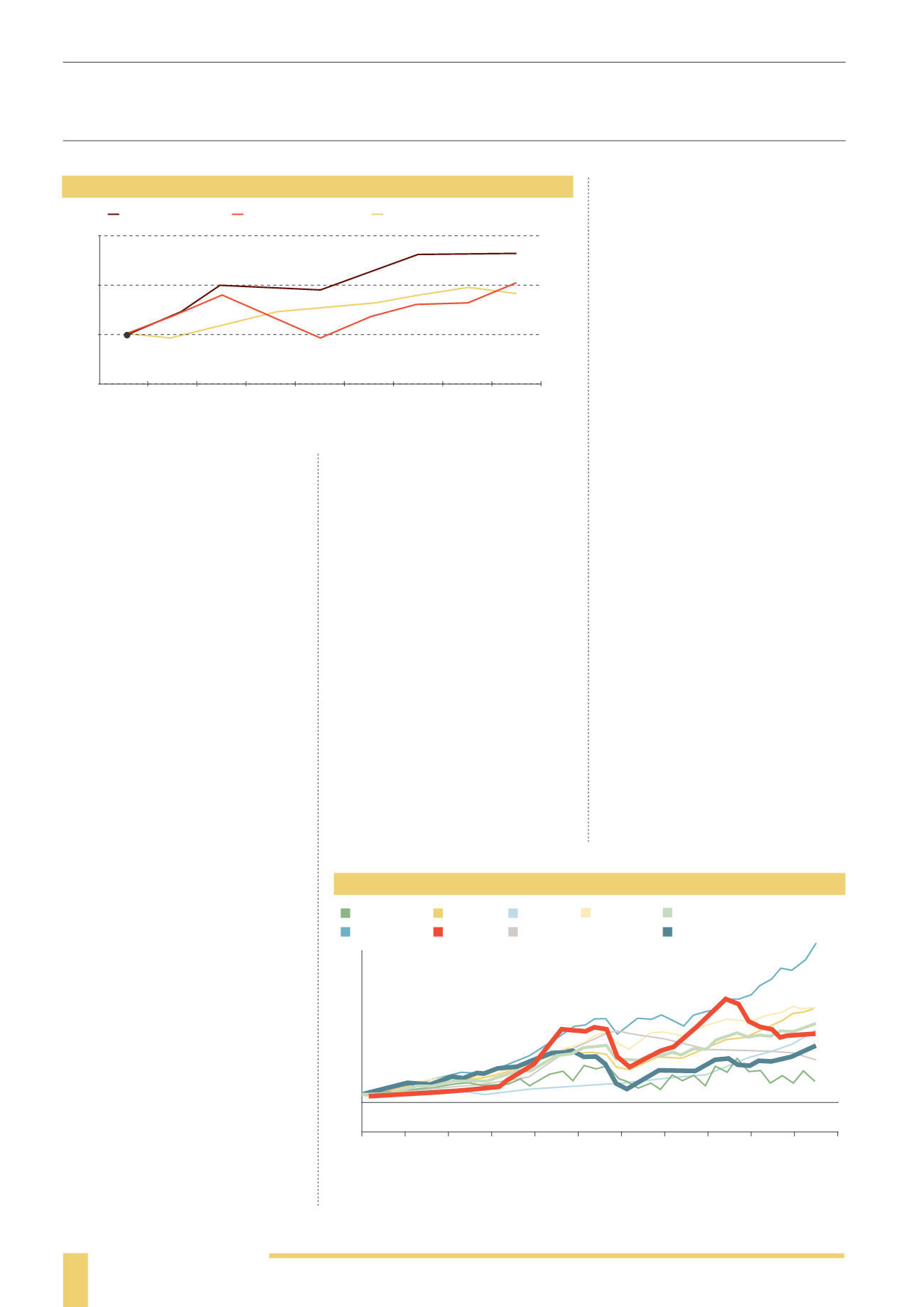

OBJECTS OF DESIRE

VS.

TRADITIONAL ASSETS

(2005-2013)

Source: The Coutts Index: Objects of Desire

Coutts Index

Global Equities

Global Government Bonds

200

150

100

50

2005 2006 2007 2008 2009 2010 2011 2012 2013

2005: 100, USD