15

The compound annual growth of the GB30

Rarities Index over the past 5 years was

4.51%, compared to 9.06% over 10 years

and 8.37% over 20 years. The 1873 2½d.

rosy mauve (Unused) achieved annualised

compound growth of 10.76% over the last

5 years, double the growth of the index.

GB

250

INDEX

The Stanley Gibbons GB250 tracks the

performance of the top 250 traded

investment grade British stamps over

the last 12 years. It is accessible via

the Bloomberg Professional® service

(STGIGB25) and is frequently quoted

in the financial press as it provides a

broad view of the investment market

for British stamps. This is the largest

stamp index in existence and used

by many in the industry to track and

evidence the performance and returns

on rare stamp investing. This index

includes watermark varieties, specimens,

errors and Government Officials.

Again there are limitations to this index:

Higher priced stamps have a higher

weighting in the index (which takes an

average based on price) and therefore

more impact on the overall performance

of the index (for the positive or negative).

A number of stamps included in

this index are far too expensive for the

vast majority of investors to purchase

(if looking to create a diversified stamp

portfolio containing a number of stamps)

It is not realistic for an investor to

purchase/own all 250 stamps – unlike

the FTSE for example, when an investor

can invest in an ETF which covers the

whole index. Therefore investors cannot

diversify across the index as a whole

STANLEY GIBBONS CHINA 200

MARKET STUDY

The Stanley Gibbons China market study

tracked the prices and performance

of 200 rare investment grade Chinese

stamps. This data is not on the Bloomberg

Professional Service® but stamps have

been selected by experts to provide

a cross section of the Chinese stamp

investment market as a whole.

This data tracks the prices of Chinese

stamps from 1989 to present (2014).

Stamps range in value from £70 to £12,000

at 1989 prices - £1,200 to £325,000

today. The total value of the 200 stamps

included in this study has increased from

£356,165 in 1989 to £4,522,300 today,

an increase of over £4.1m – compound

annual growth of 10.7% over 25 years.

The China 200 index returned 280.65%

over the previous 8 years (2006-2014).

The performance of stamps on this

index has been far more volatile than the

GB30 or GB250. Returns from individual

stamps range from a loss of 37.5% to total

returns of 2,809.09% over the period.

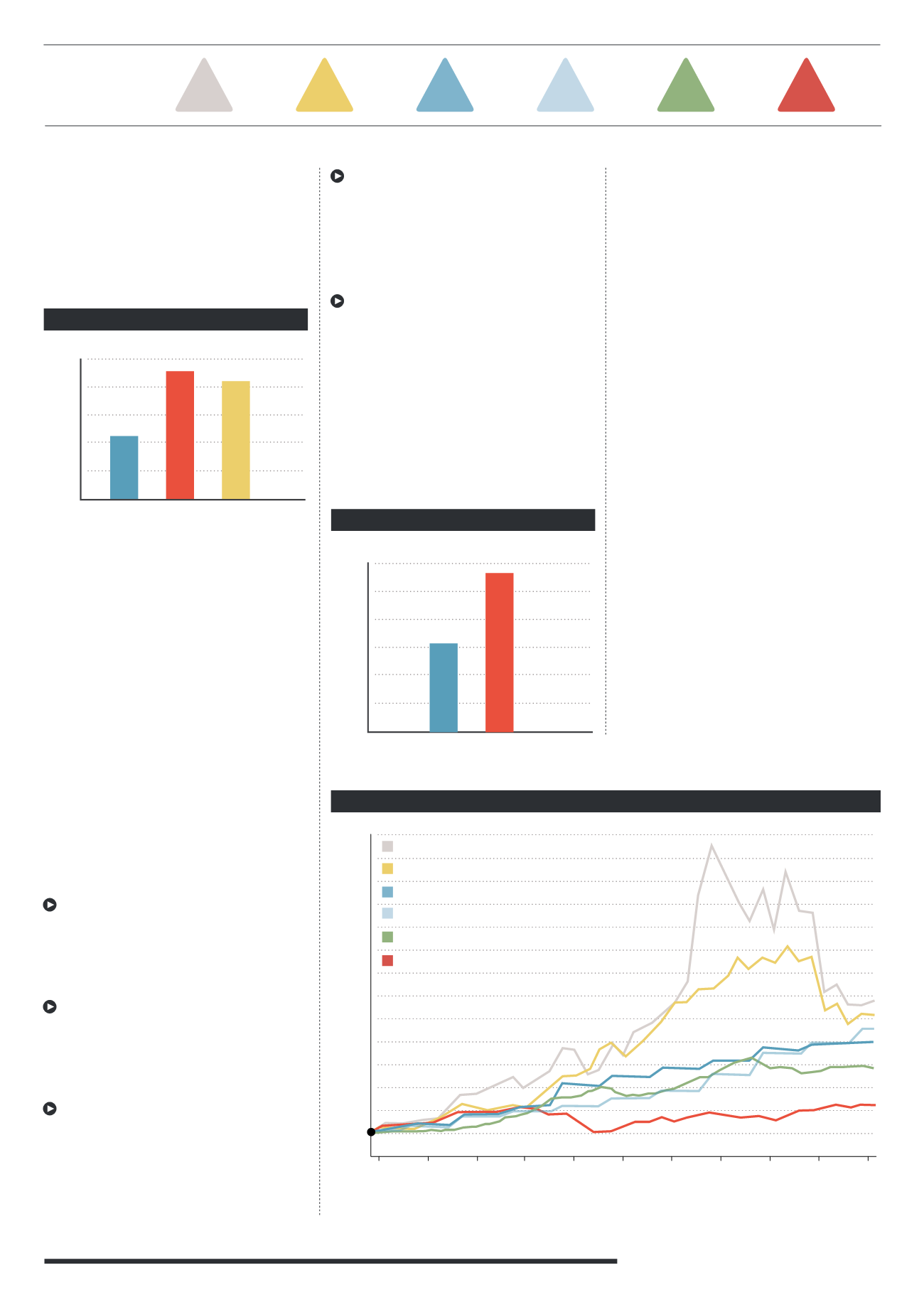

COLLECTIBLE INVESTMENT INDICES

750

700

650

600

550

500

450

400

350

300

250

200

150

100

50

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: World Gold Council, London Silver Fixing, FTSE, Stanley Gibbons, Liv-Ex

There is a wide variance in the

performance of individual stamps – how

does an investor know which to purchase?

This is where knowledge, research and

analysis are important, but analysing

past performance has many limitations

The index (as with the GB30

and China 200) is limited to Stanley

Gibbons’ catalogue prices

The GB250 index has seen a total return of

195.02% over the last 10 years – compound

annual growth of 11.4%. Compound

annual growth over the last 5 years

has been only 6.04% - stamps have not

performed as strongly since the financial

crisis and throughout the recession.

Silver

Gold

GB200 Coin Index

GB250 Stamp Index

Liv-Ex

FTSE 100

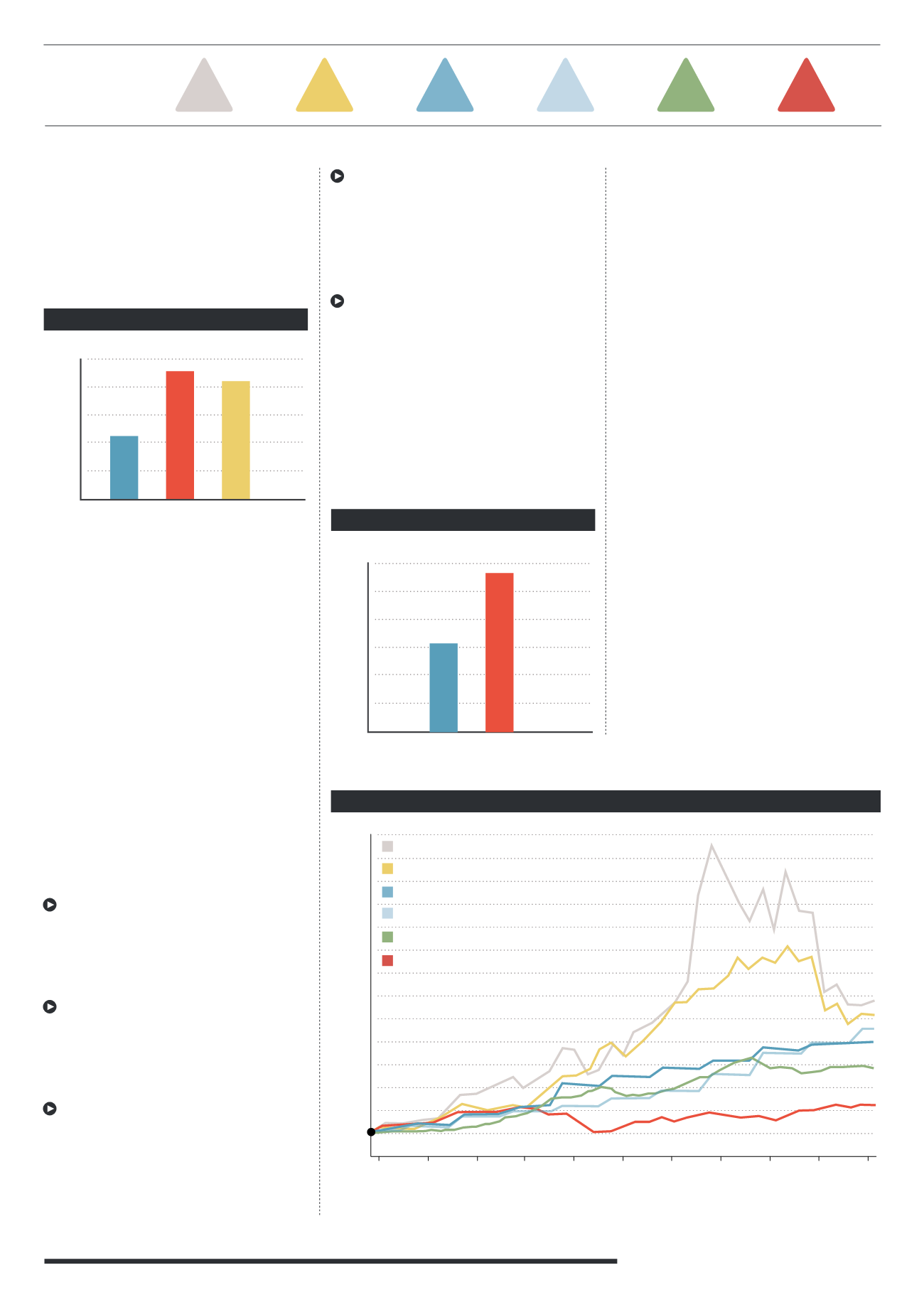

GB30 ANNUAL GROWTH*

0%

Last

5yrs

Last

10yrs

Last

20yrs

2%

4%

6%

8%

10%

GB250 ANNUAL GROWTH*

0%

Last

5yrs

Last

10yrs

2%

4%

6%

8%

10%

12%

2004 - 2014

10 YEAR

ANNUAL

GROWTH (%):

*Compound annual growth

SILVER

12.75

11.43

NOT

AVAILABLE

4.31

13.42

14.32

GOLD

COINS

STAMPS

WINE

FTSE 100