Peer to Business Lending

Alternative Finance Sector Report - November 2014

36

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

0

100

4737%

200

300

400

500

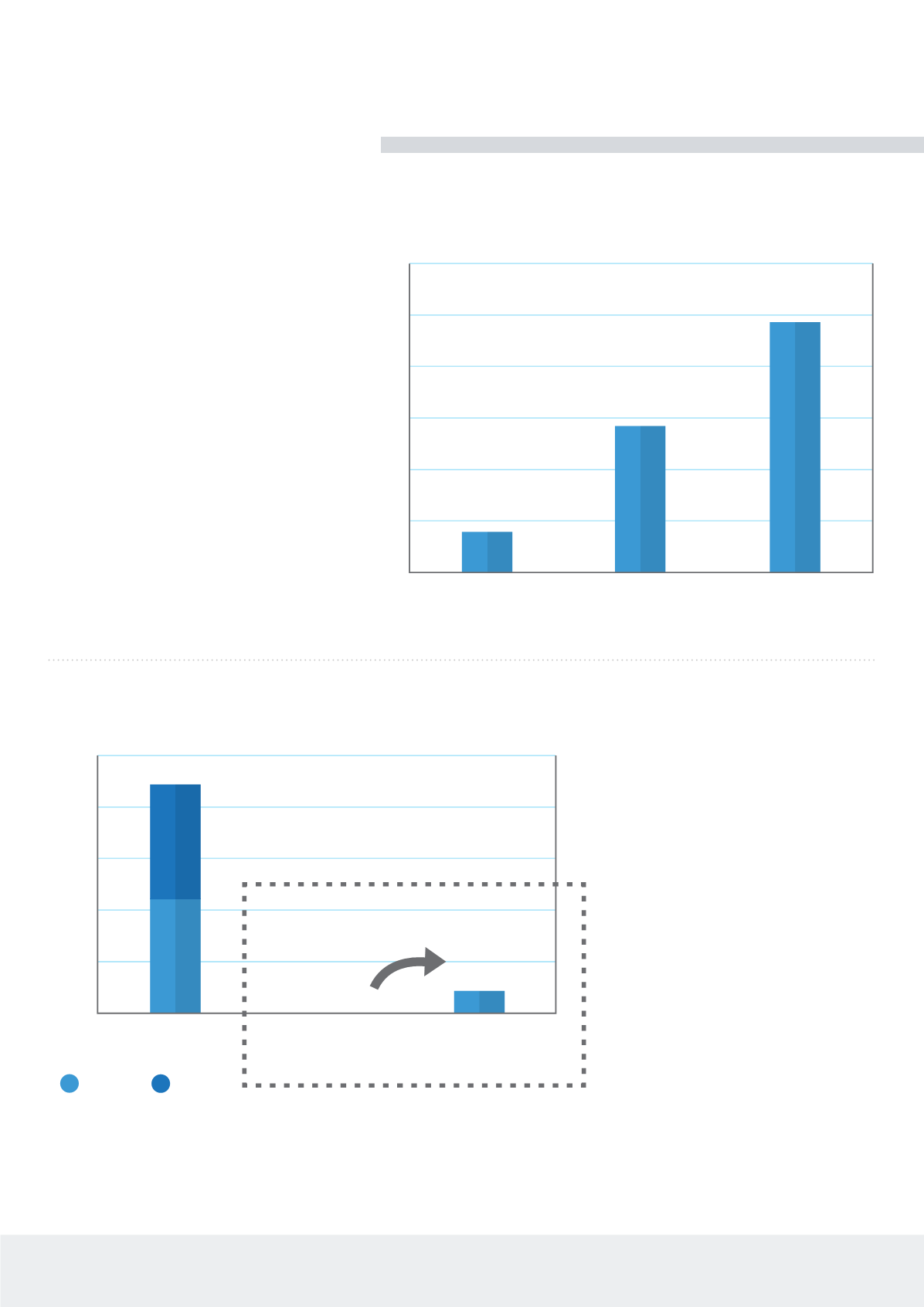

TOTAL ISA

P2P LOANS 10%

OF THE MARKET

P2P LOANS

OUTSTANDING

“We also want to

encourage growth in

the peer-to-peer sector

as part of our plan to

increase competition

in the banking sector

and diversify available

sources of finance for

businesses.”

-

HM Treasury

When P2B becomes available within

ISAs it will dramatically increase the net

returns on offer by making them exempt

from Income Tax – saving 40% for higher-

rate taxpayers. The advantage of tax free

capital gains will apply to P2B investments

where the interest is rolled-up until the

end of the investment term and paid as a

lump sum along with the initial capital.

Based on a 10% gross annual return

available through P2B lending, a 40%

taxpayer would receive 9.75% net after

tax through a loan held within an ISA,

compared to 5.75% otherwise. Holding

P2B loans within an ISA represents a

potential 20% increase in net returns for

normal rate taxpayers and 72% increase

for 40% taxpayers. Note that this doesn’t

take into account any provision for bad

debts or default rates which will have an

impact on returns.

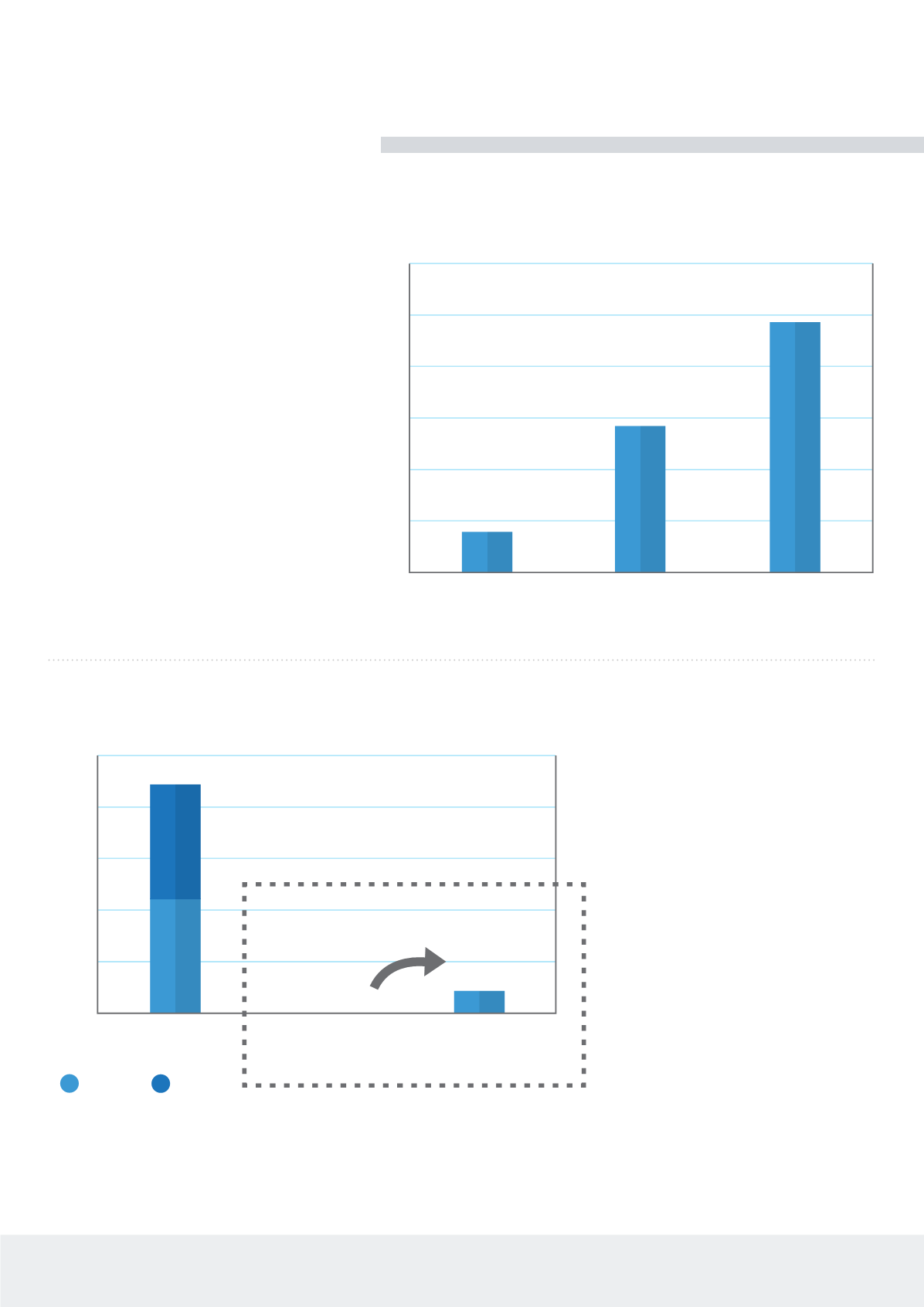

The ability to hold P2P within an ISA has

the potential to dramatically increase the

UK P2P lending market. If P2P was to take

10% of the total ISA market, UK gross P2P

lending would increase by 48x to £44bn

within the next 5-10 years. This would

make P2P lenders a strong competitor for

banks in many sectors as well as providing

much higher returns to ISA savers with

potentially lower volatility than stocks and

shares ISAs.

0.00%

2.00%

1.50%

5.79%

9.71%

4.00%

6.00%

8.00%

10.00%

12.00%

CASH ISA

RATE

P2B NET YIELD

VIA ISA

P2B NET YIELD

POST TAX*

SOURCE:

LIBERUM, ASSETZ CAPITAL,

UK DEPOSITS.ORG

Best Cash ISA Rate Vs P2B Loan Net Of Tax And P2B Loan

Within ISA

SOURCE:

Bank Of England, Zopa, Funding Circle, Ratesetter

Potential Of P2P Lending In ISAS (£BN) (2014)

CASH

STOCK