13

POTENTIAL INVESTMENT

LOCATIONS

The list of the top 10 UK cities for investment

takes into account recent growth in student

numbers, the number of university bed

spaces available and the percentage of

international students.

London has 291,000 full-time students

across 40 HEIs and a large proportion of

international students, but only 15.4% of its

students are housed in university-owned

accommodation. Knight Frank believe

there is huge scope for investment with

London requiring a further 100,000 student

bedrooms in the £150 to £200 per week

‘value’ price range.

The stature of the universities located within

the top ranking cities will have a long-term

impact on their demand. All cities in the top

“London has been highlighted by Knight Frank to be the number 1 city for student accommodation

investment”

Source: Knight Frank

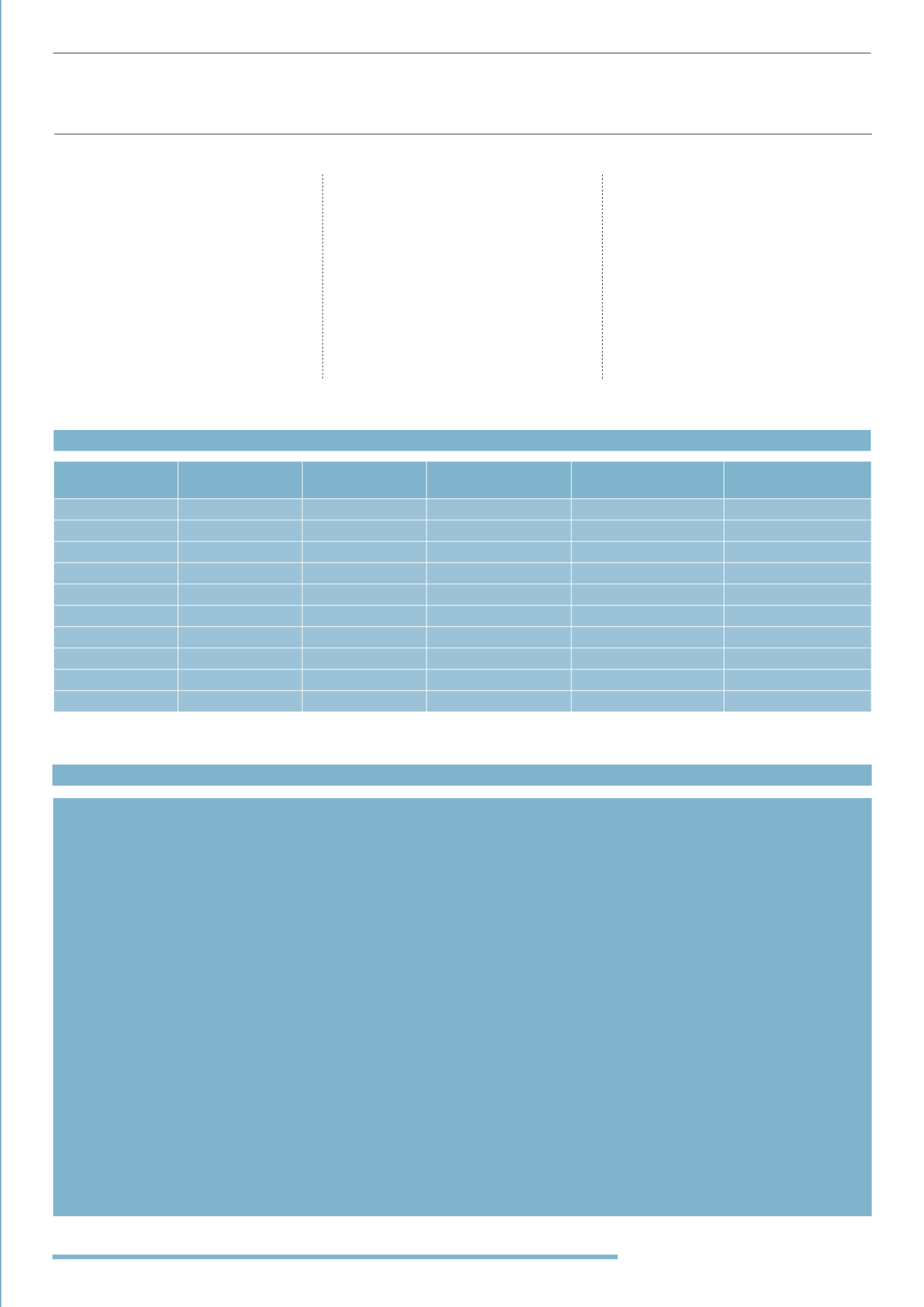

Rank

Town/City

No. of HEIs

Total full time students

09/10

Growth in students nos.

04/05 - 09/10

Students vs. University

owned bed spaces

1

London

40

291,815

20.7%

15.4%

2

Kingston

1

21,675

39.9%

10.9%

3

Brighton

2

25,345

18.1%

21.5%

4

Edinburgh

5

46,270

12.4%

20.8%

5

Durham

1

14,290

2.6%

40.3%

6

Manchester

4

79,405

14.7%

18.7%

7

St Andrews

1

7,760

4.1%

50.2%

8

Bristol

2

38,560

18.0%

20.5%

9

Oxford

2

31,620

6.7%

54.3%

10

York

2

17,350

27.3%

33.9%

TOP 10 CITIES TO INVEST

(2012)

KEY QUESTIONS TO ASK BEFORE INVESTING

Once an investor has considered these things they should then focus on the micro case and ask the investment provider as many

questions as possible. Some of the key questions advisors should be asking include:

#1 HOW DOES THE INVESTOR OWN THE ASSET?

#2 WHO IS THE MANAGEMENT COMPANY AND WHAT IS THEIR TRACK RECORD?

#3 IS THE MANAGEMENT COMPANY ASSOCIATED WITH A UNIVERSITY?

#4 WHERE DOES DEMAND COME FROM AND IS IT SUSTAINABLE?

#5 WHICH UNIVERSITY DOES DEMAND COME FROM?

#6 WHAT OTHER SUPPLIERS ARE IN THE AREA?

#7 WHAT IS THE PREDICTED INCOME?

#8 IS THERE ROOM FOR INCOME GROWTH YEAR ON YEAR?

#9 WHAT COSTS WILL I BE LIABLE FOR?

#10 IS THERE AN EXIT IN PLACE? OR A PROVEN SECONDARY MARKET?

10 list include a high ranking (Russell group or

1994 group) university which should benefit

from the recent tuition fee rise and ‘flight to

quality’ from students. This should hopefully

result in stable demand and a requirement to

upgrade existing residential accommodation,

presenting the potential for retail investment

close to selective universities.