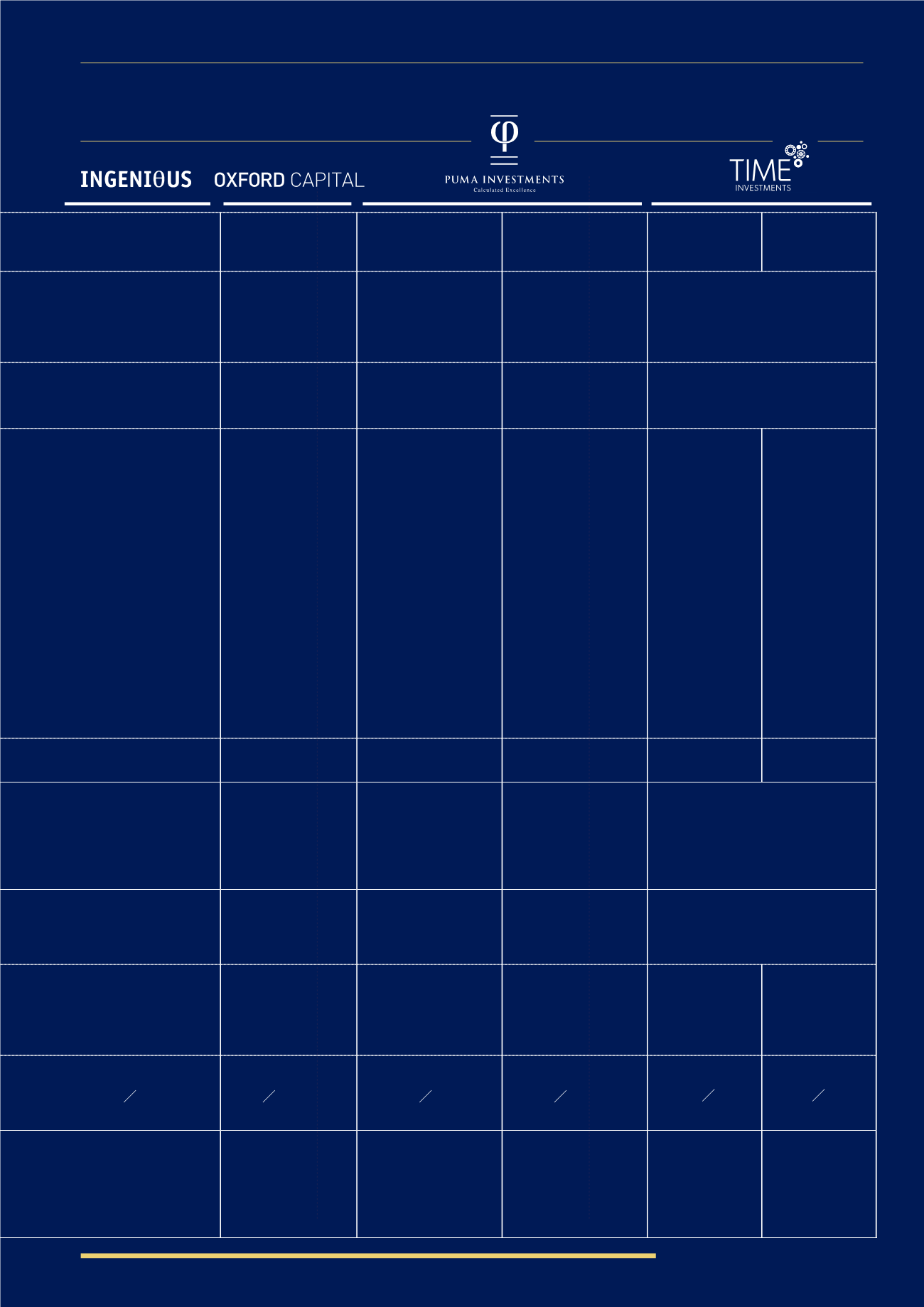

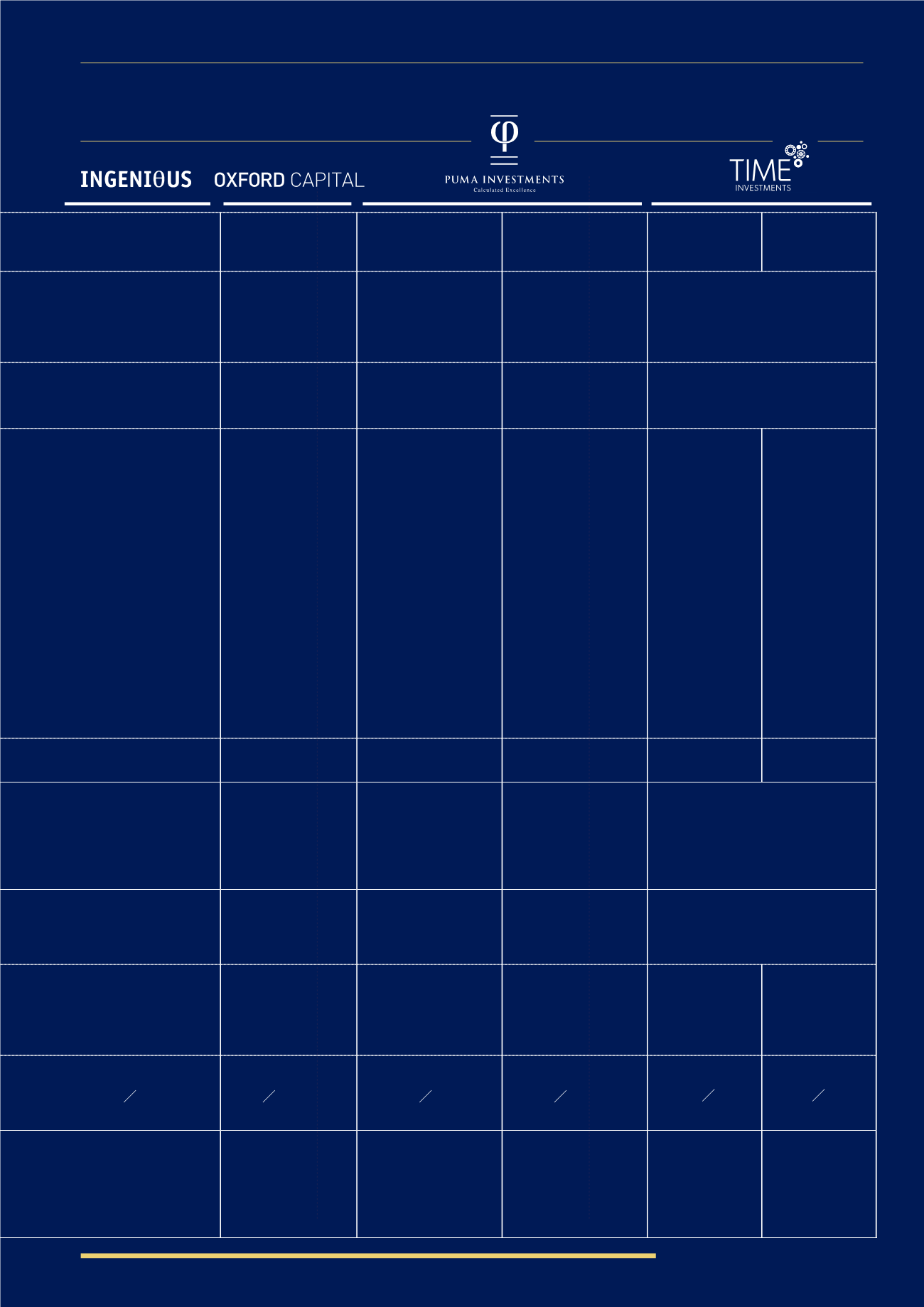

41

Ingenious Estate

Planning – IEP Classic, IEP

Care, IEP Private

Oxford Capital Estate

Planning Service

Puma AIM Inheritance

Tax Service

Puma Heritage PLC

TIME:Advance

TIME:CTC

Over £8 billion raised

and deployed with

£800m in BPR products

£300m in EIS and

BPR products

£800m

£800m

£500m (including £140m of BPR

assets). The services have invested

over £500m into BPR qualifying

trades over 19 years.

1998

Independently owned

1999

Fully Independent

1985

AIM listed

1985

AIM listed

1996

Fully independent

IEP Classic:

Initial – 1.5%

for advised retail clients.

Ongoing – 1%, payable

only from growth over

3% in that year

IEP Care:

Initial – 2% for

advised retail clients.

Ongoing – 1%, payable

only from growth over

3% in that year

IEP Private:

Initial – 2.5%

for advised retail clients.

Ongoing – 1%

Admin fee:

0.25% of

investment value p.a.

Dealing fee

: 1% on

investment and 1% on

each withdrawal

Initial Fee:

2.5%, with

tapering reductions

for subscriptions of

more than £500,000.

Annual Management

Fee:

1.5%

Initial Fee:

2.0% of

amount subscribed

Annual Management

Fee:

1.5% of portfolio

value

Dealing Fee:

1.0%

applied to purchase

or sale of stocks

A tiered fee structure

for both the initial

fee and annual

management fee is

available for those

investing over

£500,000 in the

service with further fee

reductions for those

investing over £1m

Promoter Fee:

2.5% of

amount subscribed

Annual Advisory Fee:

1.0% deferred and

only paid in full if the

company achieves a

target return of 3% p.a.

in full

Administrative Fee:

0.4% of net asset value

p.a.

Dealing Fee:

1.0%

at exit only

Performance Fee:

None

Initial Fee:

2.5%

+VAT

Annual

Management

Fee:

0.75% +VAT

deferred until exit.

Dealing Fee:

1%

on entry and exit

* If an investor

dies before 2

years TIME will

rebate some of

its fees

Initial Fee:

3.5%

+VAT

Annual

Management

Fee:

1% +VAT,

deferred until exit.

Exit Fee:

1%

* If an investor

dies before 2

years TIME will

rebate some of

its fees

√

√

√

√

√

√

Investing in companies

that operate conservative

trading strategies in

Ingenious’ core sectors of

media, clean energy and

real estate

Capital preservation,

current focus on

infrastructure assets

Puma AIM is a

portfolio service

Puma Heritage has a

conservative trading

strategy focused on

secured lending.

Focus on capital preservation

delivered through investment into

asset backed businesses

Tim O’Shea, Senior

Investment Director,

Ingenious Capital

Management Ltd

Oliver Hughes

Justin Waine

Puma Investments

Management Limited

TIME Investments’ specialist BPR fund

management team of 12

Historic average

number of days for full

redemption: 22 days

Target <30 days

(access strategy)

Target <180 days

(return strategy)

Can be redeemed

at any time with a

timeframe to liquidate

the portfolio subject

to market conditions

Redemption dates

twice a year with one

month notice

Fortnightly

Target 4-6 weeks

£50,000 initial invest.

(£250,000 for IEP Private)

£10,000 increments

£50,000 initial invest.

£25,000 top-ups

£15,000 initial invest.

£15,000 increments

£25,000 initial invest.

£25,000 increments

£25,000 initial

invest.

£10,000increments

£100,000 initial

invest.

£25,000increments

Discretionary Managed

Portfolio Service

Discretionary

Managed Portfolio

Discretionary

Managed Portfolio

Unlisted PLC

Discretionary

Managed

Portfolio

Bespoke IHT

Service