17

“2013 is predicted to be the strongest year yet for retail investment into purpose built student

accommodation with more than 55 schemes expected to launch”

The directly held purpose built student

property sector experienced a large amount

of growth in 2012 with 46 new schemes

launched to retail investors. There have

already been 28 new product launches in

2013 with further new schemes expected

to launch in the coming months. It is likely

that by the end of the year over 55 schemes

will have been launched to retail investors,

representing a huge increase in student

accommodation throughout the UK. This

would signify nearly 20% year on year

growth in the retail investment sector.

As you can see from the map on the left

it is clear that the majority of schemes

are based in cities in the North-West of

England. Liverpool accounts for over 26%

of the market with 21 schemes, followed by

Manchester (8), Nottingham (7) and Leeds (6).

It is not clearly evident why Liverpool has

such a high requirement for purpose built

accommodation, in fact as you can see

from the data on the right there is actually

a decline in student numbers in Liverpool.

Over the last 5 years acceptances to the

three main universities in the city have

fallen by between 10% and 20%. This

is likely to have a long term impact on

student numbers and demand for student

accommodation in the city.

An increasing number of purpose built student properties are being marketed to retail investors

Demand for UK university places has risen by nearly 12% over the last 5 years

Acceptances into UK Universities from 2007 to 2012 rose by 12.45% with a peak in 2011/12 of 492,030, however fell by 5.51% in the

current year (2012/13)

2012/13 is the first year of higher tuition fees in the UK of £9,000 per annum

British students starting a 3 year undergraduate degree in September 2012 could graduate owing fees of up to £27,000 (with debts of

£50,000 including maintenance loans)

London has been highlighted as the most attractive city for investment with 291,000 full-time students across 40 HEIs, but only 15.4% of

students housed in university-owned accommodation

Manchester, Bristol and Oxford are also considered strong investment locations, although as noted earlier there has been a downward

trend in university applications in Manchester

The best location for student property investment cannot be judged on figures alone and it would likely come down to the management

company and the buildings quality and price for the investment to ultimately be a success

Certain UK cities are experiencing an oversupply of accommodation and a gradual fall in student numbers

Student property can be a suitable investment but should be considered illiquid and high risk

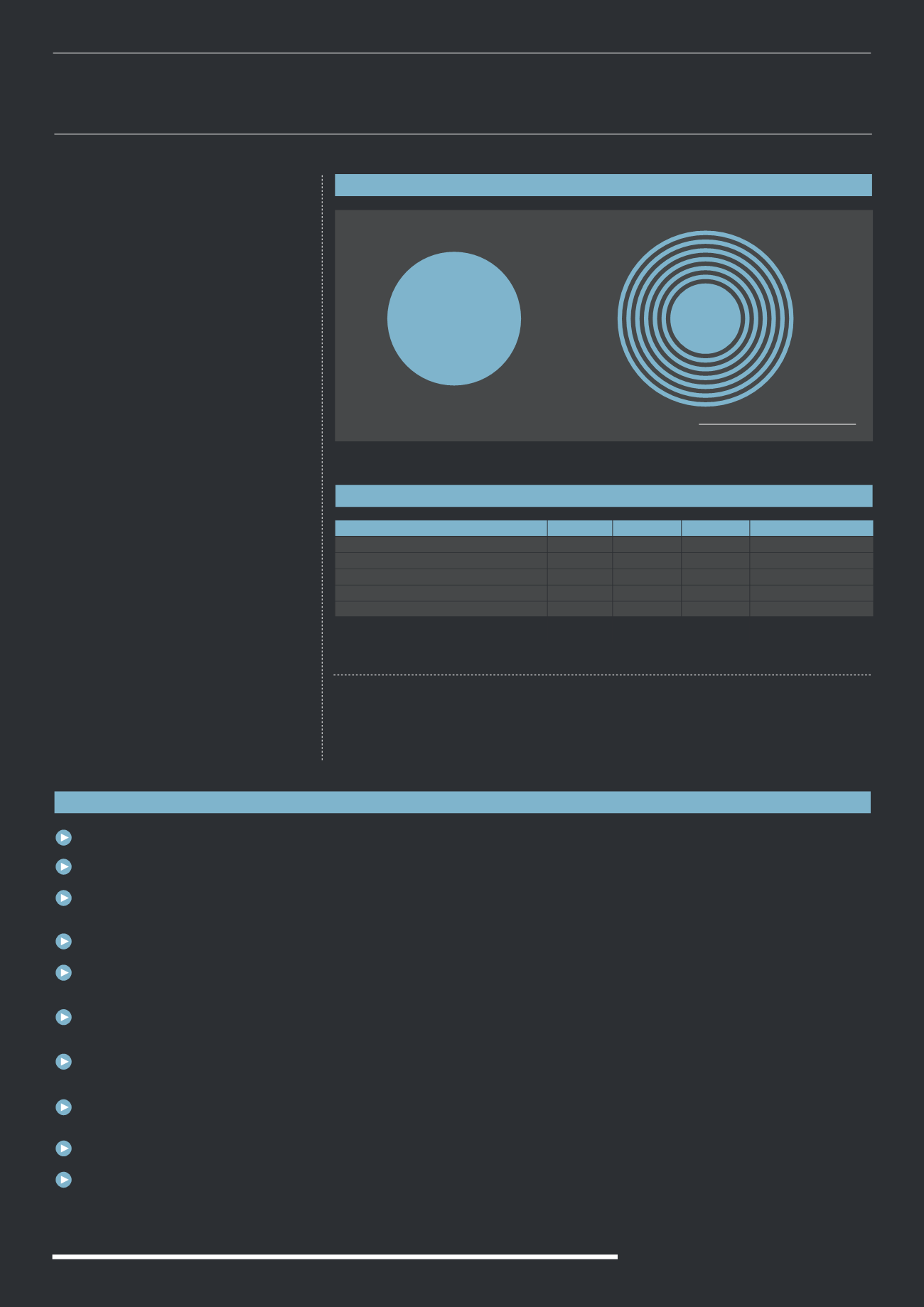

University

The University of Manchester

Manchester Metropolitan University

The University of Liverpool

Liverpool Hope University

Liverpool John Moores University

Rank

41

108

45

N/A

98

ACCEPTED APPLICANTS MANCHESTER & LIVERPOOL

Source: HESA

2008

9,294

8,737

4,417

1,668

6,923

(2008 - 12)

2012

7,861

7,642

3,945

1,476

5,473

% Change

-15.42%

-12.53%

-10.69%

-11.51%

-20.94%

:

SUMMARY

SECTOR GROWTH

(2012 - 13)

ANTICIPATEDGROWTH

55

Student numbers have also declined in other cities in the North-West and other low ranking

universities as a result of students focusing on higher ranking universities. It is not yet

evident whether oversupply will have an impact on investors in these schemes although the

full impact may come when investors choose to exit.

46

2012

2013

28