Peer to Business Lending

Alternative Finance Sector Report - October 2014 29

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

30 -

• 31 - Nesta: The Rise of Future Finance • 32 - Nesta: The Rise of Future Finance

• 33 -

/

• 34 -

/

According to the Bank of England, the

growth in lending to SMEs has been

negative for the past four years across

a range of measures, though it has

contracted by less since the start of

2013.

30

Bank support for SMEs – 1st Quarter 2014

£6.8bn of new borrowing was

approved in Q1, 10% more than the same

quarter of last year

Demand for new borrowing facilities

from medium-sized businesses rose in

Q1, leading to a small net expansion in

their stock of borrowing

SME cash holdings continue to rise,

by 9% year on year. Deposit levels now

exceed all borrowing by more than

£38bn

Northern regions, Scotland, the East

of England and the South West saw more

new borrowing approved in Q1 than in

either the previous quarter or in the same

quarter a year earlier

SOURCE:

BBA

On a positive note, demand for credit

from businesses of all sizes increased in

Q1 2014, according to respondents to

the Bank of England’s Credit Conditions

Survey.

Alternative Finance for SMEs in the UK

31

(2011-2013)

2011 - £26.7m

2012 - £104m

2013 - £332m

Average Annual Growth Rate – 254%

Number of SMEs using Alternative

Finance

32

(2011-2013)

2011 - 550

2012 – 1,406

2013 – 3,706

Average Annual Growth Rate – 137%

SOURCE:

The UK Alternative Finance

Benchmarking Report

Based on information from Nesta, 5,032

SMEs have raised a total of £463m from

alternative finance during the last three

years, with average growth in the amount

raised per year of 254%. If growth

continues at this rate, nearly £850m will

be raised into SMEs from alternative

finance during 2014. The number of

companies raising money through this

channel has increased by 137% on

average over the last three years and

could top 5,000 during 2014.

P2B PLATFORMS

Funding Circle is currently the largest

P2B lending platform in the UK (and

the world). They have facilitated over

£300m in loans to over 4,000 companies

to date, and are currently issuing £5m

worth of loans per week on average.

33

Funding Circle originally received

£20m from the Government’s Business

Finance Partnership to encourage

lending to SMEs. This £20 million was

lent to over 2,000 businesses across the

country, helping to create an estimated

6,500 jobs.

34

The Government has

since decided to invest a further £40

million alongside private investors

through Funding Circle, although private

investors account for the vast majority of

investment through the platform.

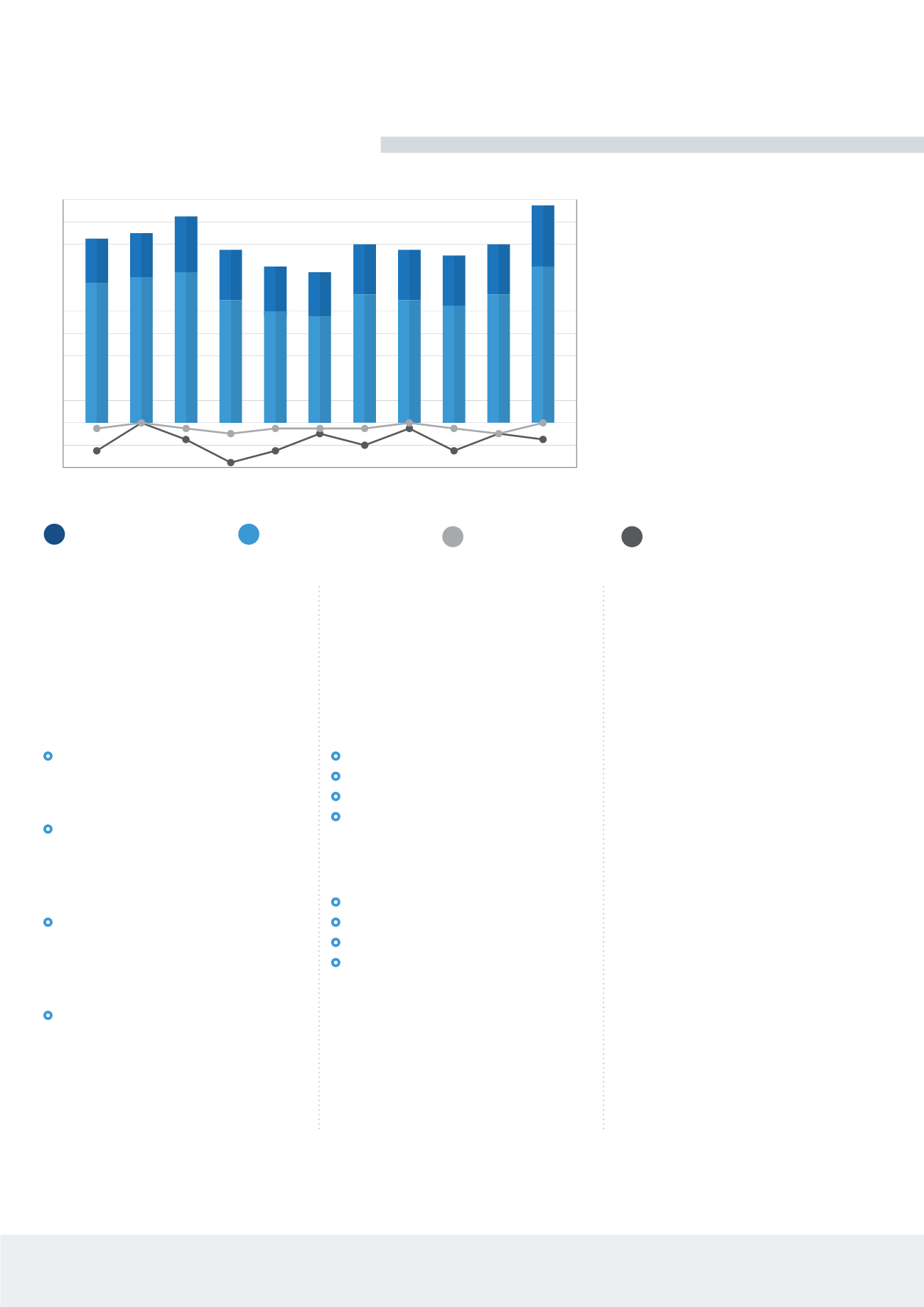

Q2

Q3

2011

2012

2013

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

-10

0

10

20

30

40

50

-10

0

10

20

30

40

50

£ BILLIONS

Gross And Net Lending To UK

Non Financial Businesses

(A) Loans by monetary financial

institutions to non financial businesses.

Data excludes overdrafts. Data cover

lending in both sterling and foreign

currency, expressed in sterling. Non

seasonally adjusted

(B) SMEs are those with annual debit

account turnover on the main business

account less than £25 million

(C) Large businesses are those with

annual debit account turnover on the main

business account less than £25 million

(D) Net lending is defined as gross

lending minus repayments

GROSS LENDING TO

SMES (B)

GROSS LENDING TO

LARGE BUSINESSES (C)

NET LENDING TO LARGE

BUSINESSES (C)(D)

NET LENDING TO

SMES (B)(D)