16

Academic research includes Ex Post: The

Investment Performance of Collectible

Stamps, Professor Elroy Dimson of the

London Business School and Christophe

Spaenjers, PhD student at Tilburg University,

they include a price index from 1899 to 2008.

This index has been produced from their

database of catalogue prices (in GBP) of

British stamps. This includes data from

each edition of the Stanley Gibbons’ price

catalogue from 1899 (edition 13) to 2008

(edition 111). Note that this data does not

include “special varieties” (the rarest and

most desirable stamps), whereas Stanley

Gibbons’ indices consist of more than half of

these class of stamps. The index has been

rebased to 100 beginning in 1899. Over the

109 year period that the index covers the

average compound growth was 6.98%.

This index has tracked annual compound

growth of 6.98% over 109 years, 7.03% over

20 years and 12.73% over 10 years. When

we compare this to the performance of the

three Stanley Gibbons’ indices analysed

earlier: the GB30 saw annual compound

growth of 8.37% over 20 years; the GB250

achieved 11.4% over 10 years and the China

200 saw growth of 10.7% per year over 25

years. There are some clear trends that

jump out, including that longer-term 20 year

performance is closely representative of

the performance over the last century, and

in the shorter-term the best performance

has been seen over the last 10 years.

However it should be noted that there was a

long period of flat to negative returns during

most of the 1980s and well into the 1990s.

This period can perhaps be explained as a

reaction to a bubble that formed in the 1970s

in response to a collapse in conventional

asset prices –showing the performance of

stamps as a diversifier. Coins experienced

a similar rise in prices in the 1970s.

FURTHER INFORMATION

For insight into detailed stamp performance,

Stanley Gibbons’ data is at:

.

stanleygibbons.com/news-and-research

GB

200

COIN INDEX

Stanley Gibbons launched the GB200 Coin

Index in May 2012 to provide transparency

for investors (and collectors) to the British

coin investment sector. The index charts

the performance of 200 rare British coins

with prices based on independent coin

catalogues published by respected experts.

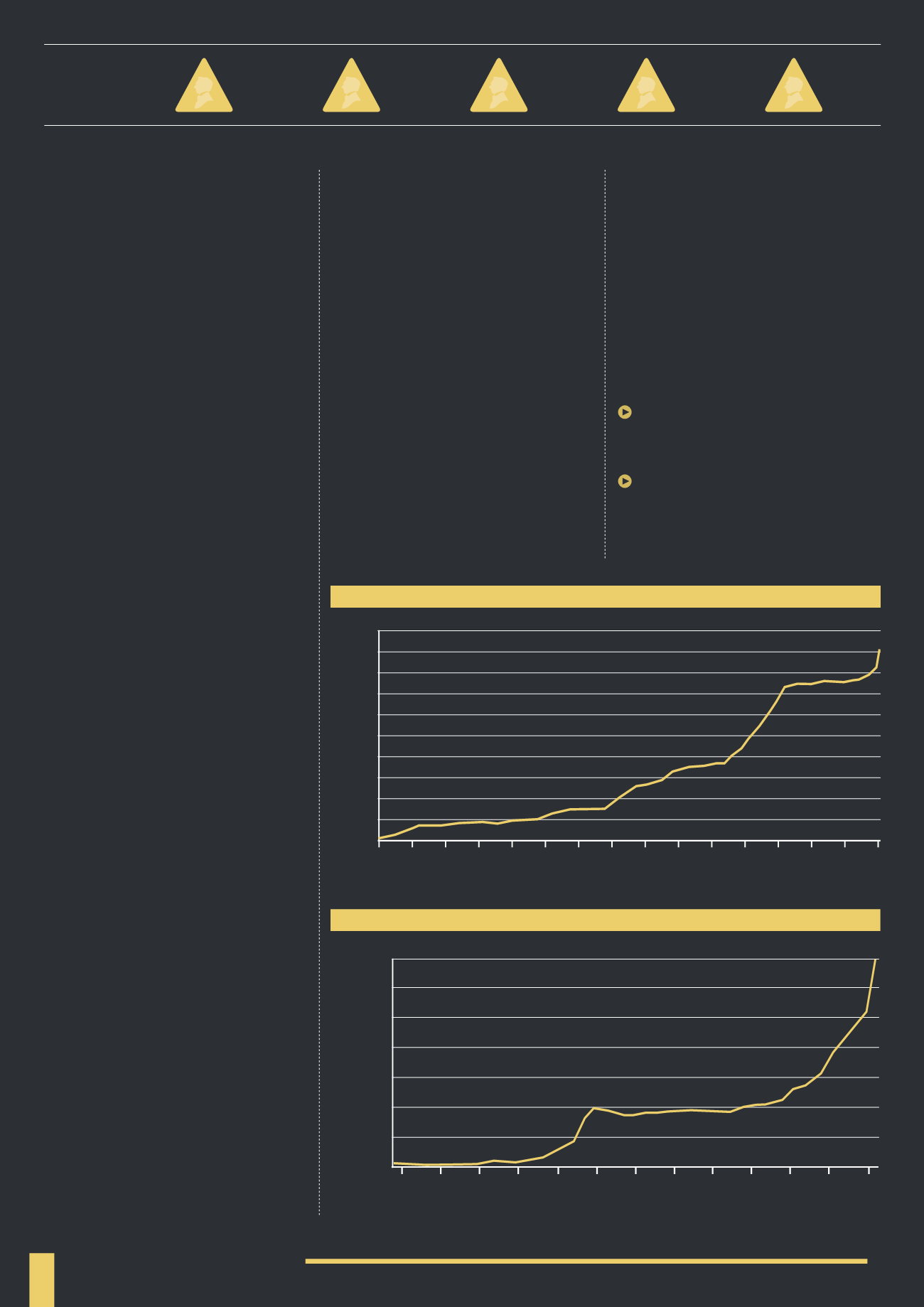

Source: Ex post: The Investment Performance of Collectible Stamps

DIMSON & SPAENJERS INDEX

1960-2008

160,000

140,000

120,000

100,000

80,000

60,000

40,000

20,000

1960

1964

1968

1972

1976

1980

1984

1988

1992

1996

2000

2004

2008

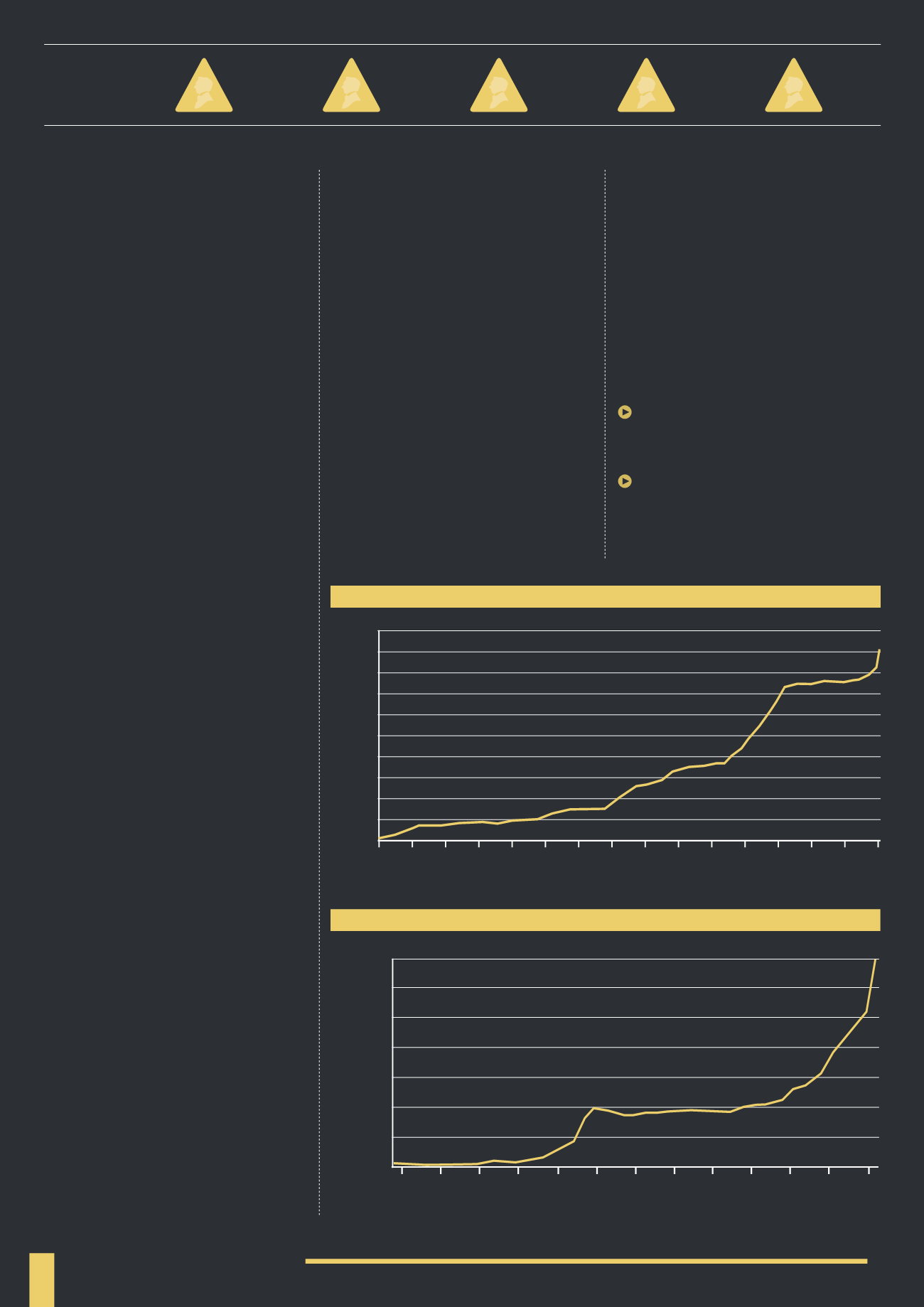

DIMSON & SPAENJERS INDEX

1899-1960

1100

1000

900

800

700

600

500

400

300

200

100

1899

1903

1907

1911

1915

1919

1923

1927

1931

1935

1939

1943

1947

1951

1955

1959

As with other Stanley Gibbons’ indices

this is quoted on the Bloomberg

Professional® service (STGIRCIX).

Of course there are some limitations with

this index: data has been backdated; the

weighting of the index and performance is

influenced more heavily by expensive coins;

and there is a lack of other data streams and

indices to compare performance against.

Coins included on the index range from

early 1st Century Celtic coinage to mid-

20th Century coins from the reign of

George V – they range in value from

£1,250 to £55,000 at 2002 prices, £5,000

to £275,000 at today’s prices (2014).

GB200 Coin Index saw compound annual

growth of 12.75% over 10 years, higher than

the 11.4% from the GB250 and 9.06% GB30

rare stamp indices over the same period.

Performance has been stronger over the last

5 years, with compound annual growth of

13.91% - rare stamps saw lower performance

over 5 years than the longer 10 year period.

CONCLUSIONS

What is noticeable is that although there

are periods where stamps and coins

underperform other markets, over the

long-term they have out-performed, but

without the volatility and downturns

that characterise other markets.

The strongest performance

across all indices has been seen over

the last 10 years (2004–2014)

Although growth has continued to be

positive, it has slowed since the financial

crisis – possibly due to investors cutting back

on luxury investments such as rare stamps

STAMP

GROWTH

RATES (%):

AVERAGE

100 YEAR

10 YEAR

20 YEAR

50 YEAR

12.73

7.66

7.08

10.84

7.05