8

HNWI ALLOCATIONS OF INVESTMENTS OF PASSION

T

he World Wealth Report

4

, previously

produced by Merrill Lynch Wealth

Management and Capgemini, now by

RBC Wealth Management and Capgemini,

covers Investments of Passion, what they

refer to as IoPs, on an annual basis.

According to the 2009 issue of the World

Wealth Report

4

, the financial crisis and

uncertainty that followed had a marked

impact on the spending patterns of high

net worth individuals (HNWI) and their

spending (and investment) on passion

assets. Although globally spending patterns

varied, on a whole this group of investors

cut back on their spending on luxury

goods and collectible items during 2008.

But the impact of this was relatively short

lived, with HNWIs “cautiously” returning

to passion investments in 2009, although

demand remained weaker than before

the crisis in many categories of assets.

Traditional mainstream investments proved

to be very volatile during the credit crunch

and subsequent economic recession,

leaving many investors facing significant

losses. Those that looked to passion

assets for diversification approached the

sector as “investor-collectors”, looking for

tangible assets as a long-term store of

wealth. Even prior to 2008, passion assets

were rising in value due to increasing

demand from emerging Asian markets –

particularly newly wealthy Chinese and

Indian investors. As the global economy

continues to recover, there are signs that

this demand is picking up once more.

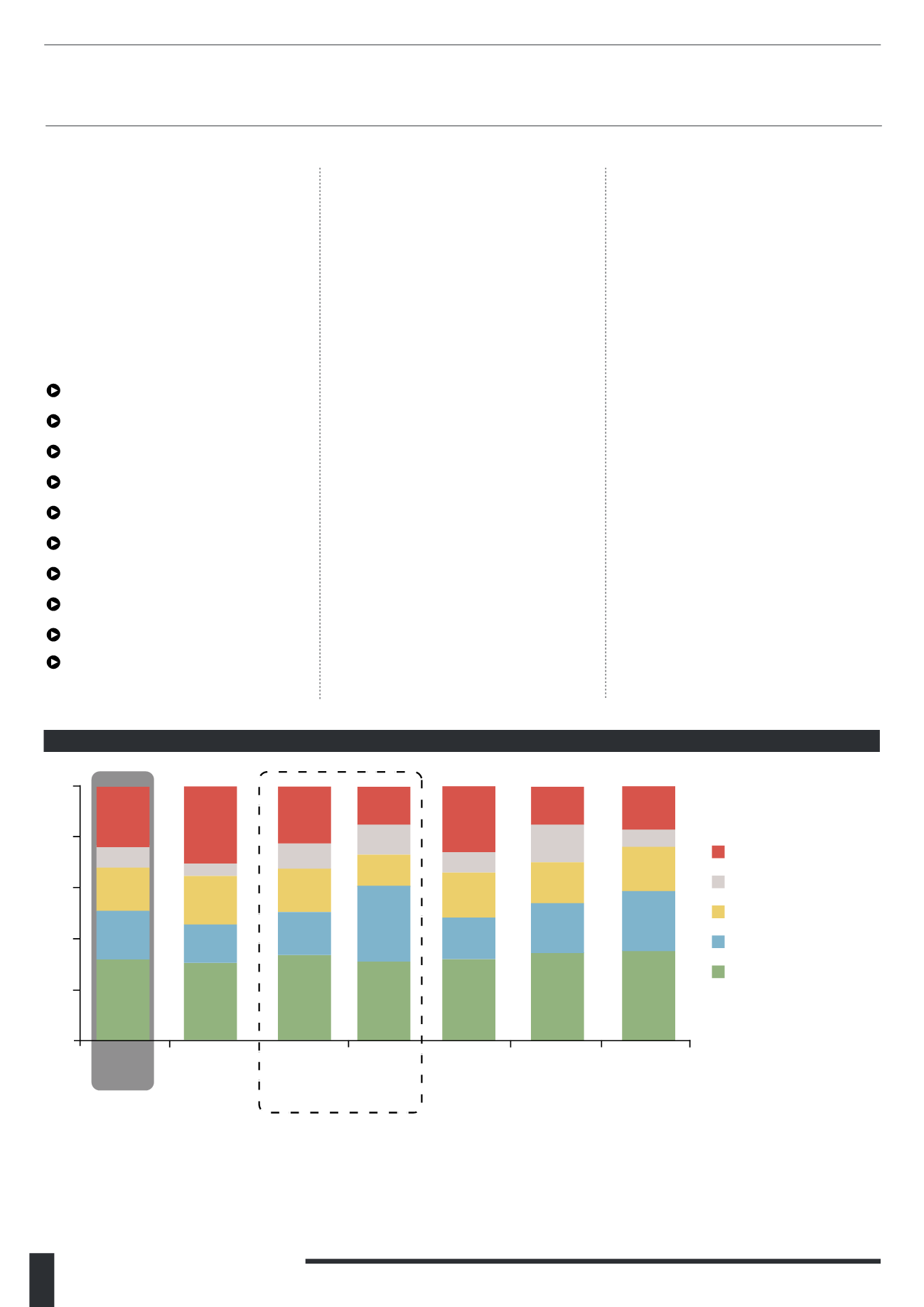

The Wealth Report does not include rare

stamps in its IoP classification, but coins are

included under “Other Collectibles”. Globally

this category of other collectibles accounted

for 24.4% of HNWI’s allocation to IoPs in Q1

2013, but there is a large variation across

geographic regions. The most popular

category across all regions is jewellery,

gems and watches – assets which are likely

to be considered more mainstream.

There have been attempts to measure the

performance of passion assets, most notably

from Coutts who compile the “Coutts Index:

Objects of Desire”, and Knight Frank who

compile the “Knight Frank Luxury Investment

Index”. Both indices show strong performance

from passion assets as a whole, with both

stamps and coins proving to be some of

the most steady and reliable performers.

INVESTMENTS OF PASSION

Q1 - 2013

* Represents coins, wine, and antiques, etc. ** Represents sports teams, sailing, race horses, etc.

*** Represents automobiles, boats, jets, etc.

Other collectibles*

Sports Investments**

Art

Luxury Collectibles***

Jewellery, Gems,

& Watches

Middle East

and Africa

Latin

America

Europe

Japan

Asia-Pacific

excl. Europe

North

America

0%

20%

40%

60%

80%

100%

Asia-Pacific

Global

Average

17.1%

17.1%

7.3%

23.6%

35.0%

34.2%

31.7%

30.8%

33.5%

30.3%

31.6%

19.0%

15.2%

16.8%

29.7%

16.2%

19.6%

15.8%

10.6%

8.3%

17.7%

12.2%

11.8%

17.3%

9.4%

4.7%

19.1%

30.6%

8.0%

16.9%

24.4%

23.0%

15.4%

26.2%

19.8%

Investments of passion, or passion

assets, encompass anything that is

tangible and is not a financial asset (it is

not a collective investment scheme, the

asset is not securitised in any way and

there is no income stream for traditional

valuation models to be applied to). They

are essentially high-value luxury items

that people take pleasure from owning.

Examples of passion assets include:

Antiques

Furniture

Chinese ceramics

Vintage watches

Jewellery

Fine wine

Fine art

Rare coins

Rare Stamps

Classic Cars

Source: Capgemini, RBC Wealth Management, and Scorpio Partnership Global HNW Insights Survey 2013

Note: Chart numbers may not add up to 100% due to rounding