Peer to Business Lending

Alternative Finance Sector Report - November 2014

26

PEER TO BUSINESS LENDING

ALTERNATIVE FINANCE SECTOR REPORT

PUBLISHED

November 14

AUTHOR

Luke Jackson

Samantha Goins

Lenders will rarely pay any fee at the start of the loan. They can usually sign up to the platform for free and lend as long as they meet

the minimum lending requirements. Platforms take their initial fees from borrowers to cover the initial due diligence, listing on the

platform and administration surrounding the loan. This will be taken as a percentage of the loan value of between 2-5% before any

costs of sale that the platform incurs.

On an ongoing basis the platform receives their revenue as a percentage of returns or a percentage of loan balances. This usually

equates to about 1% of the loan balance, but will vary by platform. A number of platforms advertise that there is no annual fee to

lenders, although this is likely to have been factored into the interest rate and instead of being payable by the lender as a deduction

to the publicised interest rate, it is paid as an annual fee by the borrower. Most platforms are very open about their fees as this is a

unique selling point of P2P over bank lending or mainstream investment products. The annual fee will be used by the platform to

cover ongoing administration and running costs of the platform.

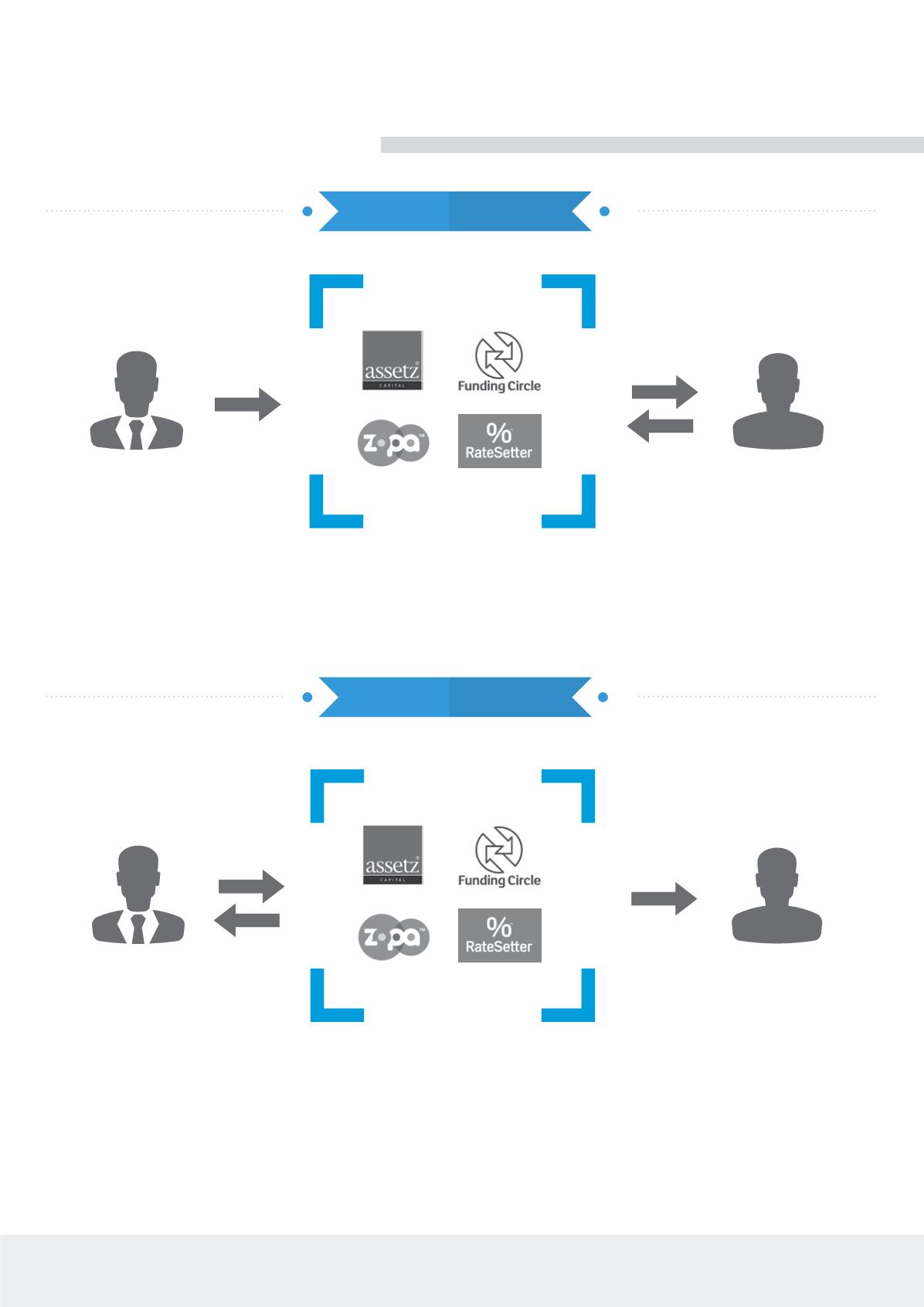

LENDER

BORROWER

PLATFORMS

UPFRONT FEE 2-5%

PRINCIPAL

PRINCIPAL

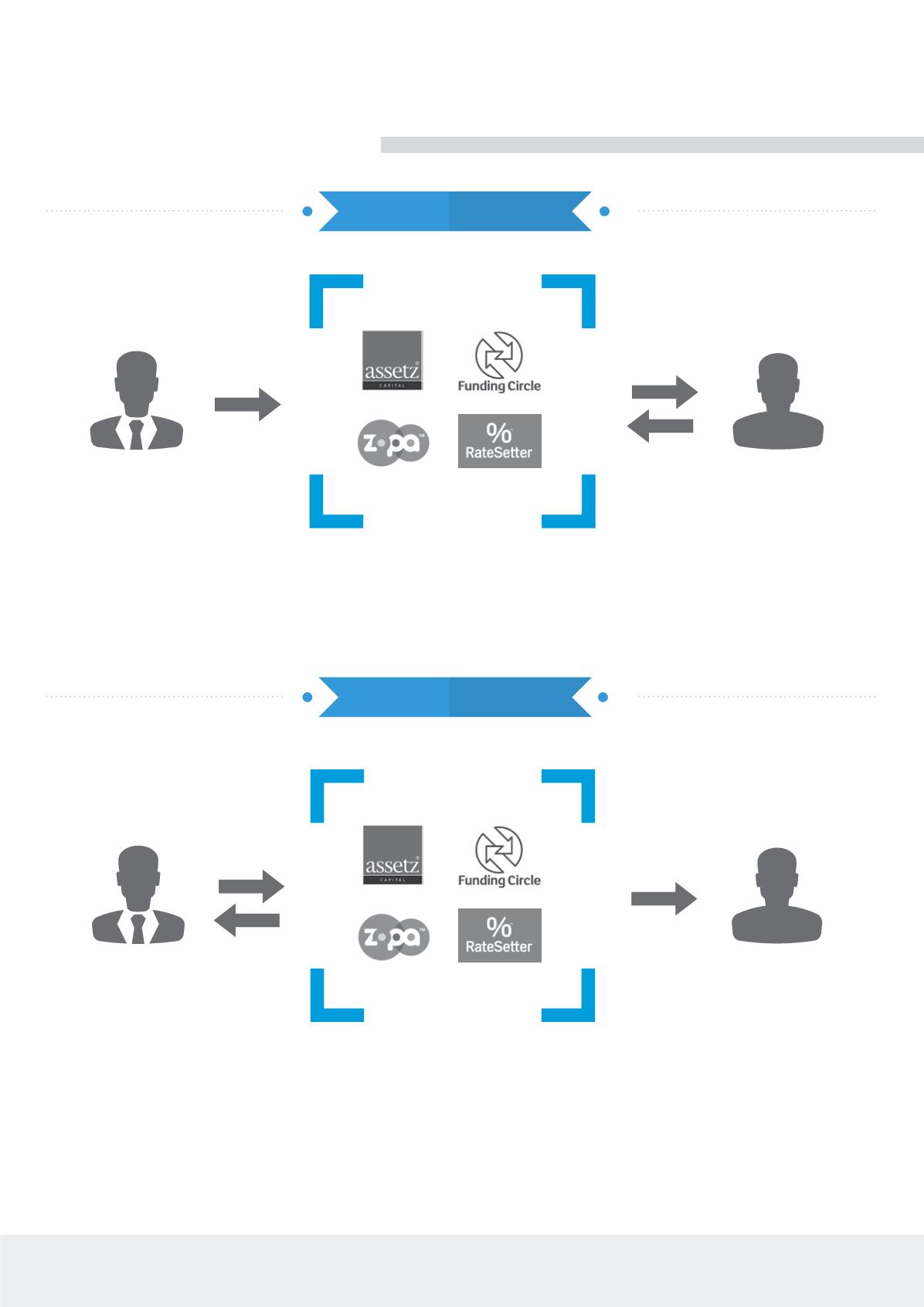

PLATFORMS

ANNUAL FEE 0-1%

PRINCIPAL

+

INTEREST

PRINCIPAL

+

INTEREST

LENDER

BORROWER

DURING THE LOAN

AT START OF LOAN