9

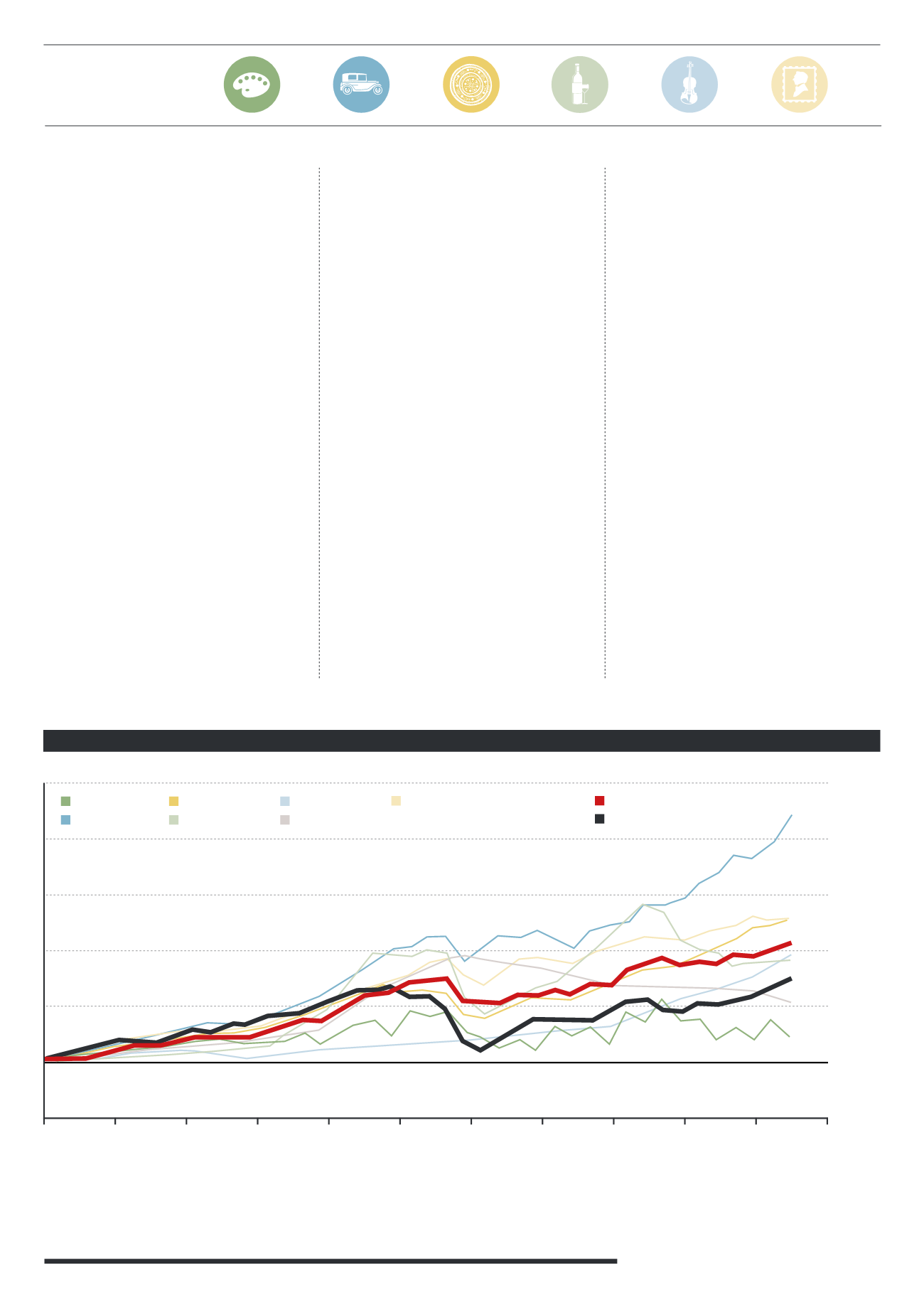

PRICE INDICES,

$

TERMS

600

500

400

300

200

100

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

0

Sources: Art Price: Vintage Guitar magazine; Florien Leonhard Fine Violins; Hagi; Liv-ex; Stanley Gibbons; Thomson Reuters; The Economist

*Including dividend income

**Underlying data not for publication

Q1 2003 = 100

The Economist Valuables Index

MSCI World

Art

Classic Cars

Coins

Wine

Violins

Guitars

Stamps

The Economist has also released the

Economist Valuables Index, which

combines the performance of recognised

indices covering vintage wine, fine art, rare

stamps, precious coins and classic guitars

and violins. Each asset on the index has

been weighted according to Barclays wealth

management holdings of rich individuals:

36% fine art, 25% classic cars, 17% coins,

10% wine, 6% stamps and the remaining

6% guitars and violins. The chart below

shows the performance of this index since

2003, tracked against the performance

of each individual asset and the MSCI

World index to evidence global stock

market returns. There has clearly been

a large amount of volatility across asset

classes, but an investor that diversified

across the whole Economist Valuables

Index would have achieved 211% nominal

growth over a 10 year period since 2003

– compared to 147% (including dividend

income) from the MSCI World index.

Passion assets have some defining

characteristics: the supply of the asset

is relatively fixed and scarce; they tend

to have the ability to last and they

2003 - 2013

provide portfolio protection in a way

that traditional financial assets do not.

Companies can fail, rendering equities

worthless and bonds can default, but

a bottle of fine wine (although it may

degrade if not stored correctly or kept past

its prime) will always be a bottle of fine

wine, a piece of art will always be a piece

of art and rare stamps or coins will remain

rare – nobody can go back in time and

mint more coins or print more stamps.

These kinds of assets are all unique and

individual. They are not fungible (individual

units are not capable of mutual substitution

in the way that say a barrel of oil or a gold

bar is – each asset has to be assessed and

valued individually) and as mentioned

earlier, there is no income stream on which

to base valuations. For these reasons they

do not fit into mainstream investment

models and are often overlooked by

mainstream finance professional and

investors. This helps to give them their

unique diversification properties and

keep them removed from the volatility

seen with mainstream markets, which

are becoming increasingly correlated.

“The clear advantage of

Investments of passion over

traditional investors is the

enjoyment - physical or

emotional - and social cache

that they can bring the collector.

Even if the value of a classic car,

watch or work of art does fall in

value, it will have undoubtedly

provided its owner with a

huge amount of pleasure.”

Andrew Shirley, Knight Frank

HOLDINGS OF

RICH INDIVIDUALS:

6%

6%

25%

17%

10%

36%