Peer to Business Lending

Alternative Finance Sector Report - October 2014 27

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

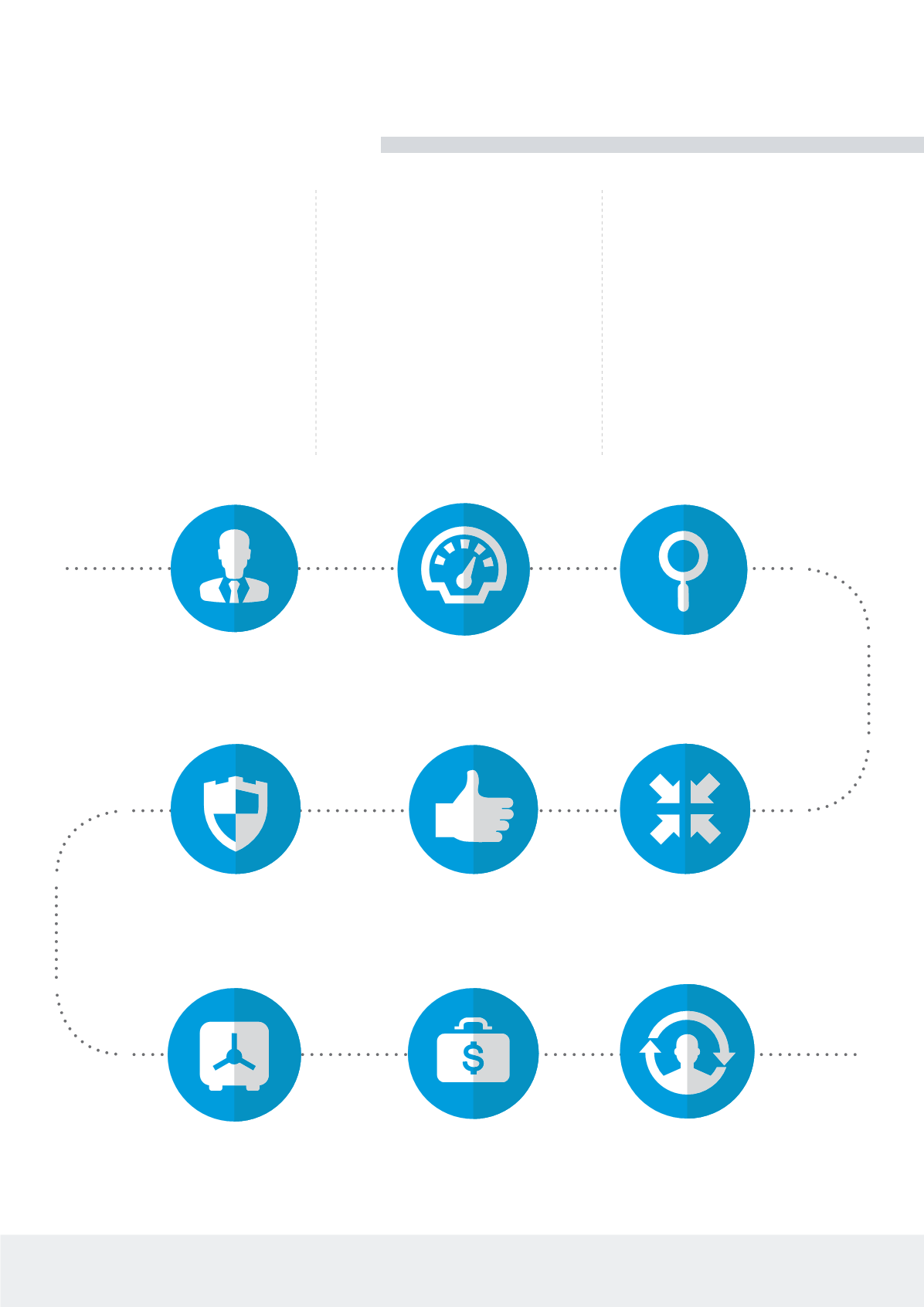

THE LOAN ORIGINATION

PROCESS

1.

A borrower approaches the platform

to request a loan.

2.

The platform assesses the credit

worthiness of the borrower and (if asset

backed) ensures that the borrower has

sufficient assets to use as security. There

should be an official credit policy in

place that has been market tested and

based upon the substantial experience of

professional lenders and principals.

3.

The platform undertakes their own

due diligence and usually provides a

credit report and risk profile on the

borrower. This should provide lenders

with information to aide their own due

diligence to assess the risks involved

and decide whether the loan

is appropriate for them.

4.

Investors decide how much they want

to invest and they make this available

through the platform. It should be

noted that some platforms do not allow

investors to choose individual loans to

participate in and instead their money is

pooled and automatically invested in one

or several loans.

5.

Investors’ money up to the value of the

loan is pooled in a client account.

6.

The platform issues the loan note,

takes any security in exchange and

transfers the money to the borrower.

7.

The loan and security is held on trust,

or by an independent third party, on

behalf of investors.

LOAN

REQUESTED

START

FINISH

SECURITY

IN PLACE

FUNDS

RELEASED

INVESTMENT

SECURED

REPAYMENT

PLAN

FINANCIAL

ASSESSMENT

INVESTMENT

RECEIVED

CREDIT

CHECK

LOAN

APPROVED