9

REASONS FOR DECLINE IN DEMAND

The main reason for the fall in applications and demand for places was the increase in university tuition fees to a maximum of £9,000.

This change meant that a large number of students chose to start university in September 2011 rather than take a gap year to go

travelling or postpone their studies a year. Anyone starting university in September 2012 would be liable for the new higher fees. The

large number of applications seen for 2011/12 knocked on resulting in a large fall in demand for the 2012/13 academic year.

ACCOMMODATION DEMAND

VS. SUPPLY

Key things students look for in their

accommodation:

- Location – to University or local amenities

- Facilities – value added services (gym,

social areas, entertainment)

- Price/Value for Money (do location and

facilities warrant the high price)

The ‘university experience’ is important

for UK students, who will look for

accommodation close to local amenities or

popular student hotspots that is good value

for money.

There is a gradual shift towards private halls

of residence which is being driven by an

increase in international students in the UK.

As mentioned earlier, international students

have different demands and expectations

from their accommodation and have

been a key driver behind the increased

investment in purpose built student halls.

Universities and developers should factor

in these demands when building new

accommodation.

Student accommodation comes from four

main sources which have all experienced

growth in recent years: University Managed

Halls, Privately Managed Halls, Private

Rented Accommodation or Living with

Parents/Family. Privately managed halls

make up only 5% of the market, but has

experienced the most growth at over 13%

year on year. This is due to a large amount

of investment in recent years driven by

the potential of high returns (with term-

time occupancy between 96% and 99%)

and demand from international students

(account for 31% of Unite’s 40,000 beds

nationally - 47% in London).

The market is dominated by private rented

accommodation (34%) which consists of

privately managed shared flats and houses,

with university managed halls and living

at home with parents each accounting for

about 19% of the market.

Oversupply is a fairly rare feature due

to the high demand and constraints

on universities to construct their own

accommodation. There are though

exceptions to this as certain cities have

seen a huge amount of development in

the purpose built student accommodation

sector without much thought into long-

term demand.

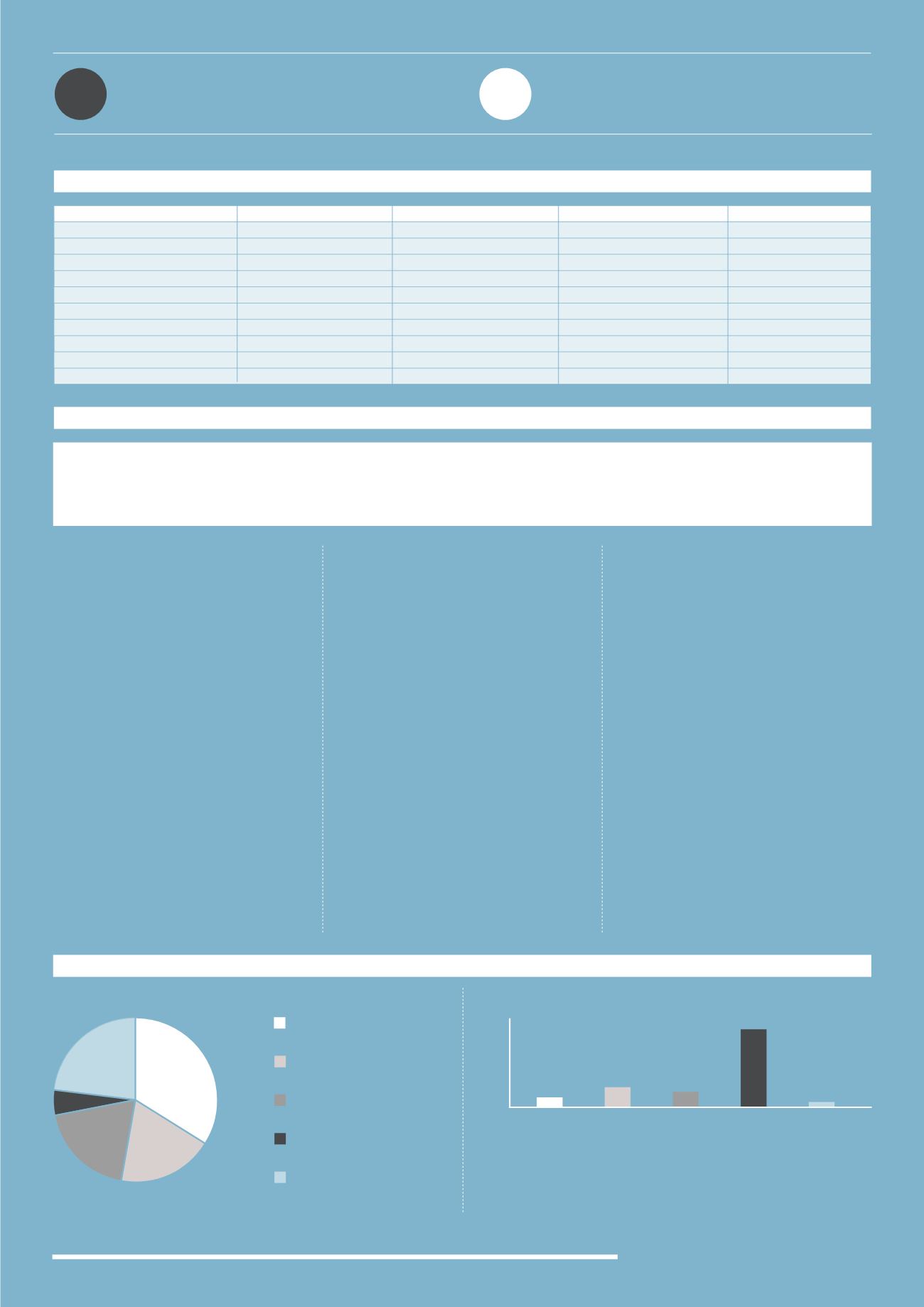

University

Manchester Metropolitan

Roehampton

Wales, Trinity

Wales, Newport

Leeds Metropolitan

Leeds Trinity

East London

Buchinghamshire

London Metropolitan

Bolton

Rank

108

109

110

111

112

113

115

116

118

120

LOWEST RANKING UK UNIVERSITY APPLICATIONS

Source: UCAS

2011

51,493

8,904

2,310

4,928

39,965

4,594

16,816

8,240

17,458

4,707

2012

43,341

6,458

1,967

4,404

35,473

3,843

14,175

7,461

14,901

4,074

Change %

-15.83%

-27.47%

-14.85%

-10.63%

-11.24%

-16.35%

-15.71%

-9.45%

-14.65%

-13.45%

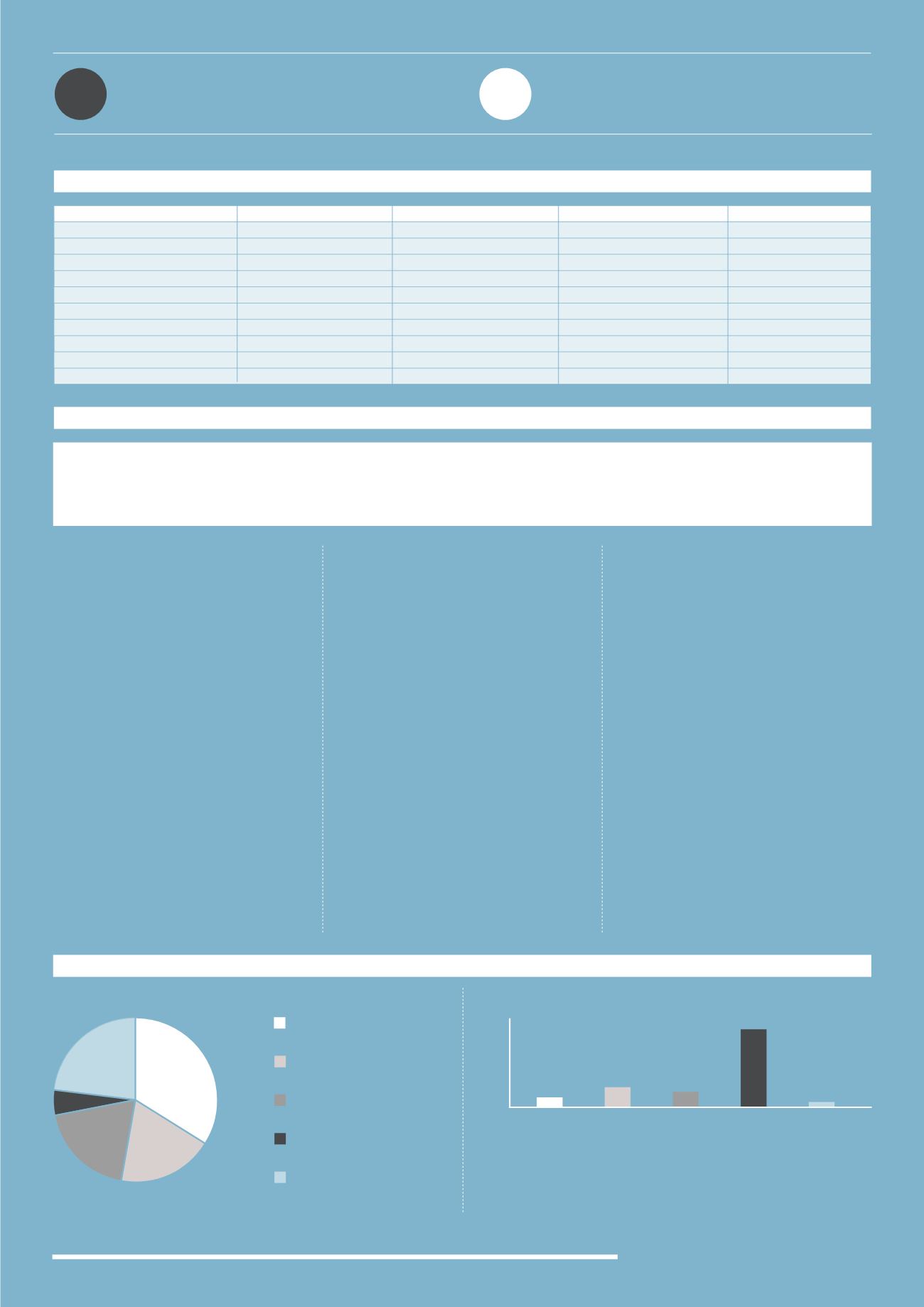

TERM-TIME ACCOMODATION OF FULL-TIME STUDENTS

PRIVATE RENTED

ACCOMODATION

PARENTAL/GUARDIAN

HOME

UNIVERSITY MANAGED

HALLS

PRIVATELY MANAGED

HALLS

OTHER

15%

10%

5%

0%

PRIVATE

PARENTAL

UNIVERSITY

PRIVATELY

OTHER

YEAR ON YEAR GROWTH (%)

Source: UCAS

% OF MARKET

Source: HESA

PRIVATELYMANAGEDHALLS HAVE A

VERY SMALL SHAREOFTHEMARKET

5%

PRIVATE RENTEDACCOMODATION

DOMINATESTHEMARKET

34%

MANAGED

(2011 - 2012)

(2011 - 2012)