BPR Industry Report 2015 - page 40

40

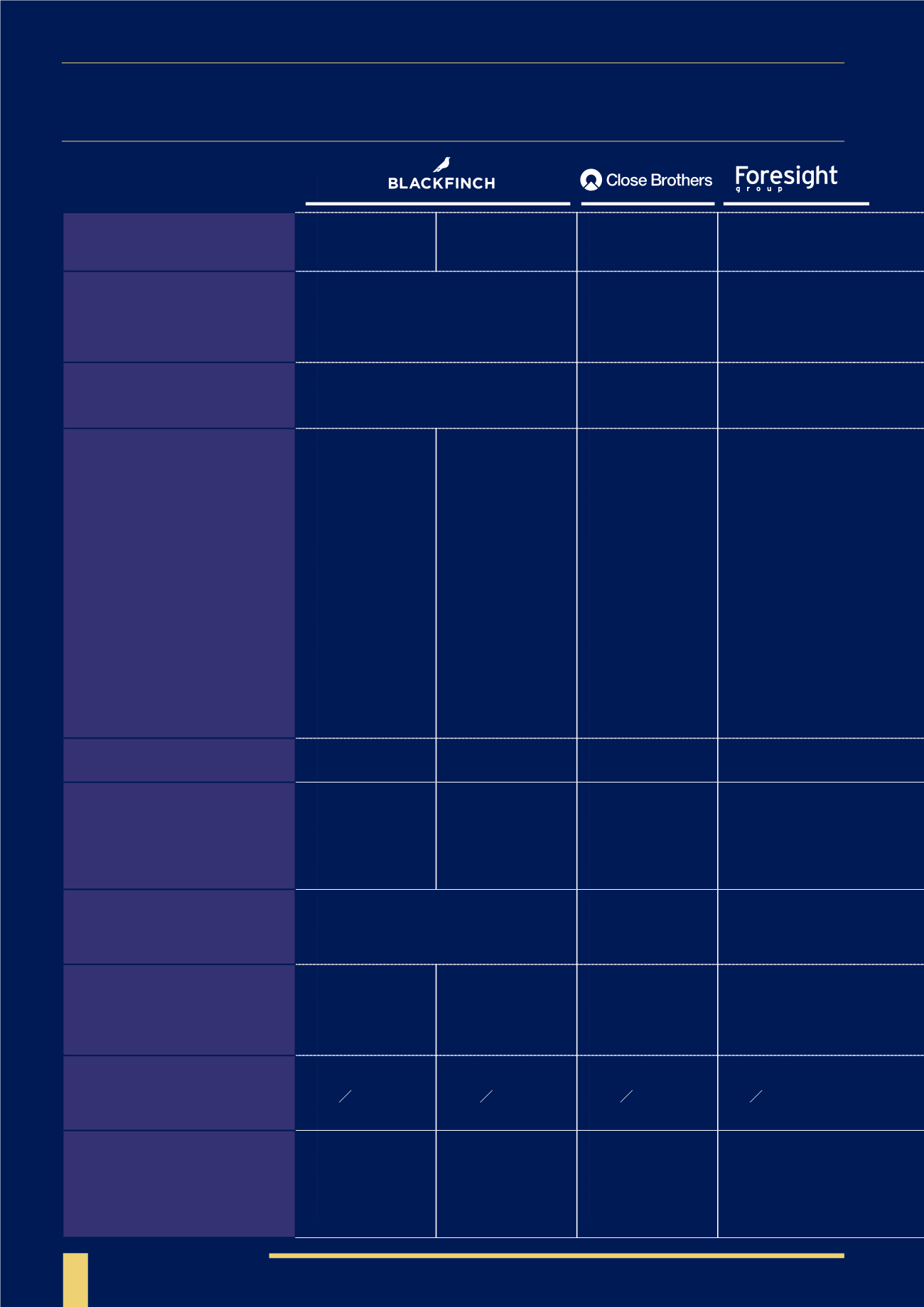

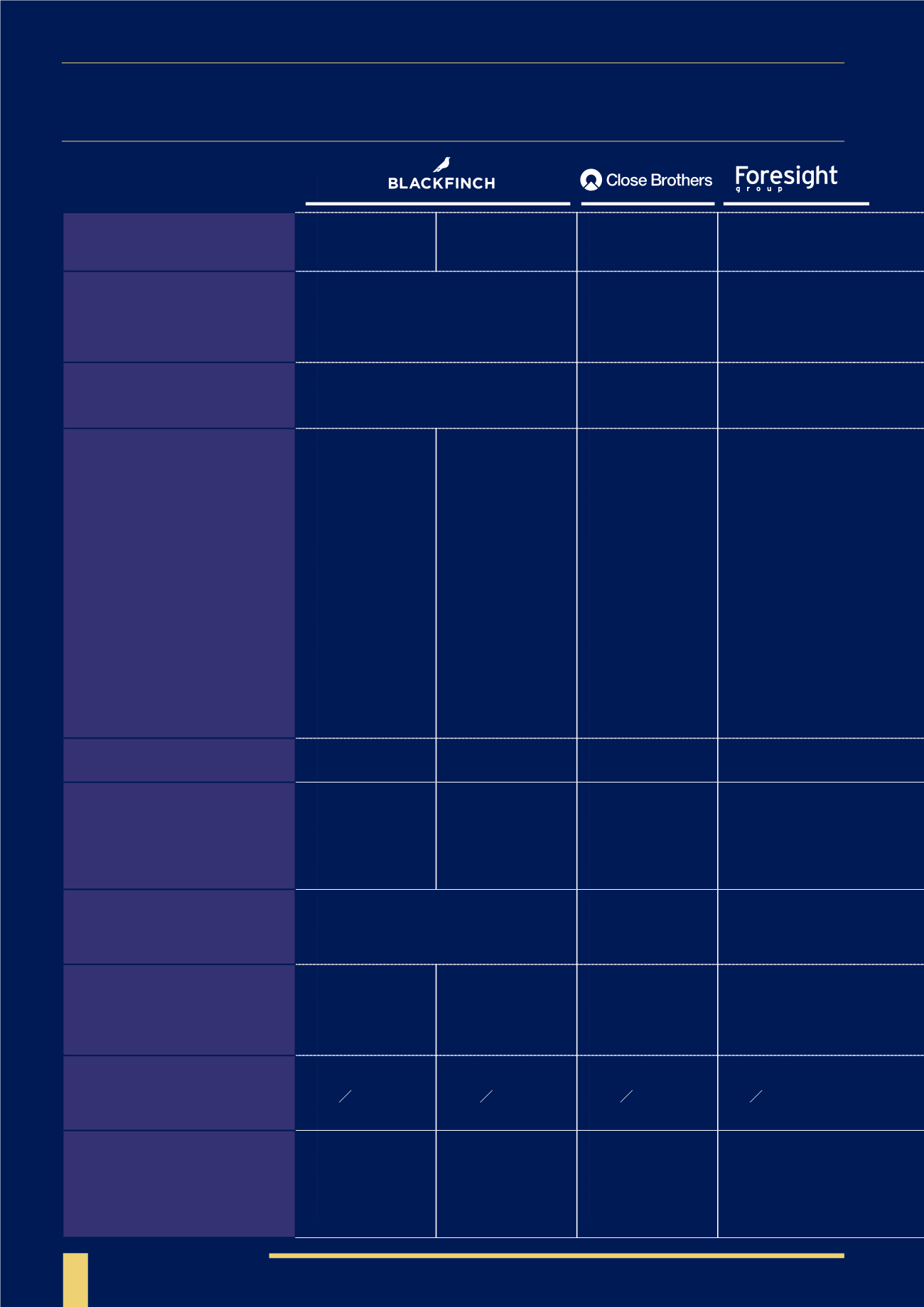

PRODUCT / COMPANY NAME

Blackfinch IHT

Portfolios

Blackfinch Corporate

Management

Service

Close Inheritance Tax

Service

Foresight Group LLP

TOTAL AUM

£500m

£10.2 billion (firm);

£113 million (BPR/

EIS/Segregated

mandates) – at

31/01/2015

£1.4bn

FIRM INCEPTION

AND OWNERSHIP

1992

Fully independent

1878

FTSE250 listed PLC

1984

Fully independent

BPR CHARGES

Initial Fee:

2%

Dealing Fee:

1%

Profit share

of 50%

over a 4.6% priority

investor return

Initial Fee:

3% \ 0.5%

+ VAT ongoing

Initial Fee:

£250

(+VAT)

On-going Fee:

1.25%

(+VAT)

Dealing Fee:

1%

Initial Fee:

up to 2.5%

On-going Fee:

2%

FACILITATE ADVISER

CHARGING ?

√

√

√

√

BPR STRATEGY

Portfolio of unquoted

trading companies

focused on capital

preservation

Asset backed lending,

focused on capital

preservation

AIM portfolio

Infrastructure

and asset backed

businesses

FUND MANAGER / ADVISER

Blackfinch Investments

Sam Barton and

Stephen Wood

Foresight

Infrastructure Team

(20+ people)

LIQUIDITY (DAYS)

Target 30 days

Target 1-3 months

Target 10 days

Target 15 days

MIN INVESTMENT AMOUNT

AND TOP UP INCREMENTS

£25,000 initial invest.

£10,000 increments

£50,000 initial invest.

£10,000 increments

£50,000 initial invest.

£50,000 increments

£25,000 initial invest.

£10,000 increments

PRODUCT / COMPANY

STRUCTURE

Discretionary

Managed Portfolio

Nominee Company

Discretionary

Managed Portfolio

Discretionary

Investment

Management

Arrangement and

Alternative Investment

Fund

BPR PROVIDER COMPARISON

1...,30,31,32,33,34,35,36,37,38,39

41,42,43,44,45,46,47,48,49,50,...76