Peer to Business Lending

Alternative Finance Sector Report - November 2014

30

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

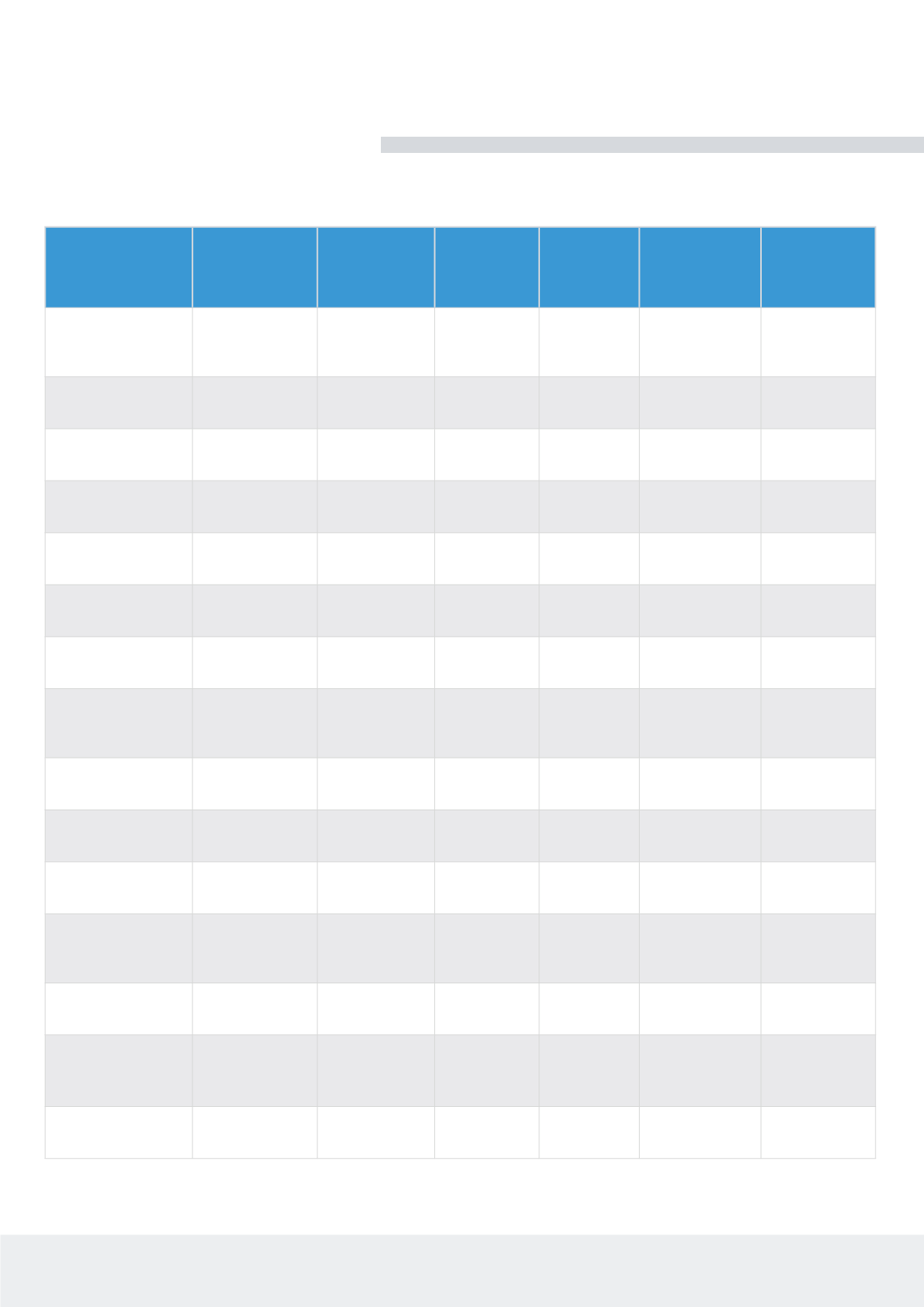

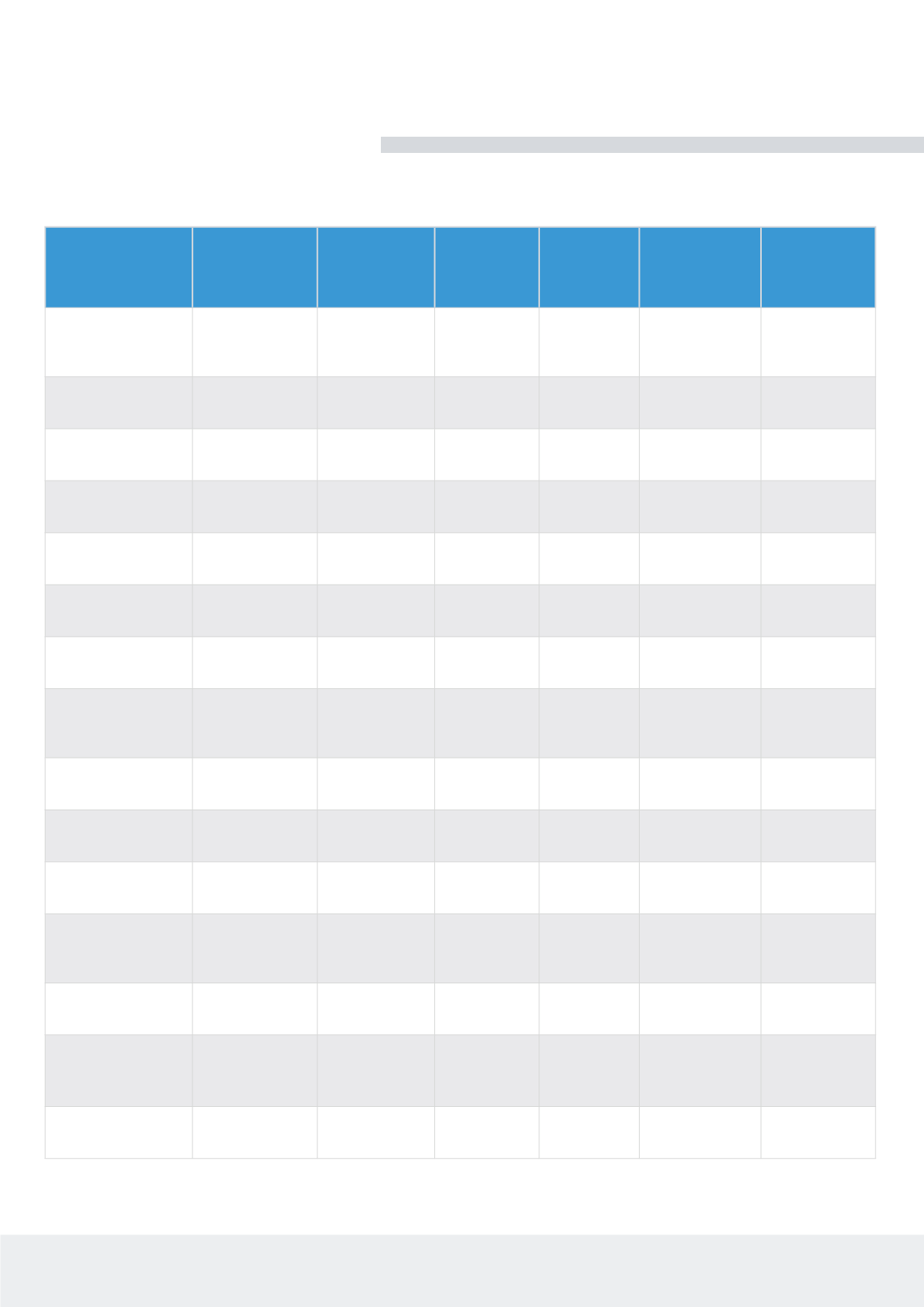

UK Based P2b Lending Platforms (08/2014)

NAME

DATE

ESTABLISHED

MINIMUM

INVESTMENT

AVERAGE

RETURN

(GROSS)

TOTAL

FUNDS

RAISED

BAD DEBT

(AVERAGE

PREDICTED)

SECURITY

Assetz Capital

Mar 2013

£20

9-18%

£51m

<1.5% with

actual loss

rate <0.5%

Asset

Backed

Funding Circle

Aug 2010

£20

7.1%

£400.7m

4.52%

Asset

Backed

Folk 2 Folk

Feb 2013

£25,000

7%

£36.4m

<1%

Asset

Backed

Lend Invest

Apr 2013

£10,000

7.80%

£132.4m

N/A

Asset

Backed

Wellesley & Co.

Nov 2013

£10

6.76%

£100.5m

1%

Provision

Fund

Money & Co

Jun 2014

£10

6%

2.65m

1%

Asset

Backed

ThinCats

Jan 2011

£1,000

10%

£79.8m

2.69%

Asset

Backed

Funding Empire

Nov 2012

£20

4-15%

£95k

<1.5%

Asset Backed

on loans over

£50k

Rebuilding Society

Sep 2012

£20

16.9%

£3.96m

1.85%

Asset

Backed

FundingKnight

Jan 2013

£25

10.7%

£7.98m

0.5-2%

Asset

Backed

Prop Lend

Aug 2013

£5,000

5-15%

N/A

N/A

Asset

Backed

Be The Lender*

suspended trading

August 2014

Mar 2013

£10

8.4%

N/A

<1%

Provision

Fund

You Angel

Mar 2011

£100

6-10.5%

£22k

0.5-4%

Compensation

Fund

Relendex*

commercial

property only

May 2013

£500

Up to 10%

N/A

N/A

Asset

Backed

ArchOver

June 2014

£5,000

5%

N/A

N/A

Asset Backed

and Insured

SOURCE:

Intelligent Partnership (data as at 31/10/2014)